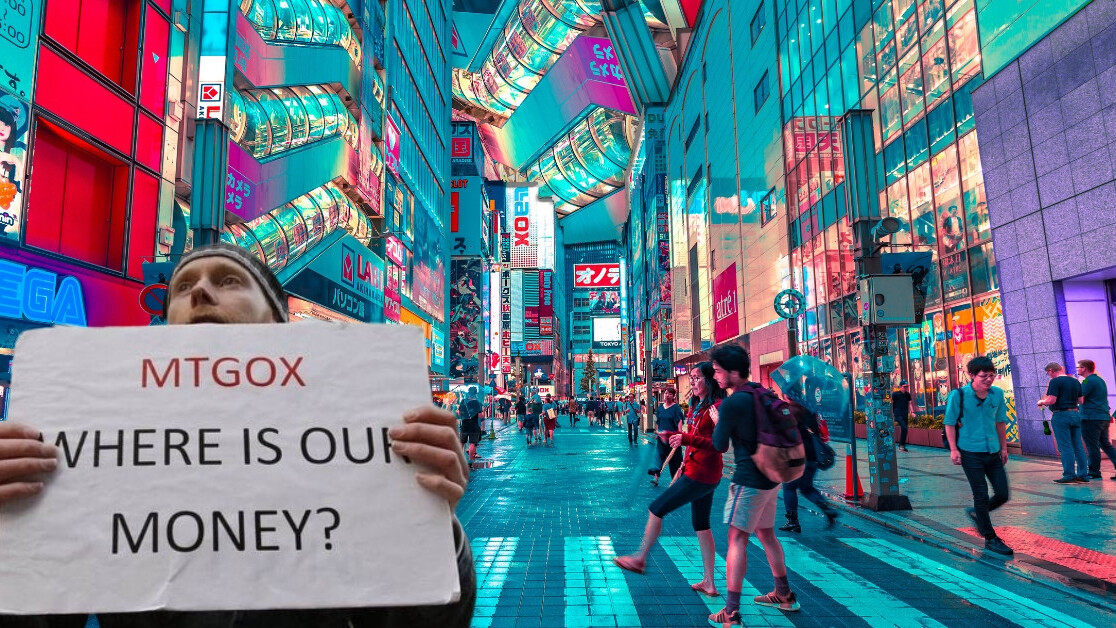

Troubled cryptocurrency exchange Mt. Gox is finally inching closer to settling its debt with creditors, some five years after it was hacked.

According to new documents published by Mt. Gox’s trustee Nobuaki Kobayashi (aka Tokyo Whale, as he’s known in cryptocurrency circles), a decision has been made with regards to creditor’s claims – they’ve been approved or disapproved – and the Tokyo District Court has been notified. Unfortuantely, though, the decision hasn’t been made public.

The trustee’s decision is due to be known over the next few days, and creditors will be notified accordingly.

The exchange’s trustee said in the documents that there was no plan to revive Mt. Gox – only to distribute assets (such as cash or cryptocurrency) to creditors if the bankruptcy plans allow it.

If the debt is repaid using cryptocurrency, this will need to be done through an exchange and creditors will have to create accounts to receive their long-awaited funds.

The details

Importantly, the documents reveal sought after details about Mt. Gox’s balance of exchange, revealing it holds over $629 million (69,553,086,521 Japanese yen) in cash as of March 20.

Additionally, according to the documents, the exchange also has access to 141,686.35 BTC and 142,846.35 BCH as of March 19 – that’s some $593 million based on Bitcoin’s current price.

The Rehabilitation Trustee is also investigating the possible existence of additional Bitcoin held by the Rehabilitation Debtor, the documents add.

So far, approved claims include 802,521 BTC (worth $3,233,256,500), 792,296 BCH ($124,953,000), $38 million in US dollars, and several other amounts in other fiat currencies, as shown in the table below.

It’s worth noting, though, that there are legitimate concerns about the negative effect on Bitcoin’s price if the market is flooded with coins as a result of creditor payouts.

Looking back

At the time of its collapse in 2014, Mt. Gox was the biggest cryptocurrency exchange in the world, handling approximately 70 percent of all Bitcoin transactions.

The exchange officially filed for liquidation in April 2014, claiming 750,000 BTC had been lost, although 200,000 BTC were later recovered in a “forgotten” wallet.

Nobuaki Kobayashi was placed in charge of the funds following the failure of former CEO Mark Karpeles – who recently received a suspended prison sentence – to safely operate the exchange.

In August last year, a press release was posted on the Mt. Gox website, along with an online tool for submitting claims, signaling the exchange was getting ready to return $1 billion in stolen cryptocurrency.

Mt. Gox seems to be the story that keeps on giving, but today’s news is likely to be well-received by creditors, who have patiently waited to receive their funds for the past five or so years.

Did you know? Hard Fork has its own stage at TNW2019, our tech conference in Amsterdam. Check it out.

Get the TNW newsletter

Get the most important tech news in your inbox each week.