In Google’s early years, users would type in a query and get back a page of 10 “blue links” that led to different websites. “We want to get you out of Google and to the right place as fast as possible,” co-founder Larry Page said in 2004.

Today, Google often considers that “right place” to be Google, an investigation by The Markup has found.

We examined more than 15,000 recent popular queries and found that Google devoted 41 percent of the first page of search results on mobile devices to its own properties and what it calls “direct answers,” which are populated with information copied from other sources, sometimes without their knowledge or consent.

When we examined the top 15 percent of the page, the equivalent of the first screen on an iPhone X, that figure jumped to 63 percent. For one in five searches in our sample, links to external websites did not appear on the first screen at all.

A trending search in our data for “myocardial infarction” shows how Google has piled up its products at the top. It returned:

- Google’s dictionary definition.

- A “people also ask” box that expanded to answer related questions without leaving the search results page.

- A “knowledge panel,” which is an abridged encyclopedia entry with various links.

- And a “related conditions” carousel leading to various new Google searches for other diseases.

All of these appeared before search results by WebMD, Harvard University, and Medscape. In fact, a user would have to scroll nearly halfway down the page—about 42 percent—before reaching the first “organic” result in that search.

Google’s decision to place its products above competitors’ and to present “answers” on the search page has led to lawsuits and regulatory fines. A number of websites said it killed their revenues—and their companies. Founders of both innovative startups and companies that had been around for a decade or more told The Markup that once Google started placing its product first, they didn’t stand a chance.

Travel research firm Skift wrote in November that the entire online travel industry is suffering. “The fact that Google is leveraging its dominance as a search engine into taking market share away from travel competitors is no longer even debatable.”

The choice to highlight its own products has been deliberate: Internal emails unearthed by the European Commission in an antitrust investigation show Google staffers discussing the need to place its comparison-shopping product at the top of the search results to garner traffic. An email the following year noted traffic to the retooled product had more than doubled from four million to 10 million visits, and “most of this growth is from improved google.com integration.”

Sally Hubbard, an expert on antitrust and technology companies with the Open Markets Institute, said Google’s decisions in search have huge implications. “Imagine you go to the library, and the card catalog is picking and choosing what book to get based on what makes the library the most money.”

Google makes five times as much revenue through advertising on its own properties as it does selling ad space on third-party websites.

In a written statement, Google spokesperson Lara Levin took issue with The Markup counting “answers,” related queries, and similar results as “Google” in our analysis.

“Providing feedback links, helping people reformulate queries or explore topics, and presenting quick facts is not designed to preference Google. These features are fundamentally in the interest of users, which we validate through a rigorous testing process,” she said. “Sometimes, the most helpful information will be a link to another website—other times, it will be a map, a restaurant listing, a video or an image.”

Levin called The Markup’s methodology “flawed and misleading.” She criticized it for being “based on a non-representative sample of searches” and said using Google Trends makes it more likely that results would include Google “knowledge panels” than a random sample would. However, Google has not publicly released a random sample of searches for research.

In response to Page’s 2004 quote about the company’s mission to get people “out of Google,” Levin said times have changed: “As a search engine, Google’s mission is to quickly direct searchers to great information, wherever that information is, as Page went on to explain. At that time, that generally meant to direct people from search results to websites. As search technologies have developed, that’s not always the best way to assist people.”

She did not answer questions about whether those changes present the search engine with a conflict of interest.

Nearly nine in 10 U.S. web searches are performed on Google.

The effects of placing its own products on the search page can be stark: In the nine years since Google Flights and Google Hotels launched, those sites have become market leaders. They garnered almost twice as many U.S. site visits last year as each of their largest competitors, Expedia.com and Booking.com, even though we found Google Flights doesn’t always show users all the options.

“Google makes the most money when, long term, they can addict searchers to their platform,” said Rand Fishkin, a search engine analyst and frequent Google critic who found that 12 percent of real-world clicks on the search results page go to Google properties. “If Google can train you, don’t go to Genius.com, don’t go to TripAdvisor, don’t go to the restaurant’s website, just come to Google—always come to Google—then they win.”

