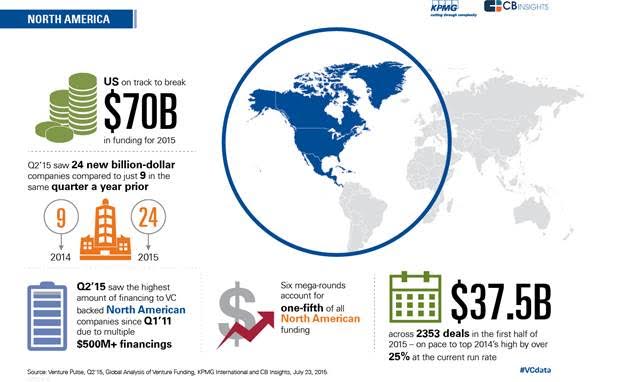

In case you weren’t sure actually how much money venture capitalists are pouring into tech in 2015, let me tell you: it’s a lot. According to findings from KPMG and partner CB Insights, venture funding in North America is projected to hit $70 billion dollars in 2015.

The estimate is based on current trends in investments for the first half of the year. So far, $37.5 billion has been invested across 2353 deals in the first half of 2015. If investments manage to hit that $70 billion mark by December, then it will be its highest in the last five years.

According to the report, a lot of the money is motivated by late stage funding rounds and the emergence of new unicorns. In the second quarter of 2014, 24 companies reached the billion-dollar unicorn valuation, up from nine last year. Adding to the 11 new unicorns in the first quarter, 35 companies have reached the unicorn mark in the first half of 2015.

Check out more stats in the infographic below:

It’s important to note that venture investment isn’t limited to Internet companies. However, they do nab the lion’s share of venture investments. Internet companies accounted for roughly 45 percent of VC-backed companies in Q2 ’15 and 51 percent of dollar shares.

So will VC investments smash records this year? The creators of the report are confident:

“Activity is high and should remain so, with 2015 shaping up to be a record year,” said Brian Hughes, National Co-Lead Partner, KPMG LLP’s Venture Capital Practice. “This is driven by a number of factors, including low interest rates, strong participation by corporate investors, and new capital sources such as hedge and mutual funds. Companies are staying private longer and growing to an immense size as a result of access to investment and stronger investor interest, combined with a trend toward late stage mega-rounds.”

Regardless, 2015 has been an exciting year of growth in the investment landscape. The only question is: will it last?

➤ KPMG

Get the TNW newsletter

Get the most important tech news in your inbox each week.