Yesterday Jan Koum, CEO of WhatsApp, announced that the popular messaging app would be releasing push-to-talk functionality for all its supported mobile platforms.

While Koum described the feature as a “pet project” six months in the making, most of WhatsApp’s nominal peers in the chat app space – namely Facebook Messenger, Japan’s LINE App, and Korea’s Kakao Talk – introduced voice-chat capabilities a long time ago, and as an afterthought at that.

LINE App and Kakao Talk are two leading chat apps in a crowded space that have raked in enormous amounts of revenue and seen staggering adoption rates by enriching basic chat functionality with games, stickers, marketing tiers for businesses, and e-commerce. Line saw revenue of $132 million for Q2 2013, 80 percent of which was driven from stickers and in-game purchases collectively. Kakao Talk claims that it earned $311 million in revenue in H1 2013 from its gaming platform alone.

Meanwhile, WhatsApp’s sole source of revenue is a 99 cent annual user fee, imposed only after a free year-long trial run. And judging by Koum’s firm dismissal of gaming platforms, it’s probably going to stay that way.

Huge revenue figures have helped feature-rich Asian chat apps generate a lot of hype, and as a result, some see WhatsApp’s stubborn refusal to enrich its monetization avenues as misguided.

The core business of messaging is WhatsApp’s core revenue stream – a modest revenue stream, possibly, but a reliable, steady, consistent one; fueled by over 300 million monthly active users who use it because it does what it has to and their friends are already on it. With a team of just 45 people and over 300 million monthly active users, many of whom have paid or probably will pay 99 cents to use the service, it’s safe to assume the firm is far from bootstrapped.

WhatsApp is taking a measured, conservative approach to development that defies the adapt-or-die ethos that defines the tech industry. But that doesn’t mean it will get left behind.

Asian chat apps are hot, but they’re not taking over the world

In order to gain users, a platform (or app, or business) must offer a better alternative to the status quo. WhatsApp has been doing that since day one as an alternative to traditional text-messaging. SMS costs accumulate. Pay a buck a year and you can use WhatsApp for free for one year. Void filled, problem solved.

Now, in order to get users to switch from a competing platform to your platform, you need to offer something different and necessary that the leading platform does not offer. And Kakao, Line, and WeChat for the moment do not. Asian chat apps are indeed platforms with avenues for gaming and shopping, but their core functionality remains rooted in chat, just like that of WhatsApp. Unless a mass of WhatsApp users have the urge to integrate their Bejeweled games and shoe purchases with their text messaging, there’s little reason to abandon the platform.

Factor in the difficulties of bringing an app to an already-saturated space in an overseas market, and we’re talking long shots here.

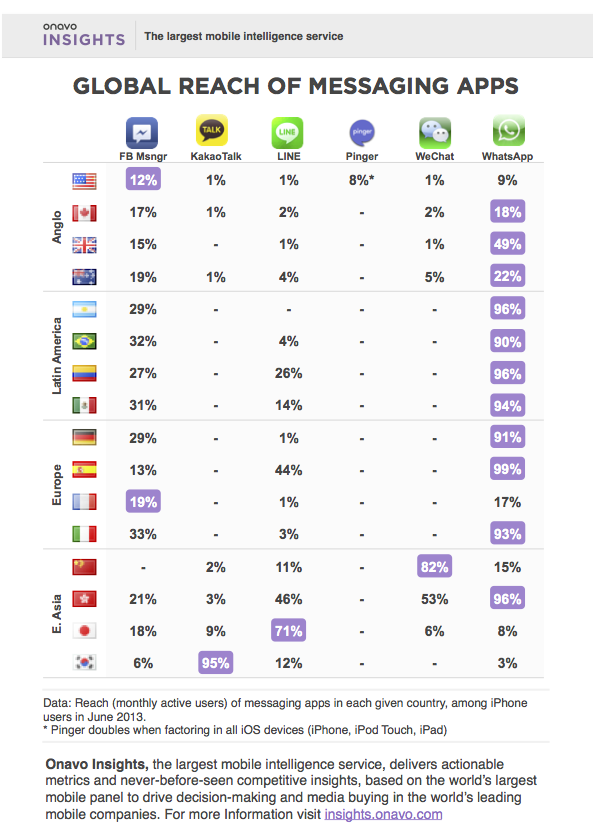

Onavo Insights published an infographic that’s been circulated almost as much as Koum’s announcement itself. Even though it covers only iOS, it’s an accurate enough representation of the chat app landscape: The Asian chat apps are popular in Asia, and the Western chat apps are popular in the West.

WhatsApp and Facebook – is WhatsApp vulnerable?

Now, if mobile users suddenly decide that they want to integrate text messaging with their shoe purchases, however, that’s a different story, and brings us to WhatsApp’s biggest competitor – Facebook Messenger.

Facebook has all the capabilities of a chat app and then some. Games? Yup. Stickers? Here if you want ’em. Brand interaction? Definitely. Media sharing? Yup. Shopping? Kinda.

Facebook once struggled in mobile, but it’s been ramping up its efforts lately. The company recently reported it had over 800 million MAUs and that over 40 percent of its total revenue came from mobile users. The recent addition of stickers, regardless of whether or not they prove lucrative, at the very least shows that Facebook is observing what other messaging apps are doing attempting to emulate elements of their success.

Facebook may have missed its chance to be everyone’s favorite SMS alternative. But since most WhatsApp users probably already have Facebook, Facebook is in a much better position to entice WhatsApp fans over to its messaging service with games, stickers, and other bells and whistles than a chat app with a user base that is 90 percent Korean.

However, consider the ability of these bells and whistles to attract new users. Games and sticker-like graphics have historically burned out at the same rate as that of most online fads. Remember when Facebook introduced Oregon Trail, virtual gifts (do you long for the days of the virtual Dick-in-a-Box?), and graffiti? None of those features made significant contributions to Facebook’s core functionality, and all proved short-lived. Instead, they were temporary curiosities that ensured that Facebook users continued to use the social network as a means to write on walls, join meaningful groups, and send messages.

As a result, if Facebook wants to nudge users away from WhatsApp, it will have to show that its messenger is more necessary and relevant than WhatsApp’s. So far, it has yet to do so.

WhatsApp’s conservative development path

Yesterday TNW’s Jon Russell called out Koum for misleadingly insinuating that feature rich messaging platforms like LINE and Kakao feature advertising that interferes with the users’ core communication experiment. It’s true that Koum’s comments are exaggeration – neither of those apps feature ads in the messaging space, and to my knowledge, avenues for commerce are limited to in-app purchases or some variation thereof.

But while monetization-oriented features might not interfere with the core user experience, they can certainly complicate it, or dilute it. Apps that grow bloated with extras can wear out their welcome among consumers.

WhatsApp currently consists of 45 team members, a staggeringly small number compared to its Asian peers. If WhatsApp invests time, money, and manpower in developing faddish stickers and games, what happens if its users suddenly get tired of these features, just like how Facebook users got tired of Mafia Wars? The pressure to maintain revenue streams grows much higher.

If WhatsApp continues its conservative development path, will it make money? Yes. Will it make TONS of money? If games and stickers are sustainable long-term revenue generators (its too early to decisively say so), maybe not. Is it losing out to markets in Asia? To a certain extent, yes, but with such a valuable core product, maybe it is content to remain a reliable, spartan mainstay on its users’ mobile devices.

Top image credit: abulhussain/Flickr

Get the TNW newsletter

Get the most important tech news in your inbox each week.