Arriving for US consumers way back in 2010, BillGuard touts itself as the world’s first ‘people-powered antivirus system for bills’. Its predictive algorithms alert you when there’s unexpected charges such as hidden fees, billing errors, scams and fraud on your credit card or debit card, while it also serves up warnings when a similar dubious charge has been flagged by other users. As such, the ‘BillGuard brain’ becomes more accurate over time.

Last July, BillGuard went mobile with its launch for iOS, and it went ‘international’ in April with a launch in Canada. Now, a little over a month after arriving on Android, BillGuard is starting to go truly global with its first launch outside of North America.

Yes, from today, consumers in the UK, Australia and New Zealand can use BillGuard too. If you’re new to BillGuard, here’s a quick recap of how it works.

The lowdown

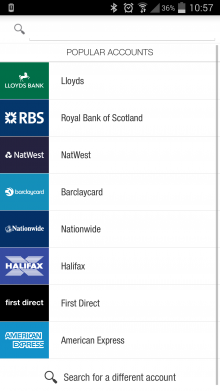

You’ll need to register an account with BillGuard, and you must set yourself up with a 4-digit passcode to access the app. After that, you tap to add your debit or credit card(s).

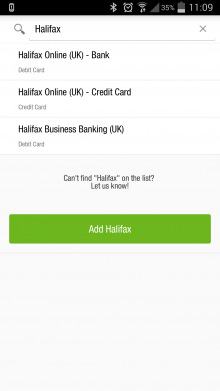

In the UK, BillGuard supports all the major banks except Barclays and HSBC, while in Australia and New Zealand, we’re assured all major banks are supported.

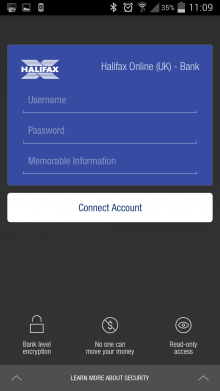

Next, select your bank, card-type and enter your bank log-in details.

This part may make some people feel a little queasy, after all you’re handing over your precious bank details to a third-party. First up, BillGuard itself is a read-only service, so you (or anyone else) won’t be able to make any transfers with the app itself. However, this doesn’t circumvent the fact that you are still handing your details over. But BillGuard says it uses:

“…bank-level security to ensure your data is kept private and secure. We require you to set a four-digit PIN for your BillGuard account and encrypt all communication.”

Still, if you’re at all wary of handing your bank details over, you’re best not using BillGuard at all.

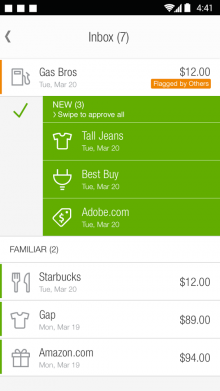

The gist of BillGuard from here on in is this: You stipulate which spending categories you wish to view (e.g. ‘Clothing’, ‘Cash’, ‘Eating Out’), and set up notifications for when new charges hit your account, which can be daily or weekly. While you can use BillGuard to view how much you’ve spent on various things, otherwise known as ‘budgeting’, this is not its main selling point. Security and saving money is the name of the game here.

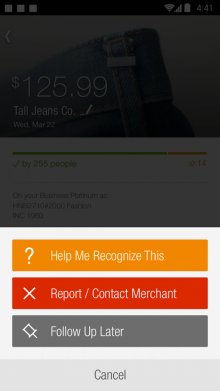

BillGuard analyzes pools of data and, if it detects something suspicious such as random fees or ‘grey’ charges (e.g. a subscription auto-renewal), it raises a red flag and asks you whether you want help recognizing it. It also allows you to contact the merchant directly through the app.

As of last month, BillGuard also issues personalized data-breach alerts, that automatically inform you when a business you’ve shopped at has been breached.

As we saw recently, when PIN details and other personal customer information had been compromised at Target in the US, and in the UK just a few weeks back when shoe retailer Office suffered a similar fate, data-breaches are a growing concern. It’s this concern and anxiety that BillGuard is capitalizing on, as it issues both email and in-app alerts for breaches it thinks you should be aware of.

As we saw recently, when PIN details and other personal customer information had been compromised at Target in the US, and in the UK just a few weeks back when shoe retailer Office suffered a similar fate, data-breaches are a growing concern. It’s this concern and anxiety that BillGuard is capitalizing on, as it issues both email and in-app alerts for breaches it thinks you should be aware of.

Features and functionality aside, BillGuard is a beautifully designed app that adopts familiar Mailbox-like swiping gestures to let you navigate your way through the app. It’ll likely find itself many new fans in the wake of its international expansion.

BillGuard says it is on course to pass the million-users mark, and is adding 2,500 more each day. Since launch, it claims to have flagged more than $60 million in suspect charges.

Finally, while BillGuard was once a subscription-based product, you’ll be pleased to know that as of February this year, it’s completely free to use.

You can download BillGuard for iOS and Android now, in the US, Canada, UK, Australia and New Zealand.

➤ BillGuard: Google Play | App Store

Get the TNW newsletter

Get the most important tech news in your inbox each week.