Budding network TRON (TRX) pitches itself as Ethereum’s rival, with its smart contracts, dapps, and soon-to-be developed decentralized finance (DeFi) products.

That’s where the similarities between the two projects cease. TRX doesn’t have any miners, as it doesn’t leverage Proof-of-Work. Instead, TRX is powered by a relatively centralized consensus algorithm that consists of just 27 validators, referred to as “Super Representatives.”

In this sense, it’s really akin to niche ‘blockchain’ EOS, as participants literally delegate responsibility to a small group of trusted third parties to maintain the network. Just like EOS, most TRX activity relates to gambling.

Still, TRX has etched a foothold in the market. It’s ranked 11th on CoinMarketCap’s list of top crypto-assets, with a market capitalization currently worth just under $1.3 million.

TRX/USD 2019 Q2 performance recap

The frustrating reality of cryptocurrency markets is that the strength of Bitcoin’s price often dictates the performance of less popular crypto-assets like TRX.

In Q2 2019, Bitcoin enjoyed positive price action. This, as usual, led speculators to dip into other markets (like TRX) as a way to compound potential gains.

So, just like Ripple (XRP), TRX followed Bitcoin and opened the quarter strong, with a sharp increase from just over $0.025 to around $0.031.

After finding support (which came in at $0.0225), TRX spent most of May in the green, and briefly spiked to clear $0.04 per token leading into June.

Following an attempt to regain those $0.04 highs, TRX would eventually close Q2 2019 at just over $0.0325.

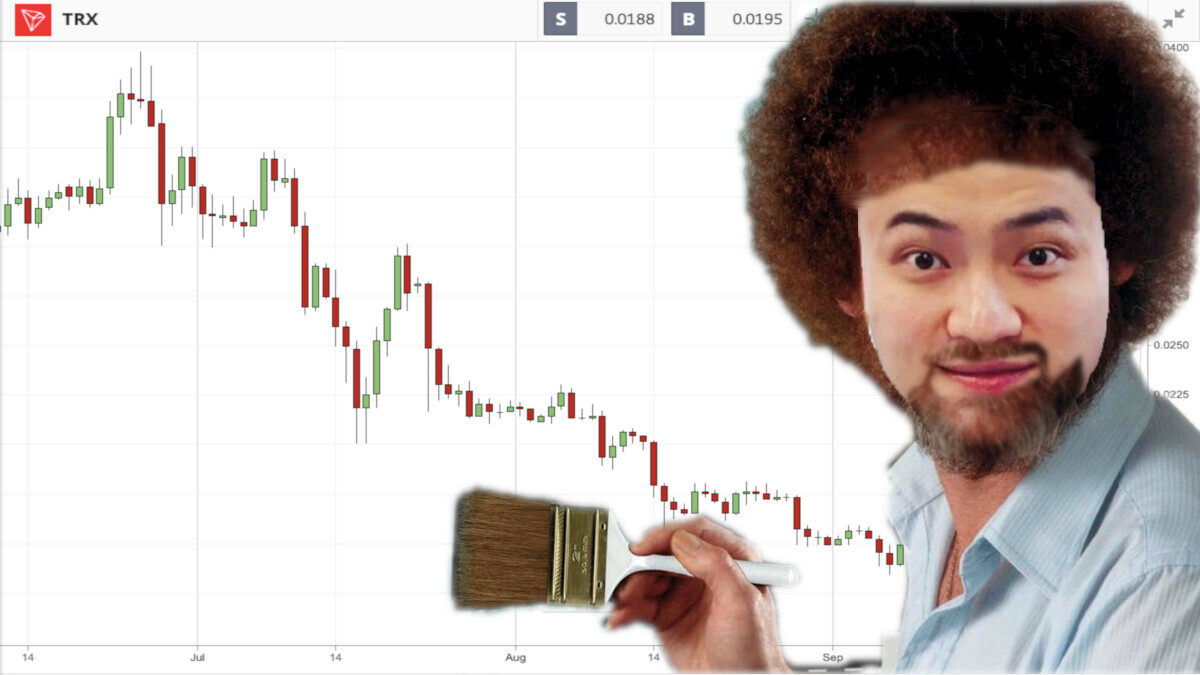

TRX/USD 2019 Q3 review

Again, like other altcoin markets, TRX got punished in this year’s third quarter, despite the apparent health shown at the end of June.

Sadly, traders would have found it difficult to earn profit from swing-trading (or flat-out investing) in TRX at any point last quarter.

Aside from a tiny bounce off $0.02, TRX was pretty well permanently in the red from July to October.

Things began to look up for TRX at the very end of last quarter. The final significant red candle appeared in the last week of September, which featured a wick that stretched down to reach almost $0.01 from $0.016.

Biggest news for TRX in Q3 2019

TRON headlines last quarter sent readers on a veritable rollercoaster, which started when incorrect reports surfaced indicating that police had raided the company’s Beijing headquarters in early July.

The real story is that a mob of disgruntled investors had attempted to storm the project’s offices, angry that they had lost money in a reportedly unrelated scam.

According to TRON, the group had been spurned by fraudsters who had solicited investments using a “Chinese version” of the blockchain’s software.

A few weeks after that blew over, Justin Sun’s penchant for publicity caught up with him when he was forced to call himself a “big mouthed over-marketer” following the “postponement” of a prestigious lunch with famed investor Warren Buffet, which Sun had paid $4.6 million to secure a month earlier.

Sun had supposedly been forced to cancel on Buffett due to health issues, specifically kidney stones. Just days later, Sun was spotted in San Francisco at an influencer-centric party hosted by TRON, which raised eyebrows.

#Tron party with @justinsuntron & @CryptoWendyO

It’s been a fun trip. I’ve got a lot of cool stuff for the channel coming soon. pic.twitter.com/toejAdeOdC

— ₿it₿oy (@Bitboy_Crypto) July 26, 2019

Looking ahead

With Bitcoin enjoying a healthy run at October’s open, TRX has had a little breathing room to make some respectable gains.

Third quarter trade started at roughly $0.0135, with the market attempting to pierce $0.0175 heading into the second week.

After bouncing off support (which appeared at around $0.014), the price of TRX rose through the last week of October to temporarily hit $0.0225.

It’s now sitting at around $0.0188, but presumably, traders are waiting to see how Bitcoin moves in the coming week before running wild with their chosen altcoins.

Get the TNW newsletter

Get the most important tech news in your inbox each week.

This post is brought to you by eToro. eToro is a multi-asset platform which offers both investing in stocks and cryptocurrencies, as well as trading CFD assets.

This post is brought to you by eToro. eToro is a multi-asset platform which offers both investing in stocks and cryptocurrencies, as well as trading CFD assets.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptocurrencies can fluctuate widely in price and are, therefore, not appropriate for all investors. Trading cryptocurrencies is not supervised by any EU regulatory framework.

Past performance is not an indication of future results. This is not investment advice. Your capital is at risk.