From Mint.com in the US, through to Money Dashboard in the UK, and onto global indie apps such as Dollarbird, there’s no shortage of services designed to help you manage your personal finances. Netherlands-based Monyq, however, is taking a slightly different approach to helping you manage your financial affairs.

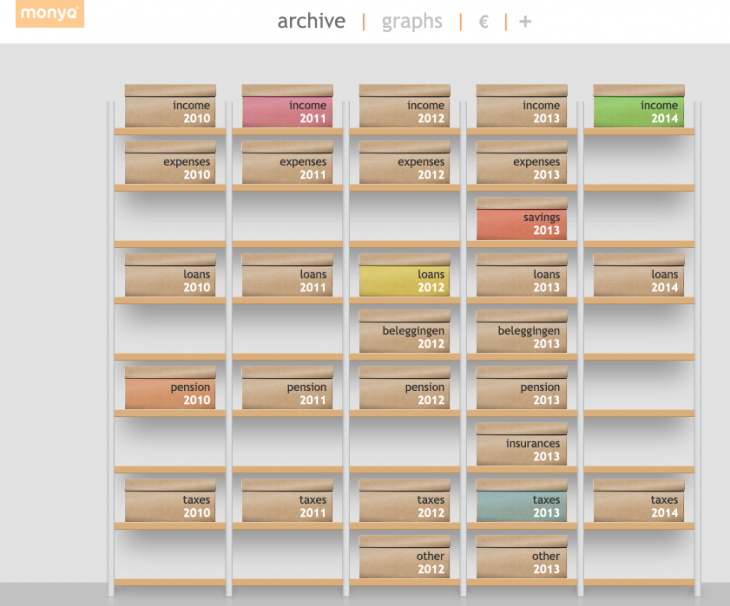

Following a six-month development phase, Monyq’s lifting the lid on its first product today. Touted as an online repository for all your documents, the archives take the ‘shoeboxes on shelves’ metaphor to literal-levels.

Available as a Web and iOS app for now, you can create separate boxes for specific categories for each year, covering income, expenses, insurance, tax, and so on. You then insert documents into a box by dragging them, for example a scanned PDF.

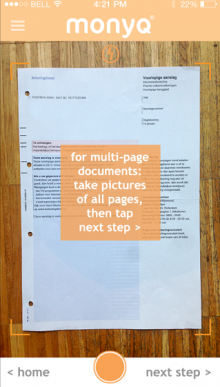

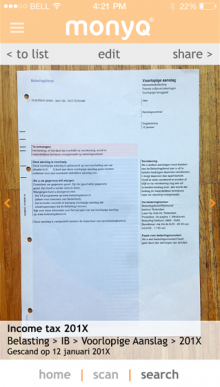

With the accompanying iPhone app, you can snap a photo of any given document, give it a name and place it in your box.

“Maybe it doesn’t seem such an exciting idea, a set of shoeboxes, but I see it as a crucial step,” explains Igor Kluin, Monyq’s founder & CEO. “You can only put everything in order if it’s really simple. Naturally you can take a picture of an invoice yourself. Or make up some files on your computer. But experience shows that a lot of people still find it difficult to structure things.”

You can view, add and edit all the shoeboxes and documents on the Web, or your iPhone, with an Android incarnation coming within a couple of months. And if you need to send an important document to anybody, for example your accountant, you can do so directly from within the app.

The financial archives are Monyq’s inaugural service though, and more is on the horizon. It has just launched a pilot scheme with physical payments cards, which will run until the end of the year.

It uses what it calls ‘category codes’ that are coupled to all card machines, so you can set budgets for each category. So, you may observe that you’re spending a lot of money ‘Eating Out’, so this card will let you set a budget for restaurant payments.

You receive a message if you are approaching that budget. You can go the extra nine yards too, by actually blocking payments that exceed a pre-set budget within a category.

How will this work in real terms though? Often, you won’t fully know how much your eating-out experience will cost until after, so will this mean that you’re left red-faced if you have ‘under-budgeted’? Well, no. It seems hard-limits will be aimed more at specialty cards, for example if you want your child to have access to some funds directly, but not overdo it on the pizza.

“Parents load the pocket money onto the card and children can no longer spend more than the parents permit,” explains Kluin. “You can even choose to limit the card so that it only works in certain shops; in that way children can safely learn how to use a pin card and how to deal with money.”

For yourself as the bank account holder, all it will really mean is that you have instant feedback after a transaction that you’ve spent more than you intended to on a certain category.

This is still very early stage though. For the local pilot in the Netherlands, Monyq has partnered with a bank and Visa, who handle most of the regulatory aspect. Introducing such a scheme at scale with multiple financial institutions globally, will be a tall order.

“The card demonstrates that Monyq is much more than an App,” adds Kluin. “At the same time, we are not a bank either. We are the company that makes it easy for you to deal with your money in a smarter way.”

Monyq’s financial archives platform is open for business on the Web and iOS now, available in English, French, German and Dutch, with Spanish to be added shortly.

➤ Monyq

Get the TNW newsletter

Get the most important tech news in your inbox each week.