In 1995, in an apartment in Manhattan’s Alphabet City, Jeff Dachis and his partner Craig Kanarick started their first company Razorfish, to pioneer the new media field. Within just a few years, Razorfish acquired several companies and expanded internationally. In April 1999, the company had an IPO that raised $48 million at $16 per share. Now, Razorfish is one of the world’s largest interactive agencies.

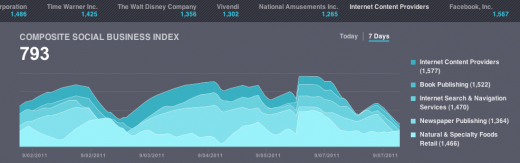

In 2008, after leaving Razorfish, Dachis founded The Dachis Group, to develop the future of social businesses. Dachis Group, which has 250 professionals spread across 13 cities in 7 countries, operates as one of the world’s largest Facebook Preferred Developer Consultants and has launched over 500 custom Facebook applications, tabs, and Facebook connect integrations for brands such as AT&T, Citibank, Coca-Cola, Disney, Estée Lauder, General Electric, Hewlett Packard, Kodak, Nestlé, Nokia and Target. Today, The Dachis Group is launching its Social Business Index (SBI), which covers over 26,000 brands from over 20,000 companies and over 100 million social accounts worldwide. Currently, Facebook, Google and News Corporation lead the list.

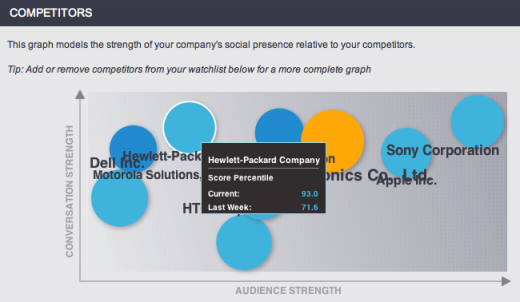

The Social Business Index provides free insight to the public on how social a given company is, and how they compare to their industry, their competitors, as well as a best in class break down by company, subsidiary, geography, department and brand. It’s described as “a lightweight glimpse into Dachis Group’s big data analytics platform”. Additional premium features are available to companies and their employees who have registered SBI user accounts.

The Dachis Group says its SBI is derived from company, employee, partner/vendor, customer, engaged market and influencer data, and it is sourced from scraping sites like Twitter, Facebook, Wikis, YouTube, forums, and blogs as well as data buys, data partnerships, company contributions, and its own internal data team. It had over 100 of the world’s largest companies participating in its early access program to help cement the data and gain insights as to how the data is used.

“The Social Business Index fills a big hole in the market, providing large global brands with a near real time quantitative data driven window into competitive, industry, and best in class social marketing adoption and social engagement performance,” said Jeffrey Dachis, Dachis Group Founder, Chairman, and Chief Executive Officer. “Unlike the typical ‘top 100’ lists that litter software vendor and social media consultant blogs, the Social Business Index is based on deep big data analysis of a company’s engagement globally and can give insight to companies on optimizing their social spend.”

We caught up with Dachis to discuss how he thinks the index will make companies more social and why it’s so important for businesses to be social today and in the future.

Jeffrey Dachis: At the macro level, we see the beginnings of an inevitable shift in brand marketing spend towards social. While there are many reasons for this, there is one factor that is of particular interest in motivating the creation of the Social Business Index and the underlying Social Business Intelligence as a Service (SBIaaS) platform on which the Index is built.

Social, as a conduit to connect with a brand’s market, is on the brink of offering a unique environment to measure the return on investment of marketing activities, particularly for the murkier business outcomes of brand marketing such as brand awareness, brand love, mindshare, and advocacy. There are a few factors that are driving this:

- First, social has now hit a scale of adoption to provide meaningful audiences for brand engagement as witnessed by Facebook blowing past the 750M user mark this year (for context, the typical superbowl commercial is viewed by 111M).

- Further, the volume of public conversation in social is staggering (remember Twitter engineering’s casual “350B tweets delivered daily” disclosure.

That treasure trove of data and potential insight is ripe for analysis and insight to understand the impact and value of a particular activity. That insight can be immediately acted on to optimize the strategies of a brand because of the unique nature of social’s authentic, two way communication with the market. Not only does this provide the potential for superior marketing results, but creates the opportunity to test many messages with many segments and measure them individually (in a way, similar to the unique A/B testing of performance marketings simpler marketing activities).

CBM: What are the challenges of measuring Social ROI?

JD: There are a couple of significant hurdles that must be over come to capitalize on social’s opportunity to be a marketing vehicle with clearly measurable performance.

- There needs to be traceability of the behaviors and activities executed by a brand in social to the business outcomes that they are trying to achieve.

- A marketer needs context to understand where their execution of a marketing behavior is on the spectrum of performance between best and worst in class for their industry (or competitors).

The latter provides the marketer with the canvas of what is possible and sets expectations for expected results. The former provides the tools to measure their performance within the context of what is possible and expected. The combination of the two allows the marketer to optimize marketing spend and confidently plan. If Coca Cola, Starbucks, or Red Bull want to add another million Facebook fans, there are many ways they could be successful. If a Chinese mining company wants to do the same, their options are… more limited.

CBM: Why did you decide to create the Social Business Index and how does it work?

JD: The Dachis Group SBIaaS data services platform was created to solve these two core problems and that is reflected in the Social Business Index, the first lens on top of the data produced by the platform. The Social Business Index measures social performance and adoption of the world’s leading social businesses. It provides a stack ranking of these companies as well as a best in class and industry rankings.

Currently we are tracking thousands of companies, their subsidiaries, and their brands. We monitor their social accounts, as well as the social accounts of their engaged market (over 100M total, and tens of millions active at any given time). This coverage increases daily. Using natural language processing and machine learning algorithms powered by our industry defining Social Business Design framework and the world’s largest Social Business strategy consultancy, we identify specific behaviors and activities that are being executed by those brands. We use the execution of those behaviors and associated measures to construct metrics which correlate to brand marketing business outcomes. We’ve started with Brand Awareness, Brand Love, Brand Mindshare, and Advocacy. We then benchmark the execution of those measures, metrics, and behaviors against each companies competitors, their industry, best in class, and the market in general. In aggregate, this gives us a company’s Social Business Index Score and is the basis of the rankings in the index.

The ability to provide that traceability from behavior to business outcome coupled with comprehensive benchmarking overcomes the two hurdles to measuring performance of marketing in social. This is the beginning. We will learn. We will evolve our approach. We know things aren’t perfect, but are excited to be at the forefront of this new and interesting world of Social Business Intelligence. We look forward to learning and participating in the dialog around uncovering insight in social data, making that data actionable, and then measuring the performance of those actions.

For more on Jeff Dachis and his earlier years at Razorfish, see our interview with him in “Where Are They Now: New York City’s Dot Com Entrepreneurs.”

Image Credit: Shutterstock/CyberEak

Get the TNW newsletter

Get the most important tech news in your inbox each week.