Twitter has revealed its S-1 paperwork that was filed with the US Security and Exchange Commission (SEC) highlighting its standing as it prepares for its public offering expected to be later this year. The company is looking for a maximum offering price of $1 billion with the proposed stock symbol: TWTR.

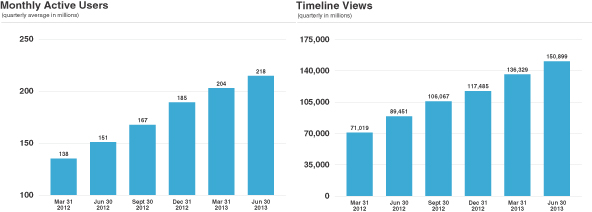

According to its filings, Twitter has more than 215 million monthly active users, 100 million daily active users — all who help to create 500 million Tweets every day. There are more than 6 million websites that have integrated with the platform, including the BBC, CNN, and Times of India, along with 3 million applications registered by developers.

As for revenue, the company says that from the six months ending June 30, 2012 to the six months ending June 30, 2013, it saw revenues increase by 107 percent to $253.6 million with net loss increase of 41 percent to $69.3 million. It’s adjusted EBITDA increased by $20.7 million to $21.4 million.

Mobile is Twitter’s aim

Where is Twitter heading? Obviously to the mobile space and it has done very well there. In its S-1, the company says that mobile products play an important part because it enables users to “create, distribute, and discover content in the moment and on-the-go.” It is seeing on average 75 percent of its monthly active users access Twitter from a mobile device — 65 percent of its ad revenue was generated just by this medium alone.

What about advertising?

We generated 85% and 87% of our revenue from advertising in 2012 and the six months ended June 30, 2013, respectively.

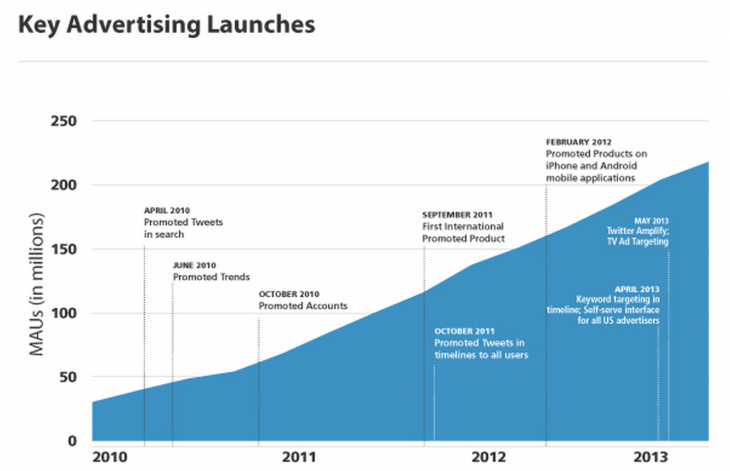

Twitter offers advertisers several ways to help generate traffic and revenue for the platform, specifically through unique ad formats native to the user experience, targeting, earned media and viral global reach, advertising in the moment, pay-for-performance and attractive ROI, extension of offline ad campaigns, connect in context, and through its Amplify product.

The company’s advertising revenue generally came through the sale of its three Promoted Products: Promoted Tweets, Promoted Accounts and Promoted Trends.

Who benefits the most?

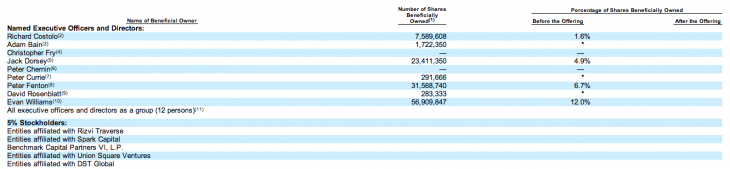

So who stands to make the most off of the public offering? Based on the S-1, it’s the founders, of course. Ev Williams holds the most shares with 12 percent while Peter Fenton has 6.7 percent and chairman Jack Dorsey holds 4.9 percent. CEO Dick Costolo has 1.6 percent.

Setting the stage

In September, Twitter confidentially submitted its S-1 to the SEC as allowed by the JOBS Act. What has become known so far up to now was that Goldman Sachs was going to be the lead underwriter for the deal and that the lockup period, the time when employees cannot sell their shares, has been set for 180 days. Twitter has been estimated to be valued at nearly $10.5 billion.

At the time, people wondered what the company’s revenue was, along the strength of its platform — just exactly how widely used is the microblogging service? Obviously Twitter is keeping that number close to its chest, at least until the S-1, but it did say during its 7-year anniversary that it over 200 million active users.

Appealing enough to investors?

Twitter is expected to be a highly valued stock when it makes its debut on Wall Street and it’s been establishing ways to show that it certainly scales, including having an advertising structure, which market research firm eMarketer projects will bring in nearly $1 billion in revenue by 2014.

Not only that, but it’s branching beyond simply being just a messaging service to adapting itself to other forms of communication and entertainment, including the second screen and in the sports arena thanks to a partnership with the National Football League.

The service has also worked to improve its internal offerings as well, including the roll out of a better recommendation system that will help users discover interesting content and people instead of a random suggested user list. It’s not afraid of experimenting with ideas and formally releasing some of those products to help its core audience. What’s more, to improve the experience, Twitter has made it easier for verified users to better filter out the noise and communicate with their fans and followers.

Twitter has certainly made a good effort at transforming itself from just a 140-character chat service to something more akin to what its CEO Dick Costolo envisioned as being a global town square. And if this statement by Costolo during CNBC’s #TwitterRevolution special is any indication by what investors can expect the future of Twitter to be, it might be a good sign:

When I get up in the morning and think about what we have to accomplish here in building this global town square, and reaching the number of people we’re trying to reach and growing as fast as we’re growing in all these different places around the world and trying to build and scale a global organization — those are the things that occupy all my time.

Facebook, take two

Twitter’s public offering has certainly been the talk of the town, but the tech industry could be a bit weary about how it’s pulled of — rightfully so. After all, it was just over a year ago when Facebook went public at $38 per share on the NASDAQ exchange, only to encounter some difficulties. Sure, the social networking company did trade 500 million shares on opening day, but it wasn’t without glitches that led to some doubt in the exchange and forever marked Facebook’s debut.

—

Today’s news comes in light of the company’s founders, Ev Williams, Biz Stone, and Jack Dorsey, holding court at Twitter’s office in downtown San Francisco on Thursday.

Twitter founders (@ev, @biz, @jack) in the house today. pic.twitter.com/9Hu32uxS6N

— Luke Millar (@ltm) October 3, 2013

More to follow. Please refresh for updates.

Photo credit: LEON NEAL/AFP/Getty Images, EMMANUEL DUNAND/AFP/Getty Images

Get the TNW newsletter

Get the most important tech news in your inbox each week.