Just 15 hedge fund managers collectively earned $12 billion last year, fueled by bullish tech stocks like Facebook and Microsoft.

Even more impressive, Bloomberg reports that five of those managers reaped more than $1 billion all by themselves in 2019. While most of the profits go directly to their clients, these top funds generally take 20% ($200 million) for themselves.

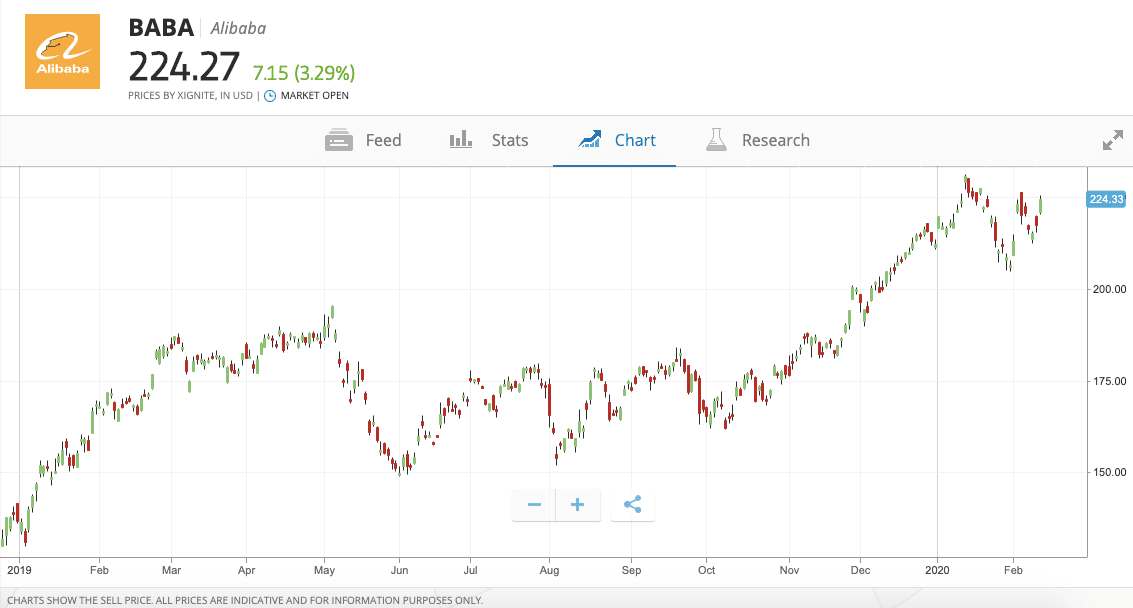

Tech stocks connect these top-performing managers. Most of the highest earners Bloomberg analyzed found significant success with investments in Facebook Inc. and China’s Alibaba Group Holdings Ltd.

The top performing fund manager, Chris Hohn, reportedly backed Google’s parent company Alphabet Inc. and Microsoft to gain 41% for his clients.

“If that’s where the opportunity is [tech], it’s where it is, [b]ut it creates challenges for us,” Aberdeen Asset Management exec Darren Wolf told reporters, adding that many of Aberdeen’s clients already invest in indexes that heavily favor tech stocks like Facebook and Alibaba.

Tech stocks made investors billions last year

Indeed, tech powerhouses Facebook and Alibaba made for great investments last year, with stock prices for both companies increasing by more than 50% in 2019.

Despite managing cloud platforms, digital payments, streaming services, and artificial intelligence initiatives, Jack Ma’s Alibaba is still an e-commerce business. A whopping 85% of its revenue in the third quarter of 2019 came from its online marketplaces (Alibaba.com, Taobao, and TMall).

Still, Alibaba’s expansion into other areas of tech makes it easier to benefit from an ever-expanding Chinese economy. This is reflected in its earnings reports, with Alibaba’s annual revenue surging 56% between 2017 and 2019, on average.

As for social media giant Facebook, healthy revenue combined with growth in monthly active users (and a relatively scandal-free year) kept it strong in 2019.

However, Business Insider recently reported that prominent Facebook investor Peter Thiel had sold $11 million worth of Facebook stock earlier this month, reducing his total holdings in the Zuckerberg-led company by 81%.

At one point, Thiel owned roughly $9 billion in Facebook shares, if scaled to today’s market prices.

In 2020, tech stocks certainly seem just as powerful. Markets trading shares in companies like Tesla, Microsoft, and Sprint have all seen positive action this year, the latter of which is enjoying a 75% pump thanks to the approval of its $26.5 billion merger with T-Mobile.

Get the TNW newsletter

Get the most important tech news in your inbox each week.