If you’re waiting to buy a phone in India this year, you might find prices in the market a tad steeper than before. The country has increased customs duty on importing certain parts to encourage local manufacturing.

Presenting the annual budget, finance minister Nirmala Sitharman said today that the country is introducing import duty on few mobile parts in order to boost local manufacturing.

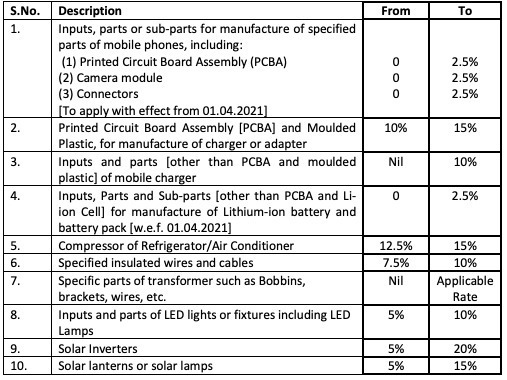

Domestic electronic manufacturing has grown rapidly. We are now exporting items like mobiles and chargers. For greater domestic value addition, we are withdrawing a few exemptions on parts of chargers and sub-parts of mobiles. Further, some parts of mobiles will move from ‘nil’ rate to a moderate 2.5%.

Manufacturers will have to pay a 2.5% customs duty for importing parts, including camera modules, printed circuit boards, and connectors, starting from April. Plus, there is an increased tax on importing parts of chargers.

Apple and Samsung have already booted out the adapter from retail packs of their phones. As IDC analyst Navkendar Singh noted, this duty hike might incentivize others to take similar steps.

So, mobile chargers & some other components removed from exempt list, to now attract 2.5%. Plus customs on PCB for charger/adapter now 15% to 10%. Apart from expected price hike, did FM just give a valid reason to the industry to remove in-box adapters? #IndiaBudget2021

— Navkender Singh (@navkendarsingh) February 1, 2021

These duties might introduce a slight price hike in the retail prices of phones. Prachir Singh, an analyst at Counterpoint, said “This might increase in prices for short term or a very modest increase as the bulk of these sub-components have already local suppliers like for camera modules, PCBAs, chargers, and connectors.”

India is pushing local manufacturing through schemes under its Make In India program. Last year, it approved applications from iPhone-makers and Samsung to grant 4-6% tax benefits to produce phones above ₹15,000 ($205).

In her budget speech today, Sitharaman said the country will invest ₹1.97 lakh crores ($26.98 billion) over five years in a Production Linked Incentive Scheme (PLI) to boost manufacturing.

Get the TNW newsletter

Get the most important tech news in your inbox each week.