California won’t try to stop a $26.5 billion mega-merger between telecoms giant T-Mobile and the struggling Sprint, CNET reports.

A US District Court approved the deal last month, which sees the third and fourth largest telecoms providers in the US become one. This is expected to swell T-Mobile’s subscriber base to 140 million, helping it compete with AT&T and Verizon.

The decision not to appeal the court’s ruling comes by way of a settlement between California and T-Mobile, with the latter agreeing to protect low-income consumers and the jobs of local Sprint workers.

[Read: Sprint stocks up 75% after judge approves $26.5 billion T-Mobile merger]

T-Mobile will also reportedly pay back California and the other states for costs associated with their investigations and litigation, a fee that’s expected to total around $15 million.

This acquisition was in limbo for over two years

Led by New York and California, the attorney generals of more than a dozen states filed a lawsuit back in 2018. This kept the plans in limbo until now, despite federal regulators having already given them the green light.

The states argued that reducing the number of major telecoms providers would inevitably drive prices up and stifle innovation in the industry.

However, T-Mobile argued that it will provide Sprint’s customers with better service, and they would particularly benefit from its upcoming 5G network.

New York’s attorney general, Laetitia James, already announced she would not appeal the decision, which means that the deal’s two biggest critics have now given up — making the merger a sure thing.

Consumers are waiting to feel the affects of T-Mobile’s plan

A big stipulation of the deal demands that T-Mobile must prop up a new Dish-branded telecoms business.

Dish is a Sprint subsidiary that has historically offered satellite TV and cable services. And the merger will require T-Mobile to support the company for seven years, with the goal of it one day becoming a competitor.

Whether forcing T-Mobile to create another top-tier telecoms business from scratch is realistic is yet to be seen.

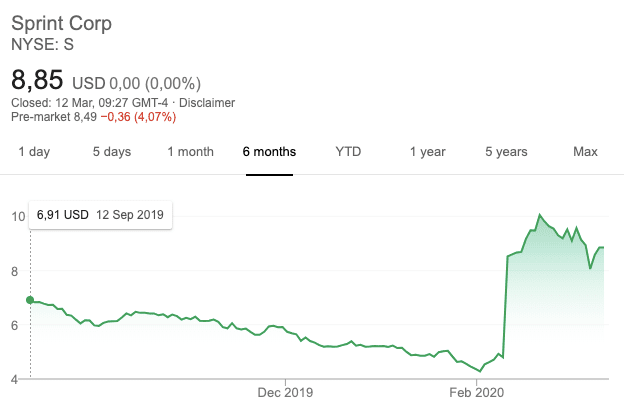

T-Mobile and Sprint aside, stock traders have made hay while the sun shines. Last month, Hard Fork reported that Sprint’s share price had pumped 75% immediately after the court’s decision.

This effectively raised the valuation of the deal from $26.5 billion to $40 billion.

As for how markets are performing now that both California and New York won’t appeal: Share prices for both T-Mobile and Sprint were up slightly at Wednesday’s close.

With the legal fight apparently over, T-Mobile needs to prove it can actually provide what it’s promised — and I’m sure its customers are watching anxiously to see if they benefit beyond enjoying better 5G service.

Get the TNW newsletter

Get the most important tech news in your inbox each week.