Editor’s note: This look at new children’s money startup KidsCash originally published by Israel’s NoCamels blog.

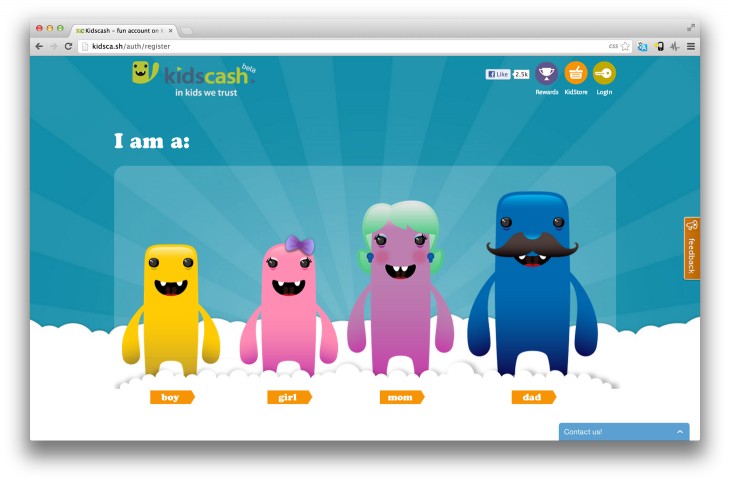

If today’s kids are the Wall Street traders of the future, let’s hope they are better prepared than their predecessors. Israeli startup KidsCash is trying to teach monetary responsibility to kids in a fun and understandable way. The KidsCash website allows children to spend, save and donate a designated amount of money while also learning the fundamentals of money management.

Erez Mizrachi, Benyamin Shoham, and Yossi Dan founded KidsCash in 2009 as an online marketplace where kids can both save and spend designated amounts of money. Mizrachi tells NoCamels: “Kids today don’t really have a good option for paying membership fees on their virtual worlds and games, or for online purchasing. They either have to get their parents’ credit card(s), or go to a convenience store and buy a prepaid card. There must be a better solution.”

Teaching kids the value of money

The KidsCash website provides a payment solution based on an allowance given to children by their parents. Parents can sign their kids up, or kids can sign themselves up, and the parents are then notified by e-mail. When a child joins, they are immediately given a virtual $5 to experiment with on the site, and can only begin real purchasing once parents give the OK, and put in their credit card information.

Parents can choose whether to place their children on the “Green” or “Red” payment lane, the Red being more strict (parents must approve every purchase by SMS or Email in the Red Lane, while the Green Lane gets automatic approval). Parents can also choose whether or not to make a one-time gift to their children, or to set up a monthly or weekly budgeted allowance.

On the website, every $1 becomes “1 KC,” the KidsCash currency, and children can choose freely what to do with the KCs in their personal bank accounts. The children can place the money into a “savings jar”, or donate it to a number of charity websites linked through the site. Arguably, the most exciting aspect of KidsCash for children is the ability to shop online on their own.

The KidsCash website has its own marketplace for purchases that includes digital, virtual and gaming goods. The KidsCash marketplace features popular gifts such as iTunes prepaid cards and Xbox LIVE points, the currency for the Xbox LIVE Marketplace. “We have developed a marketplace for kids with 300 of the most popular digital goods,” Mizrachi tells NoCamels. (KidsCash commission rate from vendors is relatively high, between 10-25 percent.)

KidsCash is also linked to a number of online merchants in which a KidsCash widget appears in the payment screen of these sites. KidsCash has deals with sites including Everloop, the largest social network for children aged six to 13, Getonic, a website for buying digital goods, and Ekoloko a popular virtual world game. “We can improve the conversion rate of these websites and of similar sites,” says Mizrachi. “By placing the KidsCash widget directly on these sites, children with accounts can easily purchase points or premium accounts on these websites, therefore increasing revenue for the site.”

Partner-based strategy

Rather than focusing efforts on marketing directly to the children (or their parents), KidsCash has chosen a strategy in which it markets directly to partner vendors. “We base our whole strategy on our partners. Think about how much exposure a KidsCash’s widget that appears in the checkout of a major vendor site will generate. Kids will see the widget, and want to know more,” says Mizrachi.

KidsCash is adamant that it is creating a secure financing site for parents and children. The company says it is currently advancing deals with financial institutions in the United States, Europe and Israel. In addition, KidsCash also plans to “white label,” its service to payment services and banks.

KidsCash is currently developing and testing further website features like alerts, alarms, and filters to make each child’s and family’s experience unique. For example, parents can be alerted if their child spends over a certain amount in a single day, or have a predetermined distribution of allowance on the market segments. For instance, a parent could allocate 10 percent for mobile, 30 percent for e-books, 20 percent for games, etc.

The company says it also wants to maintain an educational focus to their site and services. Mizrachi explains: “Think about the way children in the US learn the basics of financial literacy at such a young age. Formal education systems as well as non-profits could be interested as well in using our system to teach responsible saving and spending.” In development now are six online academic classes, games, videos and virtual lessons that are meant both to teach children about money management, and encourage them to talk with their parents about finance.

“It’s just the beginning”

The site officially launched a few weeks ago. KidsCash plans to keep its system free for parents and children, and instead charge only vendor and partner fees.

KidsCash has several private investors, three of which are the founders of 5min.com, a popular video platform website that was recently sold to AOL TimeWarner. The company has two offices, in New Jersey and Israel.

Erez Mizrachi served as the New Media Director of the popular toy Gogo’s Crazy Bones. He has over 14 years of experience in key positions in the internet field and as an entrepreneur. Benyamin Shoham has held executive positions as VP of R&D at 5min.com, and Director of Developers platform at Wibiya.com, a website-enhancing platform which was recently acquired by Israeli tech giant Conduit. Yossi Dan has worked on knowledge management and collaboration systems with websites KonoLive and TicTacDo. He also set up and managed the Israeli branch of Adobe Systems.

➤ KidsCash

This story was originally published on NoCamels, a news website covering the latest innovations coming out of Israel.

Image credit Koichi Kamoshida / Getty Images

Get the TNW newsletter

Get the most important tech news in your inbox each week.