This year may be remembered as the one when Latin America finally showed up on the radar – not only in geopolitics, but also in tech. This was certainly true for us, with the launch of The Next Web’s Latin America Channel back in May.

While other foreign media outlets and tech blogs will likely start covering the region over the next years, we’re glad to be among the first international sources to give the Latin American tech scene the attention it deserves.

This was also a very interesting period to start writing about all that happened across the region, as the last few months have been particularly eventful. Here are the main trends and events that have been transforming Latin America in 2011.

Millions of Latin Americans are becoming Internet users

According to comScore, Latin America is one of the fastest growing regions when it comes to Internet penetration. While the growth is somewhat slower in countries such as Argentina and Chile, where many already have access to the Internet at home or at work, this is particularly true for places like Mexico and Peru.

Many of these people were already accessing the Internet to some degree from public places, but having an Internet connection at home is very different. It means Latin American users spend an increasing number of hours behind their screens, confirming existing trends such as the huge popularity of social networking, while also opening the door to new possibilities.

E-commerce is one of them, and the sector has been growing fast across the region, fueled by an influx of new users, itself boosted by the fact that millions of Latin Americans have left poverty to join the middle class. In Brazil, for instance, 9 million out of the 32 million Brazilians who made online purchases this year were doing so for the first time, and e-commerce could grow by 25% in 2012 as a result.

Still, it is way too early to write cyber-cafés off, as they may be able to counter their decline by offering additional services. This is already the case in Brazil, where ‘lan houses‘ are becoming convenience and education centers, especially in poor communities. In some places, local authorities have also understood the power of the Internet when it comes to social integration. In the Brazilian state of Ceara, for instance, a public project aims to bring affordable broadband to 6.8 million people.

Still, it is way too early to write cyber-cafés off, as they may be able to counter their decline by offering additional services. This is already the case in Brazil, where ‘lan houses‘ are becoming convenience and education centers, especially in poor communities. In some places, local authorities have also understood the power of the Internet when it comes to social integration. In the Brazilian state of Ceara, for instance, a public project aims to bring affordable broadband to 6.8 million people.

The Latin American broadband market has also become increasingly interesting for foreign service providers. The Spanish telco giant Telefonica, for instance, generate almost half of its revenues in Latin America, where there is still room for growth while operations in Europe have proven tougher.

Mobile and smartphones are taking off

The Latin American mobile market attracts similar levels of interest from foreign players. Nokia, for instance, expects Brazil to become one of its top markets. The country already has 236 million mobile numbers, and its market potential is huge.

This is especially true for a player like Nokia. Though it struggles to compete with the iPhone in the US and Europe, Apple’s smartphones are still very expensive in Brazil, and very difficult to find in Argentina, due to restrictive importation practices.

This is especially true for a player like Nokia. Though it struggles to compete with the iPhone in the US and Europe, Apple’s smartphones are still very expensive in Brazil, and very difficult to find in Argentina, due to restrictive importation practices.

Still, smartphone sales have been taking off in Latin America and will continue to grow further. Consulting firm Pyramid Research predicts that smartphones will account for 46% of all cell phone sales across the region by 2016.

The phone market has been evolving fast, and is this is likely to continue – in Brazil, for example, almost half of feature phone owners planned to buy a new cell phone, we reported in August.

Overall, the rise of mobile devices in Latin America is a fact that anyone interested in the local market should take into account.

The power of crowds

With the democratization of the Internet, combined in a region where the social side of the web is very popular, it’s not a surprise that many forms of crowdsourcing have emerged over the last months.

For instance, crowdfunding websites such as Catarse, Idea.me and Fondeadora have been created, giving Internet users a chance to participate in the financing of films and other art projects. Some of these platforms even focus on other niches, such as film sessions and music shows.

However, crowdfunding is only one of the many aspects of crowdsourcing, and there are many other opportunities to leverage the power of Latin American crowds. Ledface, for example, uses what it calls ‘the collective brain’ for its Q&A platform, while Crowdtest resorts to independent beta testers to find bugs at a lower cost.

More generally, the region seems to be a fertile ground for collaboration, and co-working spaces have flourished all over the region.

Creativity and innovation

While it may sound like a cliché, Latin America is also well known for its creativity. As we reported, Mexican web design is particularly noteworthy, and several Central American countries have become a nearshoring destination when it comes to quality web design and development.

These designers and developers have also increasingly started to work on their own projects, and two recent Mexican iPad apps, Atomix and Blanco, give a good idea. Latin America has also confirmed its status as a breeding ground for gaming talent, producing very creative casual games.

But no matter how good they are, this is not just about one-off apps; several of them are backed by highly promising startups, such as the online gaming company Vostu. While it’s headquartered in New York, it targets Latin America and has offices in Sao Paulo and Buenos Aires, with a large development team in the latter.

