Last September, The American Bankers Association (ABA) announced that, for the first time, most Americans aged 55-years and older prefer online banking as opposed to visiting a branch or ATM.

According to the study, 57% of bank customers in that age group noted that Internet banking was their preferred means of managing their money, compared to only 20% in 2010. Among all age groups, 62% said they prefer online banking, up from 36% on the previous year.

In the UK, the numbers of registered online banking users pretty much doubled between 2006 and 2010, meaning that 43% of the adult population is signed-up to side-step bank queues.

Of course, there’s still a long way to go. The High Street bank isn’t yet consigned to the history books, if it ever will be. However, there’s little question that digital banking is the future for everyone. But what does that future look like?

The future of online banking: It’s all around us

To know what the future of online banking looks like, it’s probably worth looking at the present – online banking isn’t new. I’ve been banking online for ten years now, and I was hardly an early adopter.

When you think of online banking, you probably think about a computer (either a desktop or laptop), a three or four step security process and then an interface that lets you view the balance of your various bank accounts and credit cards, whilst permitting you to transfer money and pay bills. And you’re not wrong either.

But the broader definition of online banking should really be any platform that lets you move or otherwise manage your financial affairs digitally.

You’ve no doubt heard of PayPal before, if you’re not already actively using it on a daily basis. It’s an electronic platform that lets users pay for good or otherwise transfer money between two users. It completely bypasses the need for cash, plastic or cheques.

PayPal’s co-founder and former CEO Peter Thiel has claimed that it isn’t a bank, because it doesn’t engage in fractional-reserve banking, but in 2007, the situation was given some clarity when it obtained a banking license for the European Union and upped-sticks and moved to Luxembourg. It said at the time:

“Under this new charter, PayPal will be able to continue its European expansion by offering its services to more online merchants across Europe. In addition, PayPal will be moving its European headquarters to Luxembourg”

So it’s certainly not a bank in the traditional sense, but it does function like a bank. Whilst you or I may not receive our salaries into our PayPal accounts, many people do store money in it.

Whenever I sell something through eBay, the proceeds remains in the account to cover the cost of future PayPal purchases I make. And I don’t even have to monitor the balance, because if there isn’t enough money in it to cover a purchase, it’s linked to my debit card which in turn is linked to my current account. It’s like a digital debit card that saves me having to enter my lengthy card number each time I buy something on line. PayPal is one example of a number of online banking services.

You’ll note though that PayPal has traditionally been shackled to the online world. If we’re to look at the future of online banking, we have to look at the bigger picture and see how it will infiltrate both the physical and digital realms.

Two worlds collide: Online banking arrives on the High Street

It’s difficult to really fathom how much of an impact mobile phones are beginning to have on the banking space. And it’s difficult to discuss online banking without encroaching into m-commerce territory, as they’re so intrinsically connected.

There are a number of mobile payment platforms emerging in this space, and it seems that it’s ripe for innovation. Last week we reported on the latest developments at mobile payment platform Boku.

http://vimeo.com/37288262

The San Francisco-based startup has secured $40m in funding since it was launched in June 2009, and it now operates in 67 countries, working with more than 240 carriers across 40 different currencies.

Up until last week, Boku let users pay online using their mobile number. This saves having to enter long credit card numbers each time they want to buy something on the Web, and the charge appears on users’ mobile phone bill. On the retailers’ side, Boku creates software for merchants to process these payments and then takes a cut of the transaction.

But then the startup launched its white-label Boku Accounts platform, letting Mobile Network Operators (MNOs) issue their subscribers a branded mobile payment account (e.g. ‘Vodafone’ or ‘T-Mobile’), which will be accessible through mobile devices (Web, iOS, Android, and HTML5) and computers, meaning subscribers can make payments online, in-app, and in-store – through a branded debit card or NFC-enabled POS.

When they sign-up, subscribers add money to their account via credit card, by linking a bank account, or by topping up at a merchant/top-up location. They also receive a debit MasterCard for purchasing in stores without an NFC terminal – so this means anywhere where MasterCard is accepted initially.

The MasterCard is to help cover all bases, given that near field communication (NFC) is still gaining traction in retail outlets.

