Tech-focused venture fund Draper Esprit announced it has sold its remaining stake in UK fintech darling TransferWise for $22 million.

Draper’s sales were part of a $319 million secondary deal in which TransferWise allowed insiders and early investors to cash in their stock.

The deal awarded TransferWise a private valuation of $5 billion, up 43% since May 2019’s secondary sales. This ranks TransferWise as one of the UK’s top fintech startups, alongside the likes of Klarna and Revolut.

TransferWise chief exec Kristo Käärmann noted secondary rounds like these allow new investors to come in, while simultaneously “rewarding investors and employees who’ve helped us succeed so far.”

Those new investors are reportedly Vulcan Capital (founded by Microsoft’s Paul Allen) and D1 Capital Partners, both US-based firms. Existing backers Baillie Gifford, Fidelity, and LocalGlobe increased their holdings.

Draper first acquired a $23 million stake in TransferWise when it bought Seedcamp Funds I and II back in 2017. The London-listed VC says its TransferWise investment generated $42.8 million in cash across two sales, the first occurring last May.

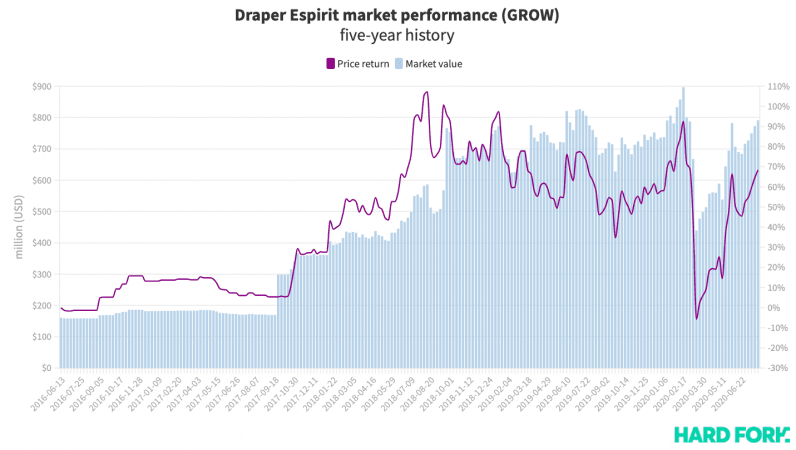

While March’s coronavirus-related market crash devastated Draper’s performance — it’s now up more than 7% for the year while the FTSE 100 is down nearly 20%. Draper manages roughly $207 million in assets.

Did TransferWise founders cash in their stock too?

Unfortunately, TransferWise has so far avoided confirming whether Käärmann or fellow co-founder Taaveet Hinrikus dumped their stock alongside Draper.

A company spokesperson told the Financial Times that the pair “had a few opportunities to sell, yet they both retain large stakes in the business.” Käärmann and Hinrikus sold less than one fifth of their stakes in the company in May last year.

[Read: Kodak, now a pharma company, expects drugs to make up 30-40% of its future business]

However, a CNBC report indicated both execs had the option to cash in their shares in this round, but TransferWise declined to reveal how much they actually sold.

Get the TNW newsletter

Get the most important tech news in your inbox each week.