While there’s no shortage of budgeting apps and other online tools designed to help you make the most of your money, OrSaveIt serves up a free iOS app to help shoppers record their “impulse savings” on the go.

OrSaveIt’s core raison d’être is to capture every tiny saving someone makes on a day-to-day basis, at the time they actually make it. It’s currently only available in the UK App Store.

How it works

Each time you make a decision to, say, get the bus rather than take a taxi – you enter the amount (roughly) that you saved into the app. This could also apply to buying a small latte over a large one, or traveling standard class over first class.

Thinking a little outside the box, if you’re trying to stop smoking, each day that passes without you buying a carton of B&H, you could include the £7 you saved, and give yourself a big pat-on-the-back when you see that you’ve saved £200 in a single month by doing nothing at all.

At the end of each week, OrSaveIt emails users to let them know how much they’ve saved.

It’s worth noting here that OrSaveIt’s claims that it will “help you save £1500 a year”, are a little wide of the mark. The app obviously doesn’t actually help you save money directly – all it does is record what you’re already doing.

But the idea here is that it will help you permanently change your behaviour on a week-to-week, month-to-month and year-to-year basis. If you can actually see how much you have saved, this will help justify your big lavish holiday, right?

Getting started

You’ll either have to create an OrSaveIt account, or link-up using your Facebook credentials. Once in, you’ll create your first goal.

You choose a category for said goal, which could be ‘General Savings Account’, ‘Bike’, ‘Camera’ and so on. You then stipulate how much this item costs.

Now, this is where one small issue lies – if you indicate ‘General Savings Account’, that isn’t something that actually costs anything. Granted, it’s just the choice of words, but still…it should automatically tailor the wording to suit your choice.

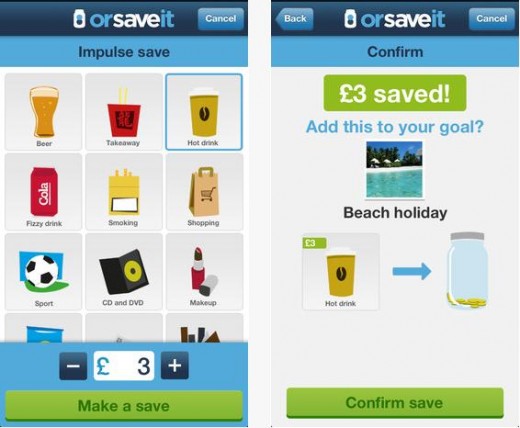

Clicking ‘Make a Save’ takes you to a list of categories to select from, including ‘Beer’, ‘Takeaways’, ‘Hot Drinks’ and more. When you hit a category, a little box pops up and you enter a figure.

As noted already, at the end of each week users receive a savings update by email, but it can also be set-up so that it links you through to your bank account to instantly transfer the ‘savings’.

“We’re all guilty of spending money on small things we could probably live without but it can add up to a surprising large sum that could be put towards something more meaningful,” says Alain Desmier, Managing Director of OrSaveIt.com.

“Not many of us can remember every £2 or £3 that we spend or have the chance to record them when we’re out and about,” he continues. “The OrSaveIt app does all the hard work for you on your mobile, by letting you track your savings as you make them.”

Desmier says that during the beta trials, they found that if users could see they were making small savings, they were more likely to get into good habits and achieve the end goal.

While the app is currently only available from the UK App Store, there are plans to make it available on additional platforms in the future.

➤ OrSaveIt | iOS

Disclosure: This article contains an affiliate link. While we only ever write about products we think deserve to be on the pages of our site, The Next Web may earn a small commission if you click through and buy the product in question. For more information, please see our Terms of Service

Get the TNW newsletter

Get the most important tech news in your inbox each week.