We’ve written extensively about NFC technology in the past. In a nutshell, it’s a set of standards for mobile devices to communicate with each other by touching them together or bringing them into close proximity to each other. However, not only do many merchants not yet have NFC technology in-store, but most mobile devices aren’t yet NFC-enabled either, which surely still poses a big problem for Boku even if a store DOES have the technology?

Well, no. Boku Account subscribers also receive a personal NFC sticker to place on the back of their mobile phone – be it a smartphone or a feature-phone, and which can be used at NFC-enabled checkouts that accept MasterCard.

It’s essentially bridging the gap between two worlds – traditional card-based digital banking, and the latest innovations in the mobile payment space. This is where the massive land-grab is currently taking place, with other big-players in the field such as PayPal (with Express Mobile) and Google (with Wallet) looking to cement their positions as leaders in the industry.

Twitter’s Jack Dorsey also has a little ‘side-project’ called Square, which is now accepted by over 1 million merchants. Square essentially offers a small piece of hardware which attaches to your iPhone, iPad or iPod touch, and allows anyone to easily accept credit cards and it does so at a rate that’s lower than almost any other processor.

Then there’s Dwolla too, which is striving to circumvent NFC restrictions with its Proxi feautre. Proxi is a peer-to-peer system that enables payments to be sent to nearby users, without the need for either party to have NFC, and it uses good old-fashioned satellites to run off GPS, which means that almost every modern smartphone can use it.

There really is a lot of innovations going on at the moment which help give us an idea of what the future of online banking looks like. What else is out there? Let’s take a look.

Banking without walls?

We’re starting to see a number of innovations emerge in the online banking space. For example, last year we reported on Movenbank, which launched in alpha as “the world’s first cardless bank.”

With Google Wallet, Square, PayPal and the likes emerging in the mobile payments space, it was surely only a matter of time before a mobile, cardless bank emerged built around the tech buzzwords – ‘mobile’, ‘social’ and ‘gamification’. The launch was announced last October by its founder and chairman, Brett King, who was also the author of Bank 2.0. He said at the time:

“This is the reboot of Banking as we know it. Movenbank will combine the best aspects of both a financial services provider and a customer-focused, tech start-up. It is integrating mobile, online engagement, social media and gamification into a new kind of customer experience for banking products and financial services.”

Then there’s BankSimple, a Web-only bank which launched in private beta late last year. The Next Web’s Drew Olanoff described it at the time.

“BankSimple isn’t a standalone bank, in the traditional sense, but rather takes on the role of replacing your bank. It aims to make banking a different experience, getting rid of surprise fees while still making bill paying, budgeting and saving a priority.”

BankSimple aims to help its customers save money and budget for travel and bills, placing a big emphasis on customer service. And this is a key point – banks typically have a reputation for poor customer service, and we’re starting to see a bigger focus placed on this with a new wave of banks.

In the UK, for example, the High Street’s first new bank in more than a hundred years opened its doors in 2010.

Metro Bank arrived on the scene promising to “revolutionize” the British banking experience through offering retail opening hours (as opposed to the traditional 9-5 approach which is standard across the country), and promising to focus on customer service.

Indeed, this hints that the future of banking may not entirely sit within the online realm, as many would have you believe. Metro Bank launched with a handful of branches, but it plans to have more than 200 across the UK within a decade – all with longer opening hours: 8am to 8pm Monday to Friday, 8am to 6pm on Saturday and 11am to 4pm on Sunday.

Pingit blind-sides the UK banking industry

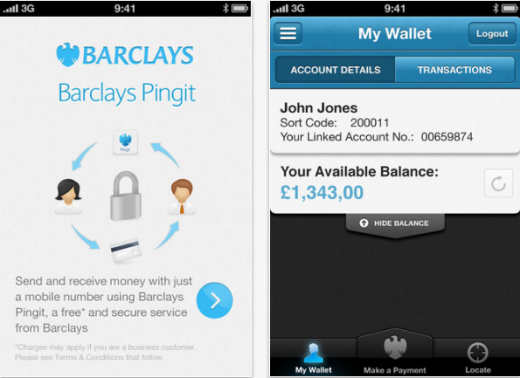

Two weeks ago, Barclays created a minor ripple in the UK banking sphere when it launched Pingit, lettings its customers send and receive up to £300 using just their mobile phone number.

