This Friday, the Blackstone Group pulled its bid to take Dell private. It had floated a price of $14.25 per share, a premium on the $13.65 per share deal that Michael Dell and Silverlake had previously tendered. Carl Icahn is also backpedaling, and instead of making a formal offer, will instead wait to see what Dell investors do in the face of the original $24.4 billion bid.

If that amount is rejected, Icahn may move. That, however, seems unlikely.

Dell fell roughly 4% in the markets Friday, following the Blackstone news. However, and this almost curious, Dell now trades below the offer price from its founder and Silverlake. Dell finished the week at $13.40, or about 1.8% below the offered price. This indicates that the market expects the $24.4 billion offer to go through, and no more; the upside on Dell’s stock is thus precisely pegged at $13.65.

Therefore, for investors to reject the deal at hand would be akin to casting off the life-vest that they have thus far enjoyed. Dell’s 52 week low is $8.69 per share, and that figure may be possible again if the buyout deal fails; the fundamentals of its business are not improving, frankly.

The PC market is shrinking, stiffening headwinds for the firm. This was, as you recall, the stated reason for Blackstone’s retrenchment. As NewsObserver noted, “Blackstone and its partners said that because of the latest PC market figures, which surfaced after their bid was submitted last month, they have dropped a plan to buy most of Dell’s outstanding stock for $14.25 per share.”

Reversal

Until recently, the tone around Dell was quite different. It was a defiant rallying call against the company being taken private too cheaply. Michael Dell, so the narrative went, was taking his baby back, but at a firesale price. As TNW reported during the mix:

Southeastern Asset Management, which owns a firm 8.5 percent of the company, thinks that the price offered for Dell is “too low and essentially robs shareholders.” In its own words, Southwestern feels like it is being all but swindled, calling the deal “an effort to acquire Dell at a substantial discount to intrinsic value at the expense of public shareholders.”

Now the public market has priced the company below the offer price, and potential suitors have found the exits. Amazing what a few months’ news can do to a deal.

If shareholders reject the deal, Dell’s market price to pre-deal rumor levels, or a decline of around 20% in short order. This could create an opening for Icahn. To be frank, I think that the original, partially Microsoft-backed consortium of Michael and Dell and Silverlake will succeed in taking the firm private.

At which point we get to ask the question: Alright, now what?

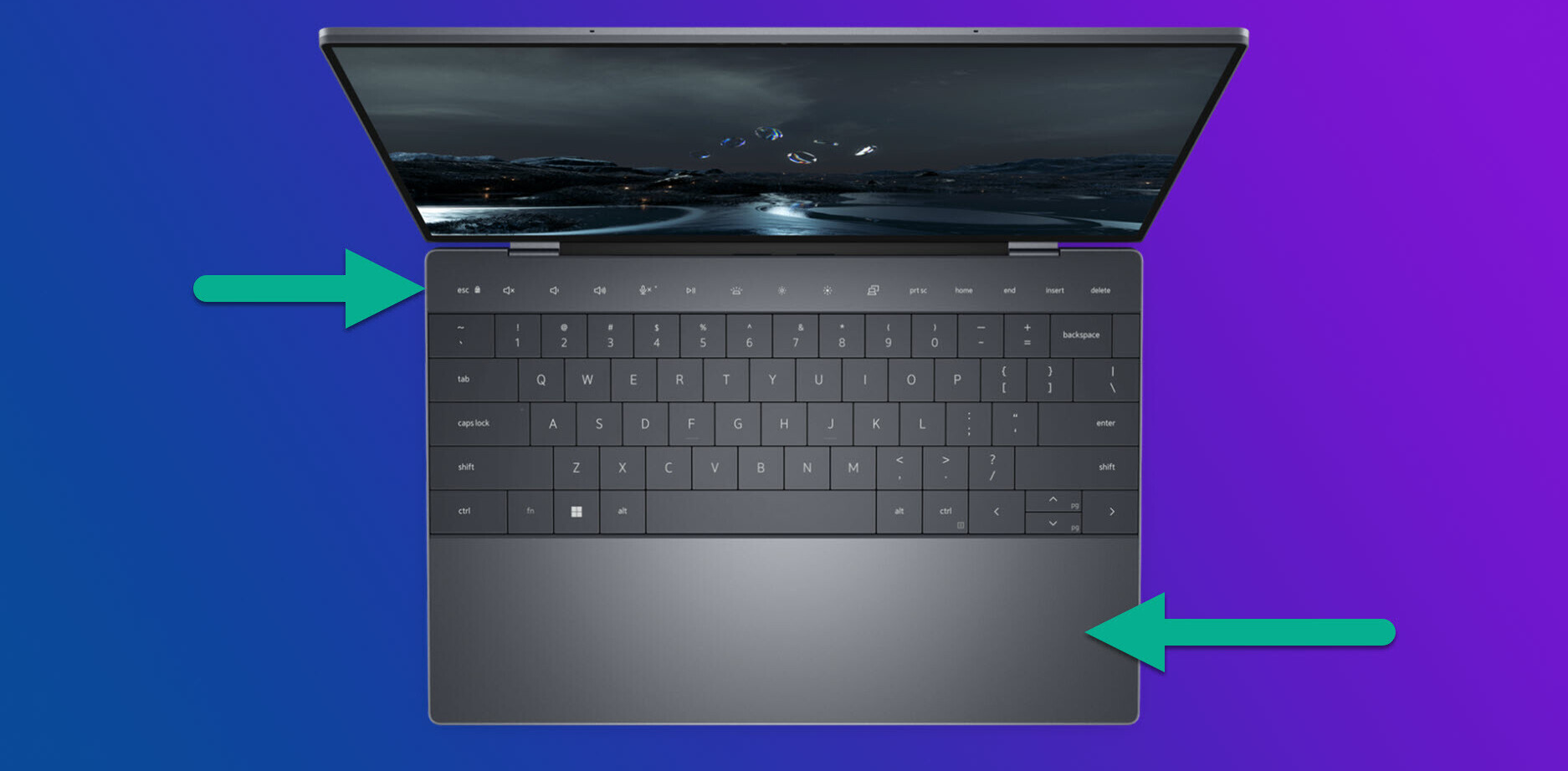

Top Image Credit: Dell Inc.

Get the TNW newsletter

Get the most important tech news in your inbox each week.