Square, the fintech stock led by Twitter billionaire and beard-of-the-people Jack Dorsey, is on fire.

In the past three days, Square’s share price has set three consecutive all-time highs, both intraday and closing.

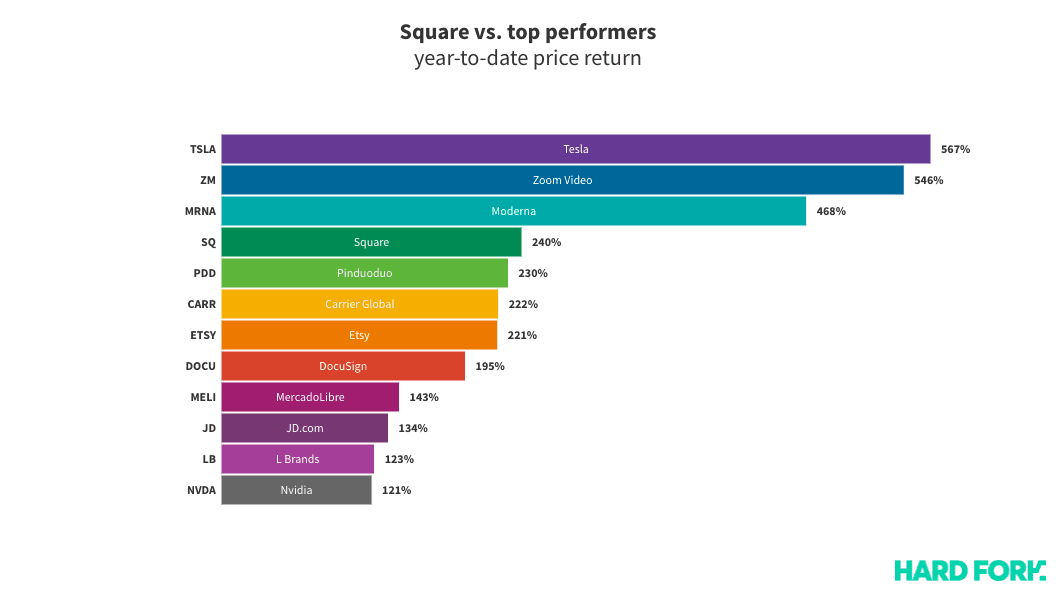

It peaked at $208 on Monday, hit $209.36 on Tuesday, and broke $214 on Wednesday to close the day up 240% for the year-to-date.

Square’s previous intraday and closing records were $201 and $198, set on November 6.

If Square was included in benchmark indices like the S&P 500 or the NASDAQ 100, it would be their fourth best performing stock in 2020.

The only stocks that’ve returned more profit would be COVID vaccinators Moderna, video callers Zoom, and electric carers Tesla.

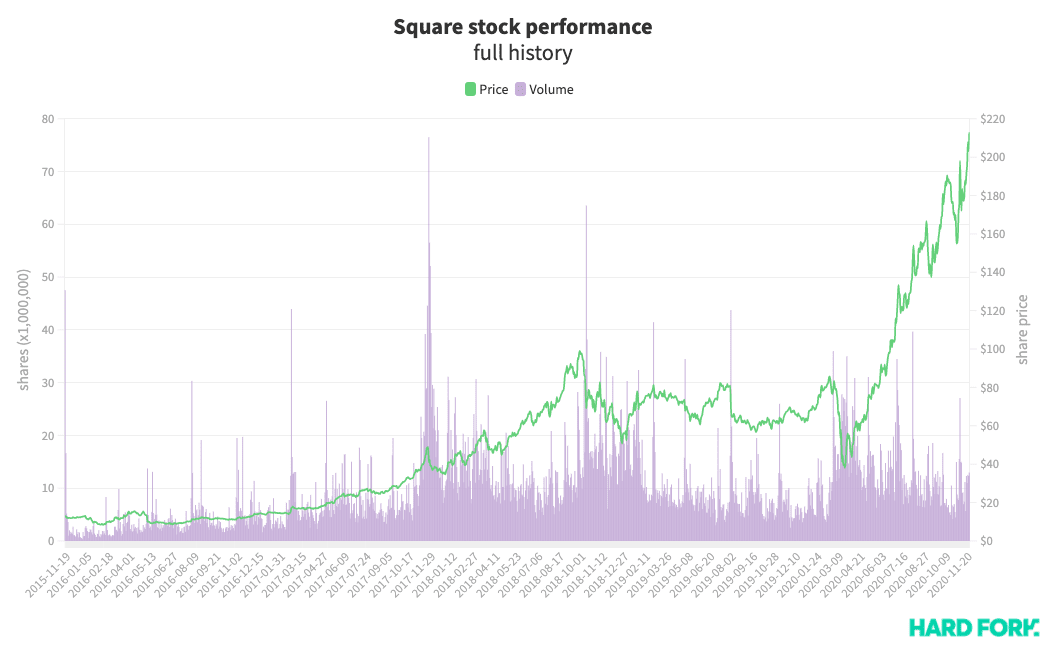

Square stock is now up over 1,800% since its IPO in 2015.

