Silicon Valley has largely dominated the narrative around technology startups and even though the American region is still king, it’s refreshing to see just how far Europe has come in recent years.

If you’re an entrepreneur, investor, or working in European tech, you’ll benefit from knowing the basics of the landscape to get a better sense of where the next opportunity might arise.

Much has been written about technology hotspots such as London — renown for its fintech capabilities — and Paris — where the national government is bolstering its effort to turn the capital city into a prominent AI hub — but other countries and cities haven’t historically received the same attention nor are they met with the same level of curiosity or scrutiny.

With this in mind, we’ve taken a look at the state of tech in the Benelux Union — a politico-economic union and formal international governmental cooperation of three neighbouring states in Western Europe: Belgium, the Netherlands, and Luxembourg.

The Benelux is one of three ecosystems that TNW and four other partners will be looking to boost in the ongoing X-Europe program. Sponsored by the European Commission, X-Europe will connect 150 startups with investment, partnerships, talent, and opportunities across Europe. By creating a community of stakeholders in the Benelux and beyond, the program will make taking advantage of the opportunities in the Benelux easier for everyone across the continent.

[Read: Here’s how to make your virtual meetings more efficient]

Benelux: An overview

Before we take a look at the state of tech across each single country, it’s important to get a general sense of how each territory differs in terms of population and economy — especially as Europe is known for its fragmentation and the varying degrees of socio-economic maturity across its ecosystems.

Out of the three Benelux countries, the Netherlands is the most populous. Today, some 17.1 million people live in the Netherlands, whereas Belgium is home to roughly 11.5 million people, and Luxembourg has a population of a little over 600,000.

On an economic level, the Netherlands had the highest Gross Domestic Product (GDP) in the Benelux region — with the figure sitting at €774 billion in 2018. Meanwhile, Belgium’s GDP stood at approximately €473 billion in the same year. Luxembourg, on the other hand, had a GDP of €63 billion. To put this into perspective, the UK’s GDP in 2019 was £2.21 trillion (€2.4 trillion) and France’s stood at around $2.707 trillion (€2.3 trillion).

When it comes to money, the region’s startups do benefit from several investment funds. In December 2019, Volta Ventures, announced its second fund, ‘Volta Ventures II,’ with an initial closing of €35 million to continue backing early stage, fast-growing companies in the Benelux region. Several months earlier, Pan-European VC btov Partners closed a €100 million investment vehicle.

And while these funds are largely welcomed by entrepreneurs in the region, there’s certainly room for improvement when it comes to access to capital.

“There’s not enough money flowing in the tech ecosystem yet. In cities like London, Berlin, and Paris there are a lot more business angels supporting early-stage startups with money and support. There are more VC funds deploying capital and governments are pumping money into the tech ecosystem,” says Jacob Claerhout, a Belgian VC at Partech, where he focuses on the firm’s Benelux’s early-stage investments.

Now that you have a general idea of each country’s size and economic prowess, let’s take a look at how their tech ecosystems compare to each other.

Belgium: A multicultural hub

“With organizations like The Eclipse Foundation making Brussels their home, the continued financial support from European institutions and a growing support network of incubators, accelerators, and corporate innovation programs, Brussels is gaining momentum,” Claerhout adds.

With its international population and relatively small size, Belgium is the perfect testing ground for multilingual startups seeking to grow in Europe — and it seems that venture capital investors agree.

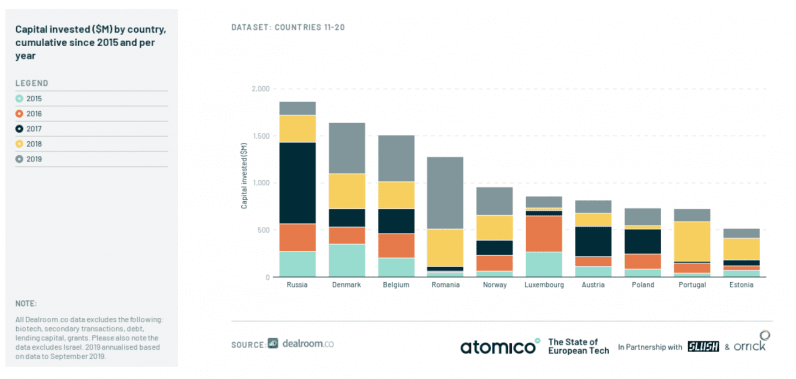

In 2019, Atomico’s State of European Tech report said that cumulative capital investment since 2015 had surpassed the $10 billion mark in three European countries (UK, Germany, and France) and more than $1 billion had been raised by a further 11 countries. Belgium missed the top 10. It came 13th, trailing behind Russia and Denmark, but coming out on top of Romania, Norway, Luxembourg, Austria, Poland, Portugal, and Estonia.

Much of Belgium’s tech ecosystem centers around Brussels. The city’s premience is also clear on a global scale. Startup Genome’s Global Startup Ecosystem Report 2020 ranked Brussels — Belgium’s capital city and where most of the country’s tech startups can be found — among the top 30 emerging tech ecosystems world-wide.

Brussels is home to several well-known tech companies including Collibra, which provides data governance solutions and allows businesses to evaluate the quality of their data. It joined the tech unicorn club after raising a staggering €87.5 million in Series E funding in January 2019, bringing its total VC funding to over €200 million.

Tech enthusiasts and founders should also be looking at Antwerp and Ghent, both of which have a healthy startup and tech event scene.

Luxembourg: Government support

Over the past few years, Luxembourg has witnessed the emergence of multiple startups initiatives, accelerators, incubators, coworking spaces, and tech events.