Levin said some regulators have defended the company’s practices, pointing to the Federal Trade Commission’s 2013 ruling that highlighting its products on search “could be plausibly justified as innovations that improved Google’s product”; and a U.K. High Court finding in 2016 that returning Google Maps for location queries was not an abuse of market dominance.

Although the FTC decided not to take legal action, as Google notes, it did require the company to change some practices. Google agreed to allow websites to opt out of having their content scraped for Google Flights, Google Hotels, and local business listings.

And at least some FTC staffers had concluded that Google’s boosting its own properties in search rankings “led to a significant decrease in traffic for the websites of many vertical competitors,” according to an internal FTC report, half of which was accidentally provided to The Wall Street Journal. At the time, Google responded, “Speculation about consumer or competitor harm turned out to be entirely wrong.”

Levin said the company “continues to engage” with regulators conducting myriad active probes of Google’s parent company, Alphabet. Fifty U.S. attorneys general are currently investigating its ads and search business for potential antitrust violations. The Federal Trade Commission is examining past acquisitions by tech companies, including Google, for harm to competition. Politico reported that the Department of Justice will file an antitrust lawsuit against the company soon. The European Commission, which has already issued three multibillion-dollar fines against Alphabet for antitrust violations since 2017, launched a preliminary investigation into Google for Jobs in 2019.

“Google helped build the free internet. And now they’re helping dismantle what they built,” said Chris Cummings, CEO of Curiosity Media, which owns the translation website SpanishDict.com.

The site provides free translations and dictionary entries, many written by linguists and translators, he said. It is ad-supported and needs web traffic to survive. For years, he said, it grew as Google grew. But then Google began giving the top spot in searches to Google Translate, which is automated and asks users for corrections.

“The big loss is for consumers,” he added, “because nobody thinks that Google Translate is the most accurate translator.”

He said data from the Google Search Console tool for websites shows SpanishDict gets as high as 80 percent or more of the clicks when it’s the top result but only 2 percent when Google Translate appears above it.

“If we’re only getting 2 percent of the click-through, there’s no business to run here. We only exist because there are still some queries where they don’t put their stuff at the top,” he said. He said Google’s actions “have affected our ability to invest in the future.”

Levin did not respond to questions about Google Translate or its effect on SpanishDict.

SpanishDict.com showed up three times in our sample, each time below either Google Translate or Google’s dictionary.

Pushed down the page

To determine the amount of space Google dedicates on the search page to direct answers and its own products, we built a custom scraper to gather all trending Google searches for two months, starting in November 2019. Then we built another scraper to run the searches as they would appear on mobile devices, where the majority of searches now occur. We wrote more than 1,000 lines of code to parse and analyze the resulting dataset, which contained more than 1 million rows.

We found that the majority of links to and results for non-Google sites were pushed down to the bottom-middle of the page, where data shows users are less likely to click.

We categorized search results into four types: Google, non-Google, ads, and AMP, a web format created by Google four years ago. AMP pages are hosted by Google but created and monetized by publishers.

AMP has been controversial, with some publishers and developers saying it gives Google too much control over the web. The company tells website owners that using it makes them eligible “for more prominent presentation of thumbnail images in search results and in the Google Discover feed.” Because AMP has some features of a Google result and some features of a non-Google result, we gave it its own category.

Levin objected to that decision, saying AMP results should be non-Google. “Those are outbound links to publishers and other web creators. To suggest otherwise is not factual,” she said. She also said our results may be heavy on AMP content because our sample, Google Trends, leans toward breaking news, which triggers “top stories” carousels. The news stories in those carousels were often delivered in AMP in our data.

Direct answers include “featured snippets,” which excerpt content from websites, and “knowledge panels,” which show summaries and facts drawn from the “knowledge graph,” Google’s fact database curated from other sources. They also include weather, sports statistics, and dictionary definitions. All of these appeared on the first search results page, typically at the top, without the need to click through.

Google acknowledged in written comments to Congress last fall that one major reason people end a search is because Google’s modules provided the answer on the search page.

In our sample, Google featured its dictionary definitions before Urban Dictionary, Cambridge Dictionary, Dictionary.com, Wikipedia, Merriam Webster, and Investopedia, among others. And searches for song titles typically returned a YouTube video in the top spot, followed by the lyrics, displayed in full on the search results page.