But no matter how good they are, this is not just about one-off apps; several of them are backed by highly promising startups, such as the online gaming company Vostu. While it’s headquartered in New York, it targets Latin America and has offices in Sao Paulo and Buenos Aires, with a large development team in the latter.

Companies which are headquartered in Latin America have also been pretty successful this year, either with proven business models, such as the Brazilian daily deals site Peixe Urbano and the likes, or with innovative ones, such as Predicta, to name just a few.

New hubs emerging, welcoming events

Not only is Latin America becoming a tech hub, but in each country, smaller cities are also becoming growing alternatives to the largest metropolises (see our post ‘Where is Latin America’s Silicon Valley?‘). In Brazil, for instance, where it was often said Sao Paulo was the country’s tech capital, cities such as Belo Horizonte and Recife are now on the innovation map as well.

While all these hubs had interesting assets to begin with, pro-active initiatives have contributed to foster their tech ecosystems. In Chile, the entrepreneurship conference Webprendedor expanded to the city of Valdivia, in the south of the country. In Mexico,the digital meeting center TelMex Hub started to tour several Mexican states with events dedicated to new technologies.

While all these hubs had interesting assets to begin with, pro-active initiatives have contributed to foster their tech ecosystems. In Chile, the entrepreneurship conference Webprendedor expanded to the city of Valdivia, in the south of the country. In Mexico,the digital meeting center TelMex Hub started to tour several Mexican states with events dedicated to new technologies.

More generally, many new events have taken place in 2011 with the ambition to build a startup community, including in Central America, where it used to be less developed, as well as in Mexico. Startup Weekends have expanded to additional cities, such as Rio de Janeiro and Monterrey, Mexico. Hackathons are also happening all over the region, HackSantiago being one of the latest additions.

Brazil has also attracted larger events, such as the international conference Red Innova, and will continue to do so in 2012 – Intel has recently confirmed that its next Developer Forum will take place in Sao Paulo.

Accelerators are mushrooming

Besides networking at a local level, many agree that the Latin American startups need mentoring from experienced entrepreneurs, as well as seed capital, which is still lacking.

With this in mind, several players decided to create startup accelerators across the region – from the Chilean government, with Start-Up Chile, which successfully attracted early-stage foreign startups and is now also open to local companies, to Telefonica, with Wayra, recently launched in several countries, including places where very few initiatives existed to boost tech entrepreneurship.

With this in mind, several players decided to create startup accelerators across the region – from the Chilean government, with Start-Up Chile, which successfully attracted early-stage foreign startups and is now also open to local companies, to Telefonica, with Wayra, recently launched in several countries, including places where very few initiatives existed to boost tech entrepreneurship.

Independent initiatives also include the Founder Institute in Colombia and Mexico, NxtpLabs and BA Accelerator in Buenos Aires, 21212 in Rio de Janeiro and New York, and Mola in Spain and Latin America – not to mention Brazil’s Aceleradora, which started operating well before this recent boom.

In Brazil, the scene is now so developed that niche accelerators have appeared; while Appies will focus on app developers, Startup Farm is a four-week intensive acceleration program which will travel to several Brazilian cities over the next months.

Although each program has its specificities, most of them share a common goal: to give startups an option to grow without having to move to another city or to the US.

Building international bridges

This desire for local opportunities doesn’t mean small-town mentality prevails. On the contrary, 2011 could be seen as a turning point, when Latin Americans finally started to take interest in their Spanish- or Portuguese-speaking neighbors. Several high-profile Brazilian companies have expanded to other Latin American countries over the last months, from Peixe Urbano to boo-box and SambaTech.

Beyond Latin America, global ties have also been reinforced, and GeeksOnaPlane‘s trip to the region was certainly one of this year’s main highlights. Organized by 500Startups, it was immediately followed by the confirmation that Dave McClure’s fund had invested in the Chilean startup Welcu, and was looking at further angel investments in Brazil, where local operations are headed by Bedy Yang.

As we recently learned, 500Startups is also one of the backers of Mexican.VC, “Silicon Valley’s first seed fund for Mexican Internet startups,” co-founded by the US entrepreneur David Weekly.

As we recently learned, 500Startups is also one of the backers of Mexican.VC, “Silicon Valley’s first seed fund for Mexican Internet startups,” co-founded by the US entrepreneur David Weekly.

If you needed one more sign of Latin America’s closer relationship with Silicon Valley, local companies such as Argentina’s MercadoLibre and Brazil’s Predicta are opening R&D centers there. However, Silicon Valley isn’t the only region Latin America has been building ties with this year; this is also true of New York, but also of China and even Finland.