Well-known companies in the country include Talkwalker, social media analytics and monitoring tool and JobToday, an online jobs board. OCSiAI, a producer of graphene nanotubes, made headlines last year when it joined Europe’s growing list of tech unicorns.

The country, which is the second richest in the world with an average GDP per capita of $79,593,91. Its economy is largely tied to the banking sector and as such there are probably clear opportunities for fintech companies to leverage.

However, founders and entrepreneurs in Luxembourg — and the rest of the region — need more success stories to look up and aspire to. There’s also a clear shortage of expertise to help companies grow at pace.

“We need more people that successfully helped scale giants like Booking, Ayden, and Elastic. The learnings of the team members at similar companies are the building blocks to accelerating an ecosystem once they move on to the next adventure,” Claerhout weighs in.

The Netherlands: Amsterdam is the clear winner

Famous for its canals, Amsterdam has positioned itself as an important technology hotspot in both Europe and on a global scale — and it arguably dominates the tech and entrepreneurial scene in Benelux.

Amsterdam has shown great growth in the past few years and has diligently built its startup ecosystem. Back in 2015, the city was ranked at number 19 in Startup Genome’s Top 30 Global Startup Ecosystem, but has continuously risen since.

In 2019, the city secured 15th place and this year it jumped up three spots, ranking as the 12th best global startup ecosystem in 2020.

Homegrown companies include global payments processor Adyen, which in June 2018 listed one of Europe’s largest tech IPOs with a value of $8 billion, and travel tech platform Booking.com.

The city ranked very high in terms of connectedness, benefiting from the Netherlands’ logistical and social links with the rest of the world. In fact, the country was ranked number one in DHL’s Global Connectedness Index — it’s therefore hardly surprising that many international companies such as Netflix, Uber, and Tesla have established their European HQs in Amsterdam.

It’s also fair to mention that TNW was founded in Amsterdam and provides most of its services from there: whether it’s media, spaces for startups, networking events, or programs. TNW — like many other Amsterdam-based companies — has managed to catch the attention of big international players and in 2020 the Financial Times acquired a majority stake in the company.

If you delve deeper into Amsterdam’s tech scene, you can discern obvious trends. Pitchbook’s report notes that the city’s food tech industry is on the rise. Online grocery platform Picnic closed an impressive $275 million Series C in 2019 and The Vegetarian Butcher, a meat substitute startup, was bought by Unilever in 2018.

Amsterdam’s prowess in life sciences is also clearly evident. The European Medicines Agency, a regulatory authority, moved its HQ to Amsterdam in 2019. Aidence, an AI company that leverages the tech process chest CTs and to support decision-making, nabbed $11 million from investors, and biopharmaceutical company AM-Pharma raised approximately $127 million in 2019 to continue developing its treatment for acute kidney injury.

What’s more, Pitchbook’s latest report estimates that Amsterdam’s ecosystem is valued at $22 billion. The median Seed round raised by companies in the city is $500,000, the media Series A sits at a comfortable $2.4 million — and a software engineer can expect to earn an average salary of $61,000.

Even though Amsterdam has much to offer tech companies — and it certainly benefited from a somewhat aggressive PR campaign that urged London companies to flee the UK in the wake of Brexit — there’s still much work to be done.

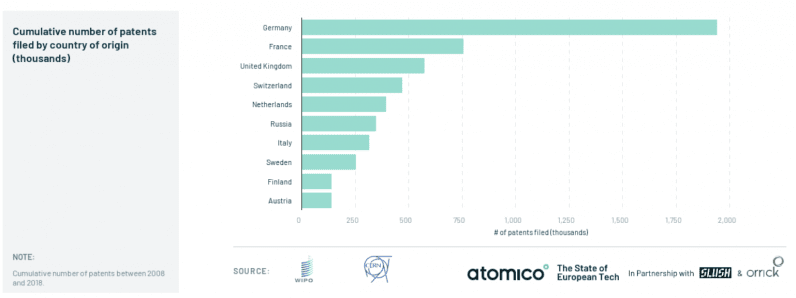

Startup Genome’s report says that Amsterdam, like New York City and Washington DC, ranks low in terms of patents — proving that founders focus much more on business innovation models rather than leveraging tangible IP production.

However, Atomico’s State of European tech report positions Amsterdam within the top 10 cities in terms of patent filings in Europe.

Amsterdam isn’t the only prominent tech ecosystem in the country. According to a Dealroom report released in September 2019, two-thirds of all startup jobs are outside Amsterdam. Roughly a third is in the next eight cities including Rotterdam, Utrecht, Eindhoven, and the remaining third are in dozens other cities. The report also states that many of the most prominent Dutch tech companies were launched outside of Amsterdam.

It’s encouraging to see how tech startups are gaining momentum across the Benelux region, but there’s still more work to be done if the ecosystems are to ever compete on a European and global scale.

“Starting a company or joining a startup is not considered a viable and responsible career choice yet, meaning that the talent pool is small. Too many bring young people still aspire to corporate careers or spend their youth in banking or consulting,” Claerhout concludes.

The mindset of entrepreneurs and innovators in these countries needs to shift — but seeing the current support it’s plausible this will change as the ecosystems grow and mature.

The X-Europe program is fostering the growth of startups in the Benelux region. Follow the program website to keep an eye on the services they are providing and the solutions being advanced by the selected startups, and join the upcoming activities.

Get the TNW newsletter

Get the most important tech news in your inbox each week.

This project has received funding from the European Union’s Horizon 2020 research and innovation program under grant agreement No 871795.