Way back in July last year, we brought you news on Dollarbird, an awesome app for tracking your income and expenses courtesy of Halcyon Mobile. Though it has partnered with agencies, brands and startups since 2005 to produce apps, Dollarbird represented Halcyon’s first self-branded product.

At the time, Dollarbird was an iOS-only affair, though the creators did state that if the reception was positive, they’d be looking to bring it to Android too. Well, it seems that the reception must’ve been positive, because Dollarbird for Android is available to download today, alongside a new Pro accounts feature that’s arriving for both iOS and Android.

But first up, a quick look at the Android app. We’ll be looking chiefly at the free, non-subscription version here, which will suffice for most people.

Dollarbird registers on Android

Whether you’re already familiar with Dollarbird for iPhone or this is your first foray into Halcyon Mobile’s expenses-tracker, it won’t take you long to get to grips with the Android app.

Upon launch, you’ll be asked to enter your opening balance – for example, how much you have in your current/checking account. It’s this figure that all future transactions will be subtracted from or added to.

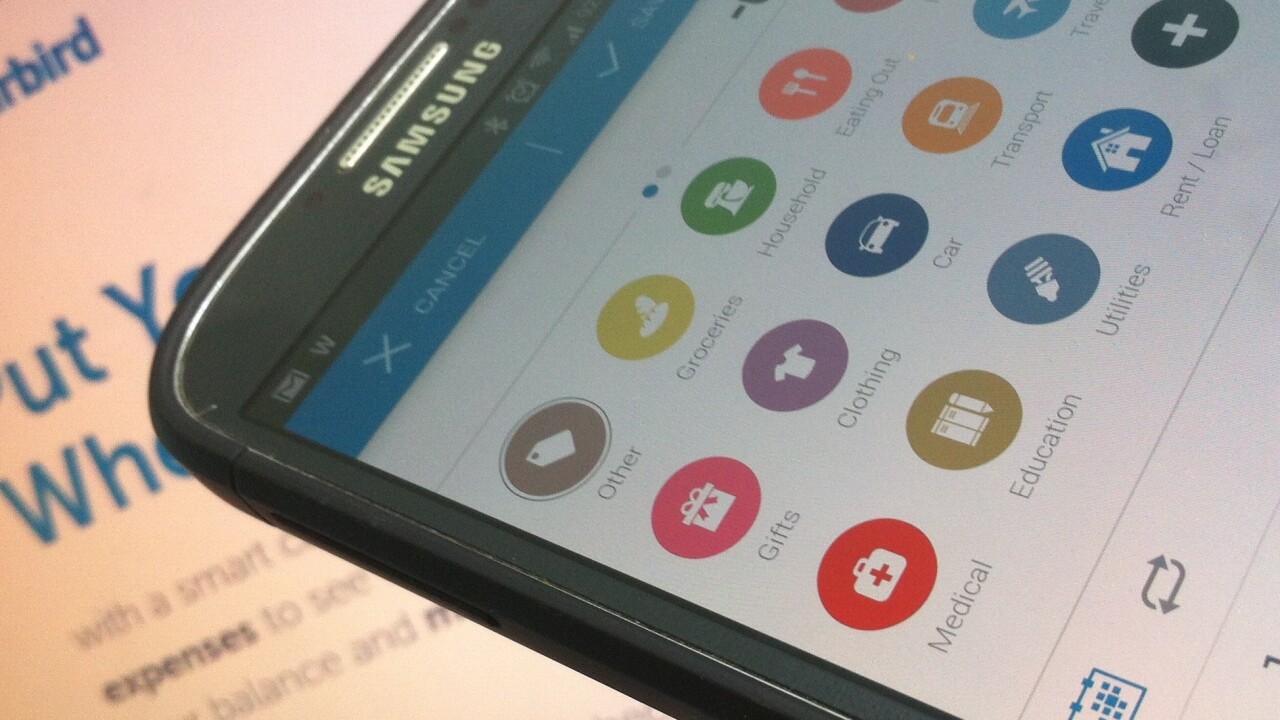

Now, to add a transaction, you simply pull down in the main calendar view and you’ll be presented with rows of categories – ‘Groceries’, ‘Household’, ‘Travel’, ‘Household’ and more. The beautiful thing here is that these are entirely editable. Don’t like ‘Eating Out’? You can change this to ‘Food Deliveries’. You can also alter the color codes to suit your own preferences too.

If you like, you can add notes to each transaction – so let’s say you have £26 that comes out your bank account each month, you can specify exactly what it is and what it’s for – this goes beyond any generic top-level category you may have filed it under. It’s also worth noting here that if you wish to add an inwards transaction, vis-à-vis salary or other unexpected jackpot, you simply swipe to the right within the ‘new transaction’ screen, and you can indicate a ‘plus’ figure instead.

Within each transaction, a ‘recurring’ button lets you specify immediately how often you wish to recur a transaction – for example ‘weekly’, ‘monthly’ or any other variation of your choosing.

When you return to the main calendar view, you’ll see each figure you’ve input on each day, and for each day you’ll see more details on what the amounts refer to. When you click on the little icon in the top-right, you can see how your balance is evolving over time, and how much it changes from month-to-month.

The whole point to this is that it can project how much money you’ll have up to five years from now based on your evolving spending and earning patterns – so this will get even more useful over time.

Additional handy features include the ability to set a PIN code to lock the app, and it lets you choose which day YOUR week starts on – not everyone likes to operate on a Monday-Sunday basis.

Dollarbird Pro

As noted already, the Android launch represents only part of today’s news. The introduction of Pro accounts means that the existing iPhone app will be made free (it was $1.99 to download before today), and users on both platforms can now pay $4.99 a month to access more features, or $49.99 a year which basically gives two months for free. Part of me feels a one-off upgrade fee would’ve been a better move here, as people tend to be more cagey signing-up for monthly or yearly subscriptions.

The main Pro features include being able to create multiple calendars – this lets you track different accounts, which could be savings, checking, credits cards and more.

Moreover, one of the key missing features in the version we reviewed last year was budgeting. But with a Pro account, you can now indicate how much you want to spend each month on travel, alcohol and so on, with Dollarbird notifying you when you’re teetering dangerously close to surpassing your budget.

Throw into the mix a Pro Dashboard which features more charts to track your expenses, a larger selection of icons to associate with your categories (100+ in Pro compared to 15 in ‘free’), the ability to sync your data across iOS and Android and manage expenses as a family, and it’s clear that Dollarbird has evolved greatly as a product. Certainly, from an Android-user’s perspective, Dollarbird is one of the nicest personal expenses-trackers out there.

Next on the roadmap, we’re told, is a version of Dollarbird for iPad and Android tablets, though no timescale has been given on this front.

For now, you can grab Dollarbird from Google Play, and if you’ve yet to check out Dollarbird for iPhone/iPod touch, that too is now free. Whether you’re sufficiently impressed to upgrade to a monthly subscription, of course, will depend on how impressed you are with the gratis version. But we think you’ll like it.

➤ Dollarbird: Google Play | App Store

Get the TNW newsletter

Get the most important tech news in your inbox each week.