Levin said Google does not give preference to YouTube, its subsidiary. Recent tests by The Wall Street Journal found that it did.

The quantity of Google results in some searches in our sample was quite large. A search for the Shania Twain song “Man! I Feel Like a Woman,” which was trending during our study, returned the following on the first page: links to four YouTube videos in various positions on the page; a box labeled “about” with some hyperlinked facts that led to new Google searches; a box labeled “people also search for,” which led to a new Google search; and a “people also ask” box. Together, direct answers and results leading to Google products took up 67 percent of the first search results page for that query. Non-Google results took up only 22 percent of the page.

Even some of the “traditional” results that appeared after the Google results in that query were touched by its hand. Genius.com and Biography.com’s results were delivered in AMP.

Competing with advertisers

Travel websites are among those who say they have suffered from Google Search’s preferential treatment of Google products. TripAdvisor, which laid off 200 workers in January, pointed to Google “siphoning off quality traffic that would otherwise find TripAdvisor” as its “most significant challenge.”

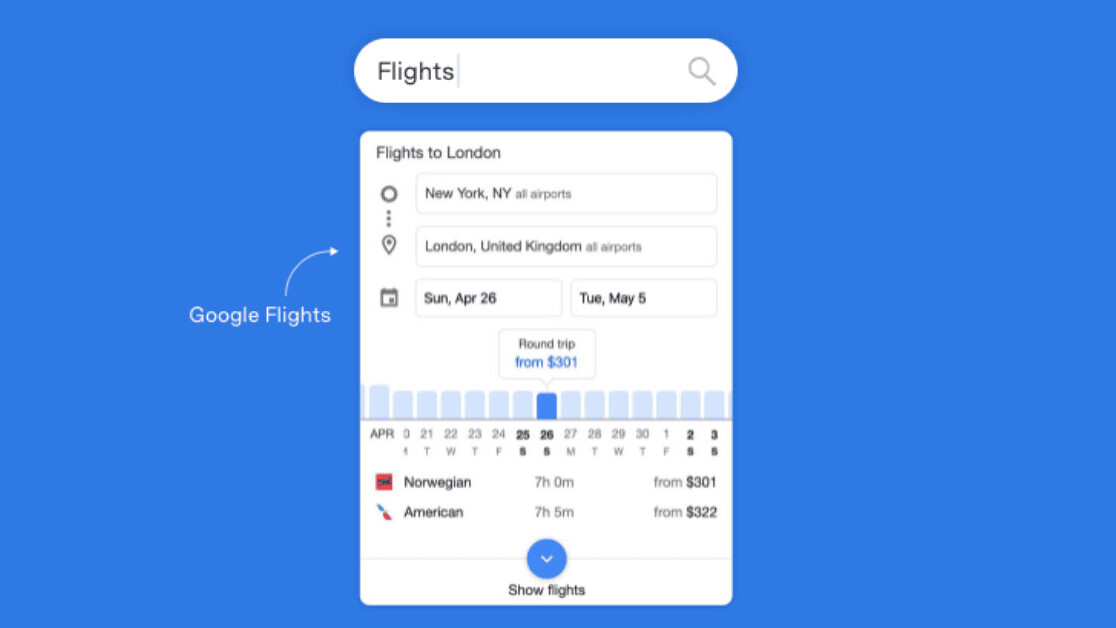

In queries for specific airlines that appeared in our sample, Google presented Google Flights at the top of the results page, before links to the airlines’ own websites. A search for “nonstop flight” also returned Google Flights in the top spot, above competitors.

And travel sites aren’t just Google’s competitors; they’re also its customers. Together, Expedia and Booking spent $5.8 billion on Google advertising in the 12 months ending in September 2019, according Skift, the travel research firm.

“When they compete against their advertisers … I think it’s bad practice,” Barry Diller, chairman of Expedia Group, said during an earnings call in February in which he called Google an “existential” threat.

In the industry, Google Flights is not seen as the best product. It did not crack the top 10 of Frommer’s 2020 ranking of airfare search engines, for instance.

The Markup found that Google Flights did not always display the cheapest fares or all available flights, even when those fares and flights showed up in ITA Matrix, which is powered by the same software Google acquired in 2010 and used to launch Google Flights.

