Today AMD reported its fourth quarter financial performance, with revenue of $1.16 billion, and losses per share of $0.63. The street had expected revenue of $1.14 billion, and earnings per share of -$0.19.

For comparison, the company lost $0.20 per share in the third quarter of 2012. The company exceeded revenue targets in Q4, but lost more than expected per share. AMD was profitable for the preceding several quarters, however, a shrinking PC market and intense competition from Intel have put AMD in a crunch. AMD states it “expects revenue to decrease 9 percent, plus or minus three percent, sequentially for the first quarter of 2013.”

The movement of consumers to purchase computing systems that are increasingly mobile likely hasn’t helped either. In recognition of that shift, the company recently hired experts from Qualcomm and Apple to expand into “new markets.”

Putting its quarterly performance in perspective, PC shipments for the quarter in question were down 4.9% year over year. However, in comparison, Intel recently reported revenue of $13.5 billion and earnings per share of $0.48 for the quarter, and promised investors that it would grow in the single digits this year, PC market be damned.

AMD’s revenue has declined from $1.7 billion in late 2011 to today’s figure, a painful contraction. The company’s current cash assets as of December 2012, including cash equivalents and marketable securities, are just over $1 billion, a decrease from $1.76 billion from the previous year.

In after-hours trading, the company is slightly up.

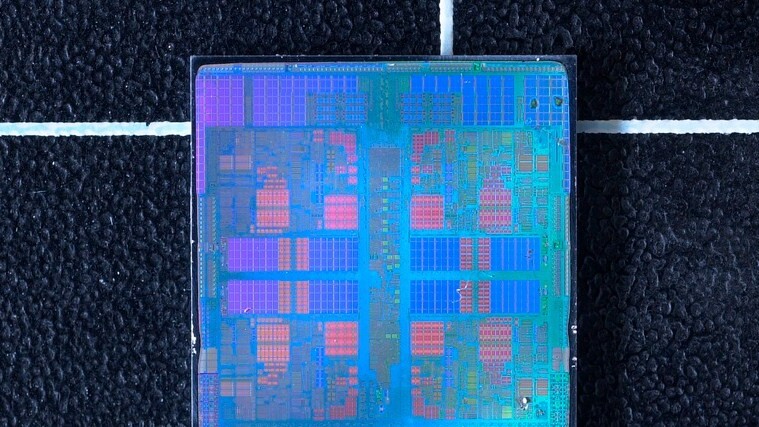

Top Image Credit: Don Scansen

Alex Wilhelm contributed to this post.

Get the TNW newsletter

Get the most important tech news in your inbox each week.