Attracting attention

These ties go both ways; while Latin American companies have started activities in the US, one of the most interesting trends in 2011 was the reverse migration phenomenon. As we reported, Brazilian expats are moving back home to work with startups, bringing back with them a global mindset and contributing to the growth of the local ecosystem by helping build companies like Kekanto.

Latin American expats aren’t the only ones who have regained interest the region; so have foreigners, and both male and female foreign techies who recently moved to the region have become go-to persons for companies and funds which are trying to learn more about the region.

Many foreign VCs have indeed started to actively explore the local market, with some of them, such as Rocket Internet and Accel Partners, already investing in local startups (which also raised concerns around a possible valuation bubble in Brazil).

As a matter of fact, Brazil has been particularly gaining momentum in 2011. International players have indeed started to take notice of its huge and growing potential market, although many efforts also focused on Spanish-speaking countries. YouTube, for instance, launched a localized website for Colombia, while Apple recently rolled out its iTunes Music Store and VOD service across most Latin American countries.

As a matter of fact, Brazil has been particularly gaining momentum in 2011. International players have indeed started to take notice of its huge and growing potential market, although many efforts also focused on Spanish-speaking countries. YouTube, for instance, launched a localized website for Colombia, while Apple recently rolled out its iTunes Music Store and VOD service across most Latin American countries.

Other foreign Internet companies which expanded to the region in 2011 include Netflix, which is prepared to bet on Latin America to boost its growth, as well as the music services Senzari and Rdio, now available in Brazil. Several companies even took things one step further and launched operations in the region, such as Facebook, LinkedIn, Evernote and Amazon Web Services – with rumors that other Amazon services could soon follow.

These decisions were sometimes made necessary by local protectionist measures. Microsoft’s decision to manufacture XBox 360 consoles in Brazil, for instance, is a tentative to avoid import taxes and help to lower prices for customers. Foxconn’s negotiations with the Brazilian authorities around iPhones and iPads made in Brazil have the same purpose. As for RIM’s decision to assemble Blackberries in Argentina, it follows severe custom restrictions which meant that only 25 of its devices had successfully made it into Argentina during 2011’s Q2.

Overcoming challenges?

This restrictive bureaucratic environment is one of the main obstacles on the way to growth in most Latin American countries – but it’s not the only one. So is the general local landscape, with violence a serious issue in places such as Honduras, northern Mexico and Venezuela. While this isn’t directly related to technology, this obviously has a negative impact on the Internet ecosystem. Not only it means potential foreign investors might have serious security concerns, but also because online journalists and bloggers have been threatened by criminal organizations.

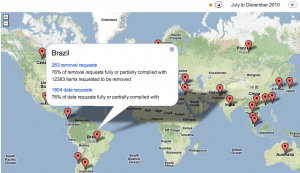

Besides criminal organizations, local politics also represents a risk to freedom of expression in some countries. Supporters of Venezuela’s Hugo Chavez have hacked into opponents’ Twitter accounts, and a Brazilian judge has fined Google Brasil for refusing to reveal the identity of anonymous bloggers. While Brazil is a democratic country, it is the country that sent the most removal requests to Google, according to the company’s Transparency report.

Besides criminal organizations, local politics also represents a risk to freedom of expression in some countries. Supporters of Venezuela’s Hugo Chavez have hacked into opponents’ Twitter accounts, and a Brazilian judge has fined Google Brasil for refusing to reveal the identity of anonymous bloggers. While Brazil is a democratic country, it is the country that sent the most removal requests to Google, according to the company’s Transparency report.

However, things aren’t all bad on the government side. Several public initiatives have been focusing on open data across the region, at the city level such as in Rio de Janeiro and Mexico City, but also at the country level. Activists across the region have been pushing for openness for a while, and it looks like Latin American authorities were listening; for example, Brazil has launched a beta version of its open data portal a couple weeks ago, closely following Chile‘s footsteps. Besides making sense for transparency and democracy, open data could also benefit to startups, which could create apps based on public APIs.

But government initiative is only one side of the question, and perhaps not the most important one. Local culture, for instance, can become an obstacle when it makes a taboo out of failure, which is actually an inherent risk to accept when creating a startup. However, a new generation of Latin American entrepreneurs seem to increasingly overcome this fear, and is taking the risks it takes to create global-minded startups. Let’s now hope they’ll soon become a source of inspiration for even more Latin Americans to follow their steps.

As for accelerators, 2012 will be a test year; their first incubated startups recently started to graduate, and the local tech community will soon be able to tell wheat from chaff. Information flow is one of the things Latin American entrepreneurs need the most – not only because transparency prevents bad practices, but also because success stories often go untold when they could make great role models.

Get the TNW newsletter

Get the most important tech news in your inbox each week.