For example, a search on Google Flights for a one-way flight from Billings, Mont., to London’s Heathrow on Feb. 19 showed the cheapest flight was $1,068. The same search on Orbitz turned up a flight for $772, while ITA Matrix offered $766.69.

And when The Markup searched for a one-way flight from Morgantown, W.Va., to New York City on Feb. 21, Orbitz produced a long list of results, including a three-hour-and-40-minute journey that combined flights from Southern Airways and American Airlines with a stop in Pittsburgh for $253.47. The same search on ITA Matrix showed the same flight at a different time for $242.40. But a Google Flights search showed nothing: “Aw snap, no results.”

The FTC found the same thing in 2012, according to the memo accidentally disclosed to The Wall Street Journal: “Although it displays its flight search above any natural search results for flight-booking sites, Google does not provide the most flight options for travelers,” the regulators wrote.

Levin would not directly address that issue with The Markup. Google’s travel support webpage said that “a partnership with Google is required” to appear in Google Flights but gave no further details.

Once up-and-coming travel website Hipmunk blames its death in part on Google Search’s high ranking of Google’s travel products. A Silicon Valley favorite, Hipmunk was among the first to compare prices for Airbnb alongside hotels. It invented an “agony” ranking to help customers decide if that cheap flight was really worth it.

To drum up traffic, it created webpages with highly specific travel tips like “How long does it take to get to the airport from downtown San Francisco?” This strategy led to booming “organic” traffic from Google, said its CEO at the time, Adam Goldstein. Then Google started to feature Google Flights, Google Hotels, and its “destinations on Google” travel guide prominently in search results.

“One quarter, that traffic started to really fall from what we were planning. And then the next quarter it fell short by even more,” Goldstein said. “This was around the time that I realized that the doors were starting to close in on us and all the small players in the travel industry.”

As Google Flights grew, airlines realized they didn’t need referrals from smaller players like Hipmunk, Goldstein said. The airlines lowered fees to nearly zero for small players, and airlines even began demanding that online travel agencies hide certain routes in exchange for access to fare data, according to Goldstein and complaints to the U.S. Department of Transportation. The department launched an inquiry but has not taken any action.

Goldstein gave up and sold the company to the corporate travel giant Concur, which he thought had enough heft to compete. Concur shut Hipmunk down in January.

Levin, the Google spokesperson, declined to address Goldstein’s complaints.

Page, Google’s co-founder, had bashed competitors like AOL and MSN in an interview with Playboy in 2004 for prominently placing their editorial content above competitors.

“Most portals show their own content above content elsewhere on the web,” he said. “We feel that’s a conflict of interest, analogous to taking money for search results. Their search engine doesn’t necessarily provide the best results; it provides the portal’s results.”

Long after leaving AOL and MSN in the dust, Google now says users want answers on the page—or, in their smart speakers, as officials said in a 2019 SEC filing, because it’s “quicker, easier and more natural to find what you’re looking for.”

This philosophical switch started around 2007, when Google introduced what it called “universal search,” which incorporated Google Maps, Google Books, and Google Video into general search results, frequently at the top.

At a conference in Seattle in 2007, Marissa Mayer, then Google’s vice president of search products and user experience, was asked about the sudden appearance of links to Google Finance ahead of Yahoo Finance in the design of the stock ticker info boxes on the search results page at that time. She responded, “It seems only fair, right? We do all the work for the search page and all these other things, so we do put it first.”

There are now many varieties of Google-created results featuring its products or information taken from other sites delivered as direct answers. Google even serves up results that lead nowhere and seem purely for entertainment, like a module that produces animal sounds.

Other search engines, including DuckDuckGo and Bing, also provide answers on the search results page but attract less criticism because of their small U.S. market share. DuckDuckGo has 1.5 percent, and Bing has 7 percent, according to Statcounter.

“Fundamentally, consumers do want instant answers,” said Gabriel Weinberg, CEO of DuckDuckGo. “That is a tension with the open web and the sites that produce that information.”

DuckDuckGo does not have any products to promote in its search results, but Bing, which mirrors Google’s features closely, directs users to Microsoft-owned products such as Bing Maps and its flight booking tool. Microsoft declined to comment.

