Mint.com has earned a great reputation in the US for its online money management tools, allowing users to keep track of their finances in real time via web-based and mobile apps. The problem? It’s only available to US residents. Stepping in to solve this problem, at least for the UK, is Money Dashboard.

Mint.com has earned a great reputation in the US for its online money management tools, allowing users to keep track of their finances in real time via web-based and mobile apps. The problem? It’s only available to US residents. Stepping in to solve this problem, at least for the UK, is Money Dashboard.

After several months in private beta, the service opened to the public this week. So, should you sign up? We’ve given it a roadtest and here’s what we think.

Getting set up

In order to use Money Dashboard you’re going to need to have Microsoft Silverlight installed. This is a pain if you use a non-supported browser (we had problems with Chrome on the Mac, even though Money Dashboard assures us it is supposed to work) but Money Dashboard’s Dave Riley tells us that they opted for Microsoft’s proprietary technology as it allowed them to provide a good looking, secure, cross-platform experience.

Once you’re set up, it’s time to add your various bank accounts. You do this by entering your internet banking login for each account. While this can feel a little disconcerting, Money Dashboard uses the same system, Yodlee, that Bank of America, PayPal, Mint.com and even Fort Knox use to secure their financial information. More details on how that works here.

Keeping track your finances

The benefit of services like Mint and Money Dashboard is that they visualise your financial activity in ways that make budgeting incredibly easy. Being web-based they’re much more convenient than traditional personal finance software like Quicken, too.

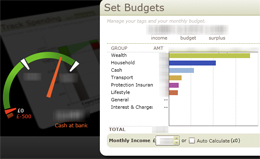

Money Dashboard’s UI is split into four screens which you can click left and right between using some fancy Silverlight-powered animation. To the left of this is a ‘speedometer’ showing graphically how your finances are doing.

Money Dashboard’s UI is split into four screens which you can click left and right between using some fancy Silverlight-powered animation. To the left of this is a ‘speedometer’ showing graphically how your finances are doing.

Your Dashboard shows the latest transactions, while ‘Set Budgets’ allows you to mark an amount of money that you want to try to limit yourself to for different type of spending. Savings, investments, groceries, gadgets and travel are among the suggested things you can set budgets for, although it’s completely customisable. If you want to budget your spending on doughnuts and iPhone apps that’s completely fine.

How does Money Dashboard know what you’re spending on each type of item? Tags. The ‘Tag Your Transactions’ screen allows you to apply, for example, a ‘Rent’ tag to the direct debit that goes out to your landlord every month. The service does quite a good job of auto-tagging many transactions based on their descriptions but you will probably have to spend some time tweaking the tags to get them exactly as you want them. It’s important to set tags as that help with your budgeting; it’s hard work at first but it will pay off in the long run.

Finally, ‘Track Spending’ shows a graph comparing how you’re doing this month with the budgets you’ve set yourself. This is a hand ‘at a glance’ look at whether you have money to burn or whether it might be a good idea not to splash out on that new MacBook Pro this month.

Alert!

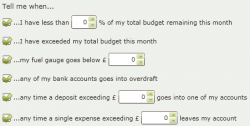

Alerts are potentially the most useful part of the service for many users. Money Dashboard has an alert and messaging system that you can set to send out an SMS or email when your bank balance drops below a set amount, you’ve overspent in one category or when it’s time to pay a bill, among other things.

Alerts are potentially the most useful part of the service for many users. Money Dashboard has an alert and messaging system that you can set to send out an SMS or email when your bank balance drops below a set amount, you’ve overspent in one category or when it’s time to pay a bill, among other things.

Monetisation

Money Dashboard is monetising its service via the ‘Ways to save’ section. If you do find yourself overstretching yourself, you’ll find advice on saving money along with affiliate links to insurance websites and the like.

Conclusion

Money Dashboard has made a strong start in providing an alternative to Mint.com for the UK. Plans for the future include mobile apps later in the year. We’d like to see more graphs and charts of how our money is doing added into the service too, but then we’re suckers for data visualisation.

The personal finance data market is set to grow over the next few years and Mint.com’s owner Intuit is likely to expand the service beyond US shores sooner rather than later. Money Dashboard will have to keep an eye on emerging competition like this, while also bearing in mind the fate of a similar service, Kublax, which was serving the UK market until it went belly-up earlier this year after experiencing funding difficulties.

Money Dashboard is showing a strong start here. They’re definitely a name to watch as they develop. The product is still in beta and the company is encouraging users offer feedback by getting in touch via the company’s user forum on their website.

Get the TNW newsletter

Get the most important tech news in your inbox each week.