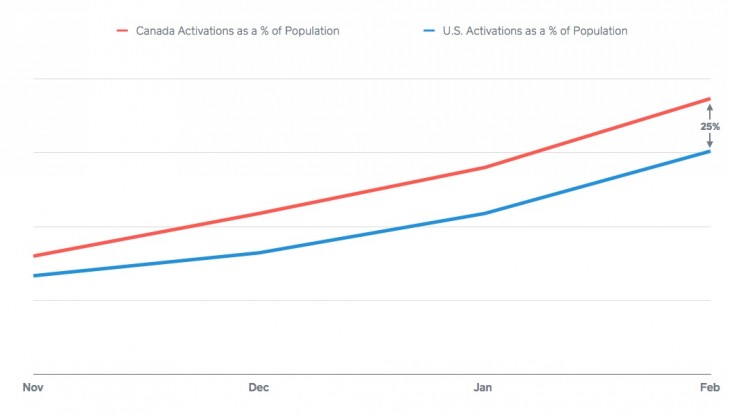

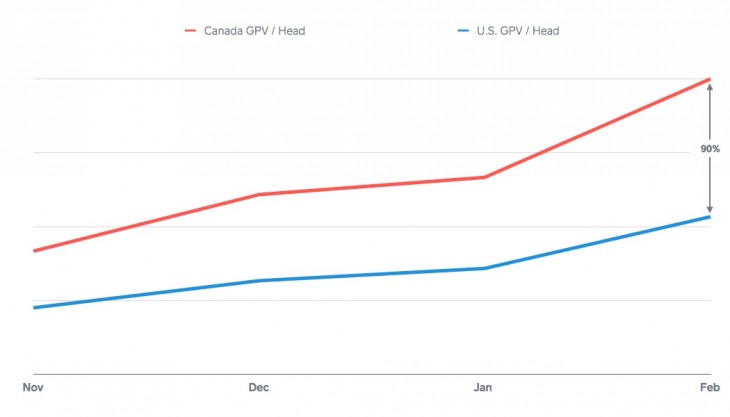

Square has shared some very interesting data points with TNW today, comparing its US launch in October 2010 to its Canadian launch in October 2012. In short, Canada is loving the electronic payment service: it has seen a 25 percent higher adoption rate per capita versus the US, a 90 percent higher gross payment volume (GPV) per capita than in the US, and a 71 percent higher average transaction size than in the US.

Yet these figures deserve some more context. First off, a higher adoption rate shouldn’t be too surprising, especially when it’s adjusted per capita. Canadians are aware of new developments in the US, and Square is certainly a name that has made the rounds even before it was available.

Here are some other Canadian-specific tidbits Square shared with us:

- Square Readers are available in more than 250 retail stores in Canada, including Apple, Best Buy, and Futureshop locations. It took nine months for Square to be in retail after its US launch.

- Services (accounting, legal services, consulting) and retailers make up the greatest percentage of Square’s activations in Canada.

- Square speaks differently to Canadians than Americans. When it launched in the US, its mobile solution was one of the most attractive features. In Canada, its “revolutionary pricing” is most appealing, as a mobile solution isn’t completely new to Canadians.

Keeping these in mind, a higher gross payment volume and a higher average transaction size isn’t too much of a surprise: almost everything is more expensive in Canada. Still, as someone who lives here, I wouldn’t say it’s anywhere from 70 percent to 90 percent more expensive.

Square says the average transaction size in the US is currently $70 compared to $120 in Canada. Here is Square’s explanation for the large discrepancy:

During our US launch, we were seeing more individuals and food trucks/carts signing up for Square, which have lower transaction sizes. We expect more food trucks and outdoor merchants to adopt Square once the weather warms up.

We would have to agree with this. There’s also a novelty factor here: some would argue that it’s more exciting to make a larger purchase with a new service. In the coming months, we would expect this difference to decrease.

Again, higher adoption rates for Canada compared to the US is not shocking simply because Square has gained mindshare in the two years separating the two launches. Nevertheless, the Canadian success should not be disregarded: Square clearly chose a country that is showing interest in mobile payments that is comparable to its cousin just south.

Top Image Credit: Lotus Head

Get the TNW newsletter

Get the most important tech news in your inbox each week.