More recently, this week’s 8% jump was solidified by the company’s acquisition of Credit Karma’s tax wing for $50 million, which traders were pretty into.

The move comes as part of Intuit’s $7.1 billion Credit Karma takeover, which until now was blocked by a civil antitrust lawsuit brought forward by the US Department of Justice.

Intuit’s TurboTax is a direct competitor of Credit Karma’s tax business, which makes buying it less than sporting ‘cos Intuit could end up with a monopoly — so Square agreed to buy it instead, and integrate Credit Karma’s tax software and IP into its own peer-to-peer money transfer thing, Cash App.

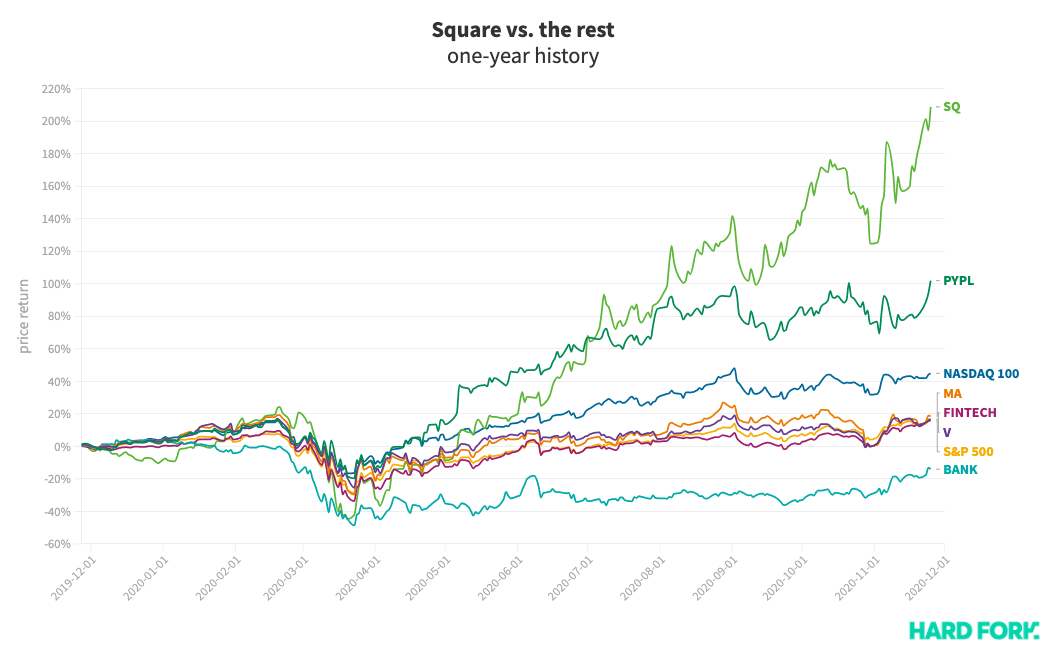

But while Square’s main rival PayPal has also benefitted from a hyper-digitized 2020, PayPal has only just managed to double its share price in the past year.

Still, both stocks are leagues ahead of grandpa payments plays like Visa and Mastercard, which are both up less than 20% since this time in 2019.

All those gains are attributed to Square’s healthy revenue, with quarterly gross profit up 59% year-on-year. The company’s net revenue rose 140% to $3.03 billion, with Bitcoin transactions (Square does that) making up more than half of that.

But even without the BTC, revenue rose 25%.

In fact, Square loves Bitcoin so much it put 1% of its total assets in BTC (around $50 million) in early October, when it traded for under $11,000.

Now it’s worth nearly $17,000, so, there’s that too.

Square’s done a lot of going up, sure, but how far can it go? Boomer question, but ok. Most Wall Street insiders consider it either a buy or a hold, according to MarketWatch.

Get the TNW newsletter

Get the most important tech news in your inbox each week.