As should be pretty clear for our readers at this point, we feel strongly that online streaming is the (nearer than most think) future of home video. So it should make sense then for Best Buy, the largest electronics retail store in the United States, to get in on this quickly emerging market if it has the chance, right?

As should be pretty clear for our readers at this point, we feel strongly that online streaming is the (nearer than most think) future of home video. So it should make sense then for Best Buy, the largest electronics retail store in the United States, to get in on this quickly emerging market if it has the chance, right?

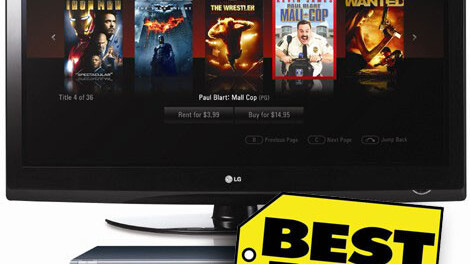

New CinemaNow

Best Buy obviously thinks so, and last month they partnered with Sonic Solutions (better known as Roxio, which just purchased DivX for about $323 million) to roll out a new version of Web 1.0 site CinemaNow (which interestingly, Best Buy apparently owned the naming rights to, but not the website) and which is now bundled with a range of electronics sold at Best Buy.

Users can buy and rent movies from CinemaNow, and frankly, their rental prices aren’t that bad – many are $3.99 and some are $2.99 for 24 hour rentals. On the other hand, the current website is pretty bare-bones, lacking in any of the polish of Netflix.com or Hulu.com.

The competition is strong…

Yes, Netflix and Hulu. And Apple TV, and Google TV and Yahoo Widgets, and YouTube Leanback, and all of the other services that we called out last week that are combining to take down mostly-brick-and-mortar Blockbuster (which probably not coincidentally also signed a agreement with Sonic Solutions in early 2009 for Blockbuster to use CinemaNow – not sure what happened with that). This space is very crowded, and frankly, requires strong Internet DNA to compete. CinemaNow does not seem right now to have the required DNA to compete here.

…but Best Buy has clout…

That said, Best Buy should be considered a serious player, for no other reason than many of the hardware manufacturers count on Best Buy to produce a large percentage of their US sales, so Best Buy has some leverage here to cut deals, possibly exclusive ones if CinemaNow gains any traction.

It really is an interesting approach, because neither Best Buy nor Sonic Solutions are Internet-centric companies like all the rest of the middlemen (i.e. not hardware or content producers) in this space, but they have two advantages the others don’t: Best Buy that leverage that we discussed above, and Sonic – through Roxio, which is pre-installed on many PCs – a way to possibly get CinemaNow onto future PCs (if in fact that is an advantage, as PCs may be on their way out). CinemaNow must be an attempt by Best Buy to offset falling DVD sales, and Sonic must be looking for a way to justify paying $323 million for DivX so that CinemaNow could reach beyond Windows-based platforms. So will they succeed?

…but unlikely to succeed

All that said, if Best Buy / Sonic Solutions can pull this off, it would near to a miracle. While having their system installed on a variety of devices sounds nice, few of the devices they list on the CinemaNow website are hot items (the Xbox is, but there are many other ways to view content on the Xbox).

Netflix and eventually Hulu will also be almost ubiquitous at some point as far as their reach onto devices, so this really isn’t much of an advantage. That said, the single largest problem that we see right now for CinemaNow is that their web interface simply does not stack up against the competition, and – while we haven’t actually seen the device interface – that doesn’t bode well for the user experience on devices other than computers.

So while Best Buy / Sonic Solutions have the right idea about getting into this market now before the market sorts itself out and declares a winner or two, the new/current CinemaNow offering doesn’t seem to be enough to dislodge its many competitors.

Get the TNW newsletter

Get the most important tech news in your inbox each week.