Launched in the US back in April 2010, BillGuard sells itself as the world’s first ‘people-powered antivirus system for bills’.

In a nutshell, BillGuard’s predictive algorithms alert users of unexpected charges such as hidden fees, billing errors, scams and fraud on credit card bills. It also issues alerts when a similar dubious charge has been flagged by other users, or receives a complaint elsewhere on the Web. As such, the ‘BillGuard brain’ becomes more accurate over time.

However, BillGuard has thus far been a Web-based entity – until today, that is.

The iPhone app was actually soft-launched back in March as a beta test to garner feedback, but was subsequently pulled from the App Store a few weeks ago when the beta-phase came to a close. From today though, the BillGuard app is live for anyone in the US.

How it works

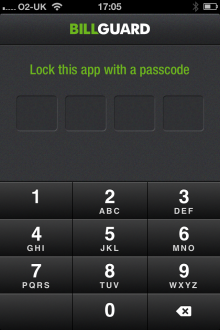

When you first launch the app you’ll be prompted to log-in, or set up an account if you don’t already have one. You’ll also need to include a 4-digit passcode.

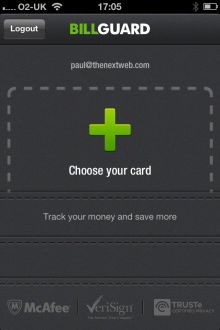

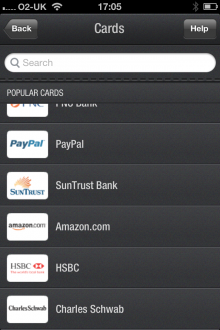

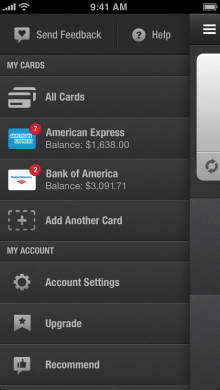

Next, you’ll need to choose which cards and accounts you want to integrate if you’re setting things up for the first time.

Bear in mind this is a US-only service, and works with the likes of Chase, Bank of America, Wells Fargo and so on. Though you can also add your American Express, PayPal and Amazon cards too. It supports 5,000 different accounts in total.

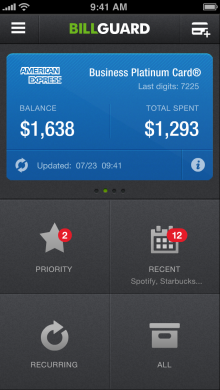

You can see a basic at-a-glance overview of all your connected cards, including balances and total amount spent.

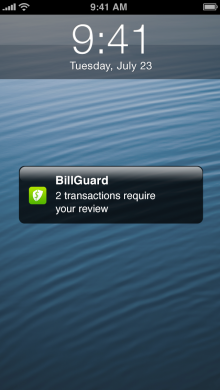

Push notifications tell you whenever a transaction is made on one of your accounts, and you can dig deeper to see exactly what it was and, indeed, whether it’s kosher.

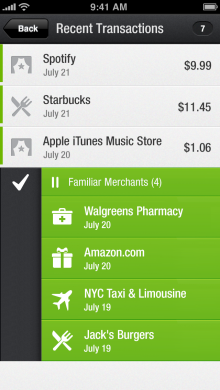

The ‘smart inbox’ lets you swipe through charges in an email-style interface, while you can also contact merchants directly through the app to resolve disputes.

BillGuard says it’s looking to combat the billions of dollars lost by American cardholders each year to so-called grey charges – basically deceptive or otherwise unexpected charges.

Indeed, to coincide with today’s launch, BillGuard is also releasing an industry report on grey charges, claiming that American cardholders were hit with $14.3 billion in deceptive or unexpected charges in 2012. The most prominent type of grey charge is “free-to-paid”, for example when a consumer takes receipt of goods for a free trial period, but then is automatically charged a fee if they don’t return it within a specified timeframe.

BillGuard is a pretty ingenious idea for sure, insofar as users essentially help each other by flagging rogue charges, which help others recognize anything awry with their own accounts. When a charge is repeatedly disputed across the board, it is prioritized for all cardholders who can review it themselves.

“We have built the largest crowdsourced transaction monitoring community in the world,” says BillGuard co-founder and CTO Raphael Ouzan.

“As consumers ourselves, we realized early on that bill checking for most people is a long arduous task that most would prefer to avoid,” he continues. “So we set out to develop a tool that would make bill checking fast, fun and exceptionally effective, with a little help from some very sophisticated algorithms and millions of fellow cardholders.”

We’re told that BillGuard has eked out more than $50m in grey charges so far and, as you’d expect, they’re keen to get everyone on board. “Our data shows that if every American cardholder used the BillGuard iPhone app, the total annual savings in grey charges could top $7 billion,” adds Ouzan.

BillGuard actually added support for Apple’s Passbook application last year, before it even had an iOS app. So this has been a long-time coming.

Pricing

While BillGuard does have a free tier, the premium price for the full service costs $45/year, or $4.99/month, which gives access to more than two cards. Though, as part of the launch campaign, they’re offering premium access for a one-time fee of $9.99 until the end of August.

BillGuard for iOS is available to download now. And we’re told an Android version is currently in the works, with an expected launch some time in Q4.

Disclosure: This article contains an affiliate link. While we only ever write about products we think deserve to be on the pages of our site, The Next Web may earn a small commission if you click through and buy the product in question. For more information, please see our Terms of Service

Feature Image Credit – Thinkstock

Get the TNW newsletter

Get the most important tech news in your inbox each week.