We know from reports earlier this year that VC investment is once more on the rise for European startups. And the wave of optimism seems to be continuing — at least for the continent’s deep tech sector.

Munich’s Vsquared Ventures today announced the closing of a new €214mn fund for early-stage investment in deep tech startups. It is reportedly the largest ever early-stage fund for the sector in Europe.

The VC firm will divide its second fund between 25 deep tech companies across all of Europe, handing out between €500,000 and €5mn. It will also reserve some funds for follow-on investments.

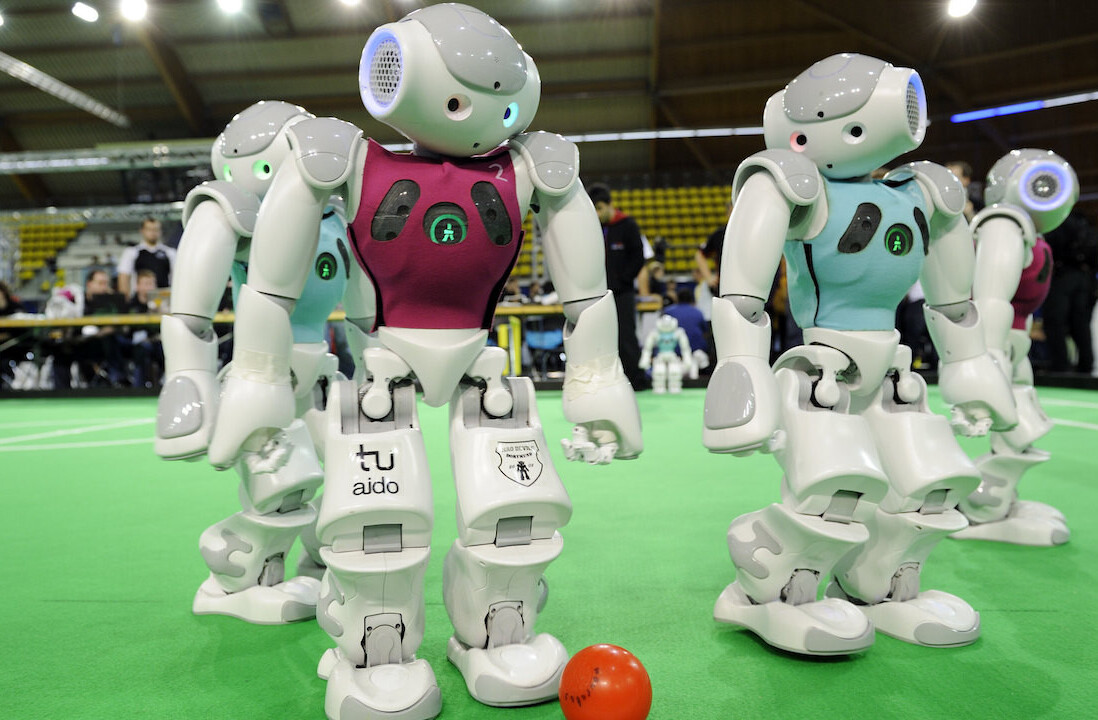

The fund targets six general growth themes. These are AI and next-gen software, energy transition, new computing and sensing, new space, robotics and manufacturing, and techbio (biotech that utilises data-driven tech to transform drug discovery and patient care).

“Right now there is immense opportunity for Europe to become a global deep tech powerhouse — which is also imperative to secure the continent’s sovereignty and to make it future-proof,” the VC said in a statement. “Companies that solve real problems through real technology on a global scale will be successful and these are the ones we partner with.”

Deep tech VC expertise

LPs for the new fund include Novo Holdings (the investment company of the Novo Nordisk Foundation), the NATO Innovation Fund (NIF), and the European Investment Fund (EIF), among others.

Marjut Falkstedt, Chief Executive at EIF (with whom you can hear an interview on the TNW podcast from earlier this year) has high hopes for the fund.

“Europe has leading research facilities and an incredible talent pool, and turning bright ideas into viable business propositions is top of our priority list. This is why we are excited to be supporting Vsquared, who are deep tech experts, to continue to channel financing into Europe’s deeptech ecosystem,” she said.

Vsquared’s investment portfolio includes Finland’s IQM quantum computing hardware startup, which just landed a deal with AWS to provide the cloud giant’s first quantum processor in the EU.

On the list are also rocket launch and space tech startup Isar Aerospace from Germany, its compatriots graphene-based superchip connector Black Semiconductor as well as cognitive robotic assistant startup Neura Robotics, and droplet microfluidics technology startup Atrandi Biosciences from Lithuania — just to name a few.

One of the themes of this year’s TNW Conference is Venture: Show Me The Money. If you want to go deeper into what it takes to get your startup funded, discover the next company to back, or simply experience the event (and say hi to our editorial team), we’ve got something special for our loyal readers. Use the code TNWXMEDIA at checkout to get 30% off your business pass, investor pass or startup packages (Bootstrap & Scaleup).

Get the TNW newsletter

Get the most important tech news in your inbox each week.