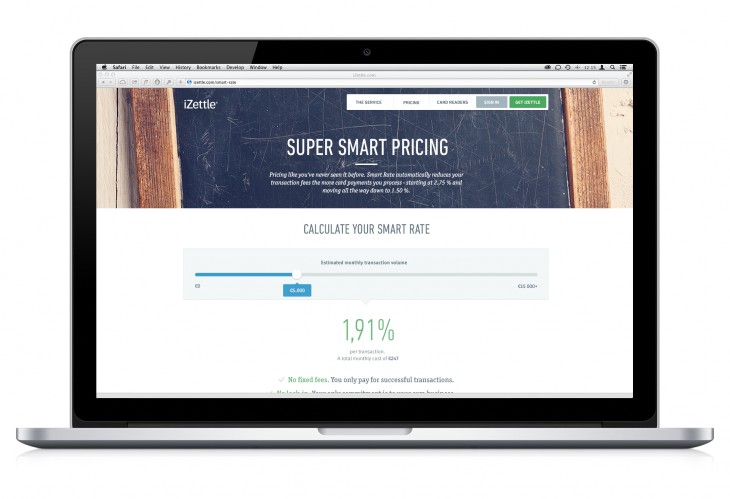

The mobile payment processor iZettle is rolling out a feature called Smart Rate which will see the percentage it takes of each transaction fall for qualifying merchants.

The feature, which is only available in the UK initially, cuts the rate that iZettle users have to pay on each transaction providing they process enough money each month.

For example, taking the standard fee as 2.75 percent, a merchant taking in £5000 per month would ultimately pay 1.92 percent on each transaction (rather than the 2.75 percent) and a small business taking £13,000 per month in transactions would pay just 1.5 percent, a reduction of 45 percent from the original rate.

While restricted to the UK for now, Jacob de Geer, co-founder and CEO at iZettle, told The Next Web that “the UK is our testbed for this new pricing model. If it is successful we’ll certainly be rolling out a similar initiative in other markets in due course.”

The minimum qualification rate for the Smart Rate is just £2000 and merchants that qualify will automatically be opted in to the system. Rather than using a tiered rate system, iZettle uses a sliding scale of anything above £2000, with anything above £13,000 qualifying for the 1.5 percent rate.

Instead of working it out incrementally, iZettle simply charges the same 2.75 percent it normally does and then credits back the due amount, depending on how much the merchant processed that month.

The move is a smart one on iZettle’s part. Offering a reward for businesses that are successful provides a level of incentive for a growing company to stick with their tried and tested payments processor and forces the competition to up its game.

The most notable competitor is arguably Square, which offers the same 2.75 percent per swipe as iZettle or an alternative flat monthly fee of $275 with 0 percent per swipe on the first $21,000 per month. Square, however, is currently not available in the UK. Other alternatives such as Payleven and SumUp which are available in the UK charge the same flat 2.75 percent per month.

It also follows an already aggressive strategy for 2013 that has seen the company land a €6.6 million funding round, expand into Mexico and launch a new combined Chip and Magstripe reader, and revamp its apps.

However, while the lower fees will likely prove enticing to potential iZettle merchants, businesses often prefer to know exactly how much they are paying in advance for services rather than finding out at the end of each month.

Featured Image Credit – iZettle

Get the TNW newsletter

Get the most important tech news in your inbox each week.