Pfizer sent stock markets into a spin on Monday after the pharmaceutical giant shared promising results of its COVID-19 vaccine trials.

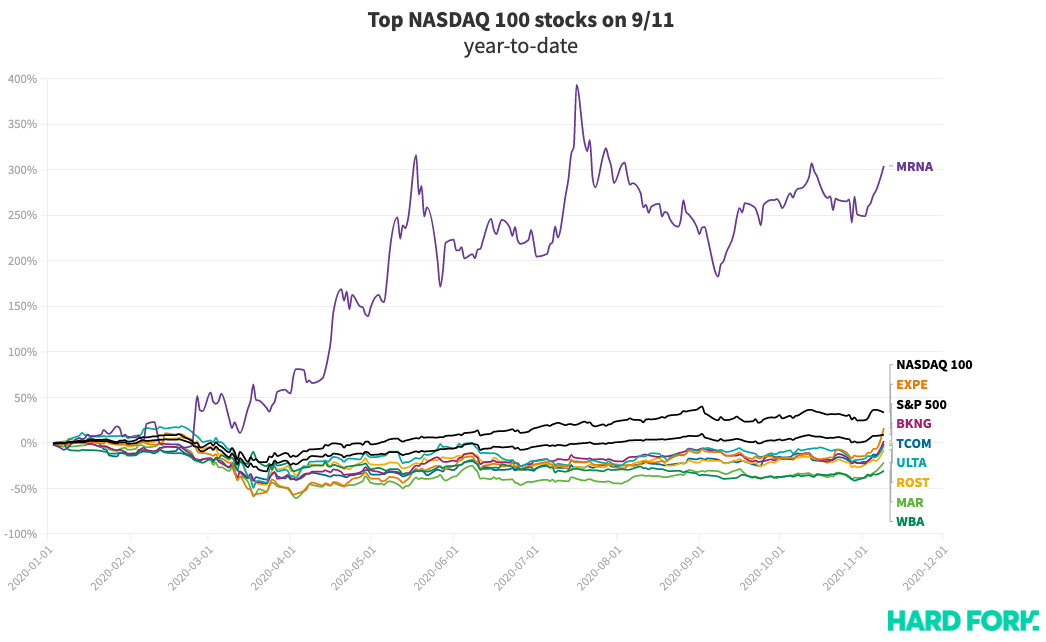

Traders, presumably buoyed by the idea of an eventual return to normal, dumped 2020’s most successful ‘stay-at-home‘ stocks for travel plays like Expedia (EXPE) and Booking Holdings (BKNG).

EXPE and BKNG jumped 20% and 16% respectively to bring them back into the green for the year-to-date.

[Read: Here’s what you need to know about Pfizer’s COVID-19 vaccine]

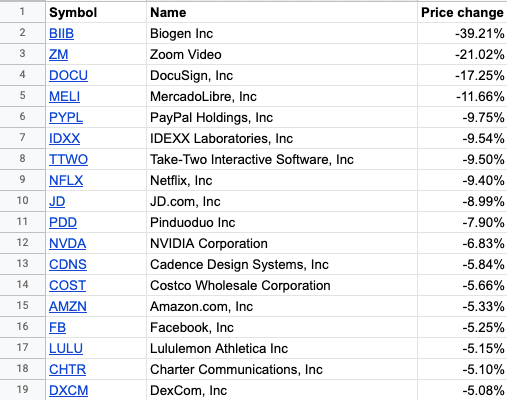

On the other hand, conference call darling Zoom Video (-21%) and digital signature prince DocuSign (-17%) collapsed, but remain significantly up in 2020.

US tech giants PayPal (PYPL), Netflix (NLX), and Amazon also fell, alongside gaming stocks Take-Two Interactive, Activision Blizzard, and NVIDIA.

The market’s sentiment also shows up at the macro-scale. The tech-heavy NASDAQ 100 index dropped more than 2% while the broader S&P 500 (which includes airline and old-school bank stocks) rose 1% to nearly break its September 2 record high.

Pfizer’s COVID vaccine tease boosted ‘back-to-normal’ stocks

Travel stocks EXPE and BKNG were indeed the NASDAQ 100’s biggest benefactors of Pfizer’s glimpse into a post-COVID world, at least yesterday.

In fact, Norwolk-headquartered BKNG gained more dollar value than any other NASDAQ 100 company. Pfizer’s announcement added $11.8 billion to BKNG’s market cap, which now sits close to $87 billion.

(If the visualizations below don’t show, try reloading this page in your browser’s “Desktop Mode”.)

Other big winners include coffee lord Starbucks ($5.8 billion increase), hotel kingpin Marriott International ($4.2 billion), and retail discounters Ross Stores ($4.6 billion).