“It’s not a snippet on Google”

Some of the information Google presents in direct answers is gathered from websites that agree to it, including the crowdsourced encyclopedia Wikipedia, which allows anyone to publish its content as long as it’s credited. Wikipedia said it has not seen a drop in donations as a result.

Dario Taraborelli, former head of research at Wikimedia Foundation, which operates Wikipedia, said he is concerned, however, about the effect on media literacy.

“It’s become really difficult to understand where information comes from. What is the provenance of what we’re learning?” he said. “It’s going to be become much harder for a new contributor to understand … that Wikipedia exists as a separate project, that it’s not a snippet on Google.”

A 2017 study found people were more than five times more likely to mistakenly attribute information to Google itself after reading it in a Google direct answer than when no direct answer appeared in results.

Google also scrapes websites without explicit permission, a practice it has defended by arguing the “fair use” exemption to copyright laws and noting that websites can opt out of inclusion in featured snippets while remaining in the search index for other results.

Brian Warner, founder of the website CelebrityNetWorth, said he declined Google’s request to include his site’s information in the “knowledge graph,” but two years later Google started showing information taken from CelebrityNetWorth in “featured snippets” results.

His traffic crumbled, and Warner said he had to lay off half of his 12-person staff.

The song lyrics site Genius said its click-through rate from search results fell from 60 to 80 percent to 5 to 20 percent after Google started displaying lyrics on the search results page. The company also alleges that one of Google’s lyrics providers, LyricFind, had stolen Genius’s watermarked lyrics and they were showing up in direct answers.

“The fact that Google often populates its lyrics boxes with lyrics misappropriated from our website makes Google’s behavior even more unfair,” Ben Gross, chief strategy officer at Genius, said in an email.

Genius sued Google in December. Google filed a demand for a jury trial. Levin declined to comment on the company’s claims or its lawsuit.

Some websites try to get into featured snippets because it’s high up on the page. Levin said “it can drive meaningful traffic to their sites” but declined to provide specifics.

Some sites take whatever traffic Google search provides and don’t complain. “My goal in life is not to cross the Google gods,” said one sports media executive who did not want to be quoted by name or the name of the website for fear of being shut out by Google.

Cummings, of SpanishDict.com, said something similar. “Google delivers the traffic for the whole internet. Unless your name is Facebook, you rely on Google,” he said. “It’s very risky to speak out at Google because you don’t know what type of retaliation you’ll face.”

Frederic Lambert said his site was demoted in search listings when Google rebooted its shopping product in 2012.

A penny-pinching roadside ad salesman, Lambert launched Acheter-moins-cher—“buy cheaper”—in 1998 to aggregate products from around the web and rank them by price. It allowed consumers to set alerts if the price dropped. When users clicked or bought something, sellers paid him a commission.

At its peak, about 40,000 shoppers visited the French site, and it took in more than a million euros a year in revenue. Starting in 2012, revenues decreased by half, until he shut it down in 2018.

“They did kill us,” he said. “But not by making the best product.”

In 2017, the European Commission levied a then-record-breaking €2.42 billion fine against Google, finding it gave preferential treatment to Google Shopping while demoting comparison shopping sites in the rankings. Google said it disagrees with the commission’s decision, which it has appealed.

Still, it agreed to allow comparison-shopping sites to buy ad slots in Google Shopping, a remedy the commission approved. Levin, the Google spokesperson, said 600 sites are participating, and their “click and impression” share grew from 20 to 40 percent between 2018 and 2019.

Last year, 41 comparison shopping companies sent a letter to the commission saying that they “have not experienced any substantial overall increase in traffic to their websites.”

Google continues to abuse its market power, they said, and the industry has not rebounded, despite the remedy.

“Many competitors died,” said Thomas Höppner, a partner at the law firm Hausfeld, who represented three Google Shopping competitors in the European Commission case. “And some argue that the industry will never fully recover.”

This article was originally published on The Markup by Adrianne Jeffries and Leon Yin and was republished under the Creative Commons Attribution-NonCommercial-NoDerivatives license.

Get the TNW newsletter

Get the most important tech news in your inbox each week.