Amsterdam-headquartered Nebius, which builds full-stack AI infrastructure for tech firms, has secured $700mn in a private equity deal led by Nvidia, Accel, and asset manager Orbis.

The funding comes in the form of a private placement — when a company sells stocks directly to a private investor instead of on the public market. The deal will see Nebius issue 33.3 million Class A shares at $21 apiece.

Nebius, which is the rebranded European arm of “Russia’s Google,” Yandex, is investing more than $1bn across Europe by mid-2025 as it seeks to cash in on booming demand for AI computing power. It also recently announced plans to build its first GPU cluster in the US.

“We have demonstrated the scale of our ambitions, initiating an AI infrastructure build-out across two continents,” said Arkady Volozh, founder and CEO of Nebius. “This strategic financing gives us additional firepower to do it faster and on a larger scale.”

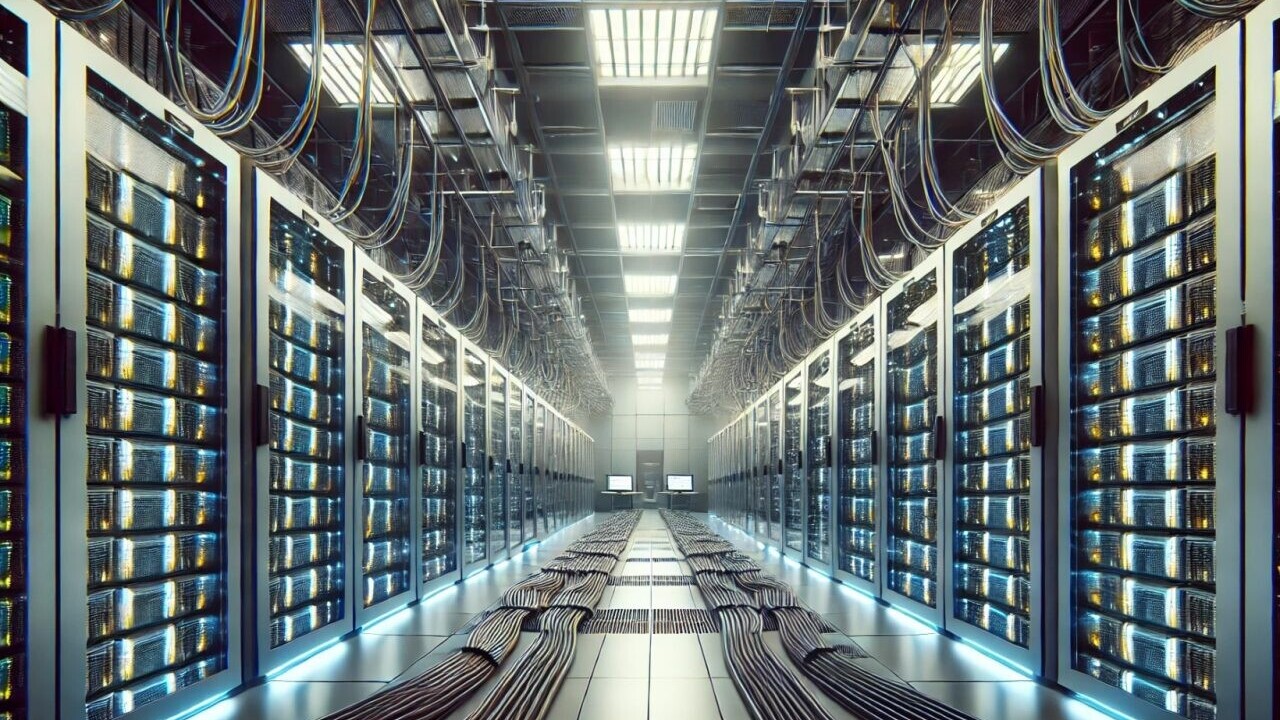

Nebius’ expansion strategy includes constructing new custom data centres and expanding existing facilities, like its data centre in Finland which we visited in October. It will also deploy additional capacity through colocation.

Volozh aims for Nebius to be a Phoenix rising from the ashes of what remained of Yandex following the company’s divestment from Russia earlier this year. The $5.4bn deal constituted the largest corporate exit from the country since the start of Russia’s full-scale invasion of Ukraine over two years ago.

Nebius’ core product is an AI-centric cloud platform for intense AI workloads. The company is also one of the launch partners for Nvidia’s fabled Blackwell GPUs, however, this investment does not guarantee that.

“The deal is not about the GPUs,” Volozh told Bloomberg. “But, of course, it shows our close relationship, which we hope will influence our pipeline.”

Investors are pouring huge sums of money into AI compute. The global AI infrastructure market size is projected to grow from $46.15bn in 2024 to $356.14bn by 2032, according to Fortune Business Insights. One competitor to Nebius, US firm CoreWeave, is preparing for an IPO that could put the company, founded in 2017, at a $35bn valuation.

Get the TNW newsletter

Get the most important tech news in your inbox each week.