Pingit is one of Europe’s first person-to-person service for sending money this way, requiring customers to own just a UK current account and a domestic mobile phone number. The service does away with bank details by linking a customer’s account to their mobile device.

If there was every any doubt as to whether this would be of interest to consumers, we later reported that the app – available across iOS, Android and BlackBerry devices – had been downloaded a whopping 20,000 times in the first two days. And it saw 120,000 downloads within 5 days.

But what was the real significance of this? Would it really be enough to make customers jump ship from other banks to use Barclays’ service? Well, as it turns out, they won’t have to.

Barclays plans to make the service available to customers of all other banks too. By blindsiding other financial establishments, Barclays’ Pingit system could become the industry standard before any of its competitors have even spluttered into their morning ‘papers. It’s understood that the Royal Bank of Scotland (RBS), owner of NatWest, is looking at similar ideas, as is Lloyds Banking Group.

Antony Jenkins, chief executive of retail banking at Barclays, said that Pingit would revolutionize banking, or at least live up to the scale achieved by telephone and Internet banking before it. “You can send and receive money in seconds without having to enter account details,” he said.

An indication that Barclays’ move was a masterstroke came in a frank admission by an HSBC spokesperson, who said that whilst it had no current plans to launch a service to rival Pingit, it was “certainly a step forward for the banking industry.” That’s about as high-praise as you’ll ever get from one bank to another.

What’s in it for Barclays? Well, that’s the $64,000,000 question. Jenkins admitted that there was no direct way to make money from the system at present, but by instantly gaining access to millions of rival banks’ customers, there’s definitely scope to cross-sell other products or even recruit them as clients

Mobiles and money management

Once upon a time, money-management was as simple as knowing how much money you had in your wallet, and how much money you had in your bank account. With the likes of chip-and-pin (debit and credit cards) now the standard for many in-store purchases in the UK, it has gotten increasingly difficult to keep tabs on how much we’re spending.

With mobile phones entering the fray, this will become more so. Think about it – you’ll likely still have some cash in your pocket, and there will be an array of payment options at your disposal. Centralizing all of this under one easy-to-monitor platform will be essential, with NFC, mobile apps (e.g. Pingit), plastic, PayPal and whatever other innovations come along in the intermittent period fighting for our attention. It’s a minefield.

Mobile phones have morphed into the most essential lifestyle accessory. You’d likely leave home without your wallet before leaving your phone behind. We’re not quite there yet, but the trajectory we’re heading certainly suggests that our smartphone will BE our wallet in the foreseeable future.

Old-school online banking is already making way for alternative conduits into personal money-management. Mint.com has made significant inroads in the US for its online management tools, allowing users to keep track of their finances in real time via Web-based and mobile apps. And the likes of MoneyDashboard, which we’ve covered before, is striving to do the same for the UK market.

We’ll see many similar platforms emerge as we strive to keep tabs on the comings and goings of our hard-earned money. The various facets of our spending will all be pulled together under one centralized platform, accessible through mobile devices, TVs, desktop computers and likely any connected device. Maybe even your fridge.

The future of online banking? Mobile.

Mobile telephones have been firmly ingrained in society for well over a decade now, but the smartphone revolution is enabling a newer, nimbler shopper. The shackles that once confined consumers to a laptop or desktop have been shed, and we’re now seeing innovations across the financial sphere.

Last year heralded the first big wave of contactless payments in the UK, with McDonalds first up, followed by Starbucks which rolled out a similar service to let customers carry out small transactions in-store with their smartphone. We also saw the UK’s first mobile rail ticketing service, trialled by Chiltern Railways, whilst Orange announced ‘Quicktap’, lettings its customers buy goods in-store with their mobiles in a partnership with Barclaycard. The big obstacle at present is still the lack of NFC-enabled devices on the market, which will change as we move forward into 2012 and beyond.

So, what’s the future of online banking? Think ‘mobile’, and you won’t be too far off the mark. Will online banking kill off the High Street bank? Maybe, but not for a long time yet.

Get the TNW newsletter

Get the most important tech news in your inbox each week.