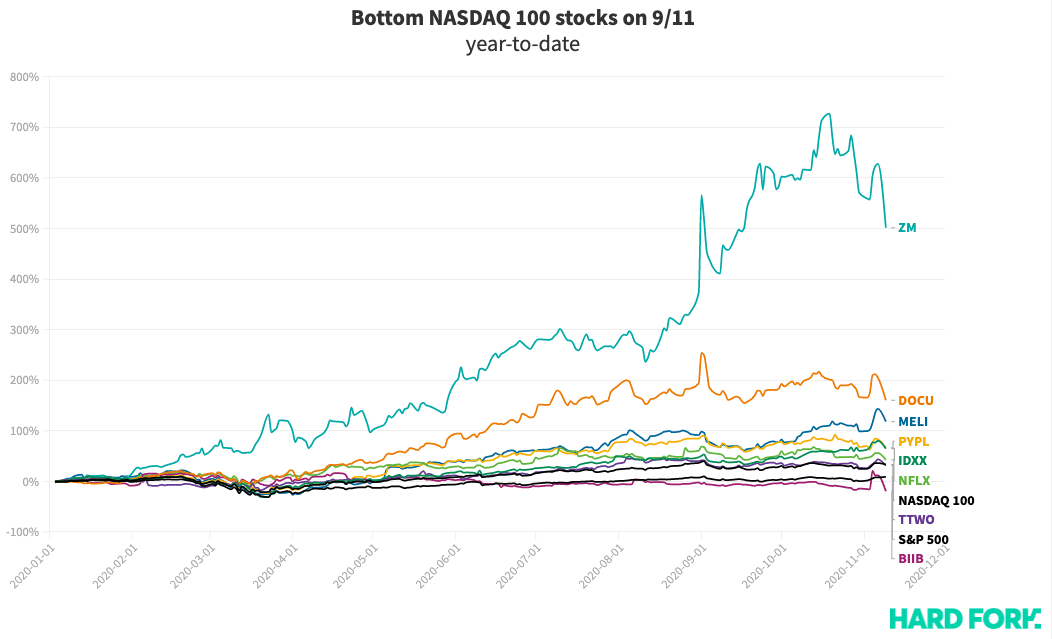

As for the biggest market value losers: Beijing-headquartered JD.com saw more dollars drain from its market value than any other, down $102.2 billion (it’s still worth more than $1 trillion).

The four horsemen of our techpocalypse Amazon, Facebook, Microsoft, and Apple were next hardest hit, having collectively lost $215.2 billion from their market values yesterday.

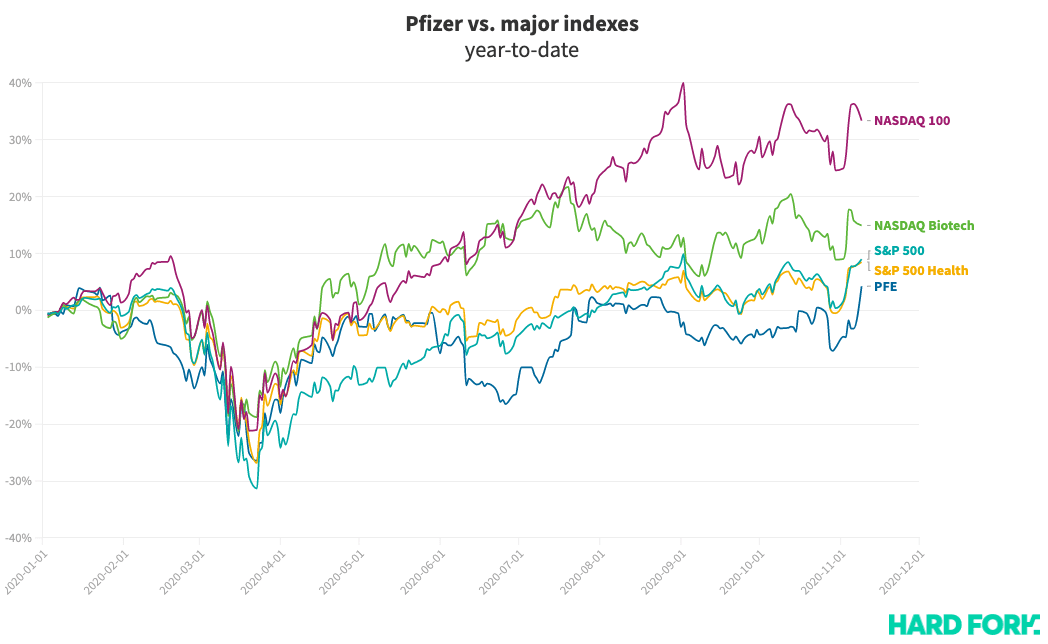

Curiously, Pfizer’s share price (PFE) didn’t pump quite as much as some ‘back-to-normal’ stocks.

Despite the company sourcing the (supposed) good news, PFE rose just 7.6% to break into the green again for 2020.

Still, PFE trails practically every relevant major index for the year-to-date. Pfizer has underperformed against the NASDAQ 100 and the S&P 500, as well as the more specific NASDAQ Biotechnology and S&P 500 Health indexes.

However morbid, it’s hard to say who needs Pfizer’s vaccine more: the company itself, or the rest of the market that just placed huge bets on it actually working. Fingers crossed until we find out, I guess.

Get the TNW newsletter

Get the most important tech news in your inbox each week.