New data published today by Dealroom reveal that European VC investment rose 5% year-on-year for the first quarter of 2024. What’s more, the Netherlands is showing a particularly strong comeback. Amsterdam funding rose a highly encouraging 107%.

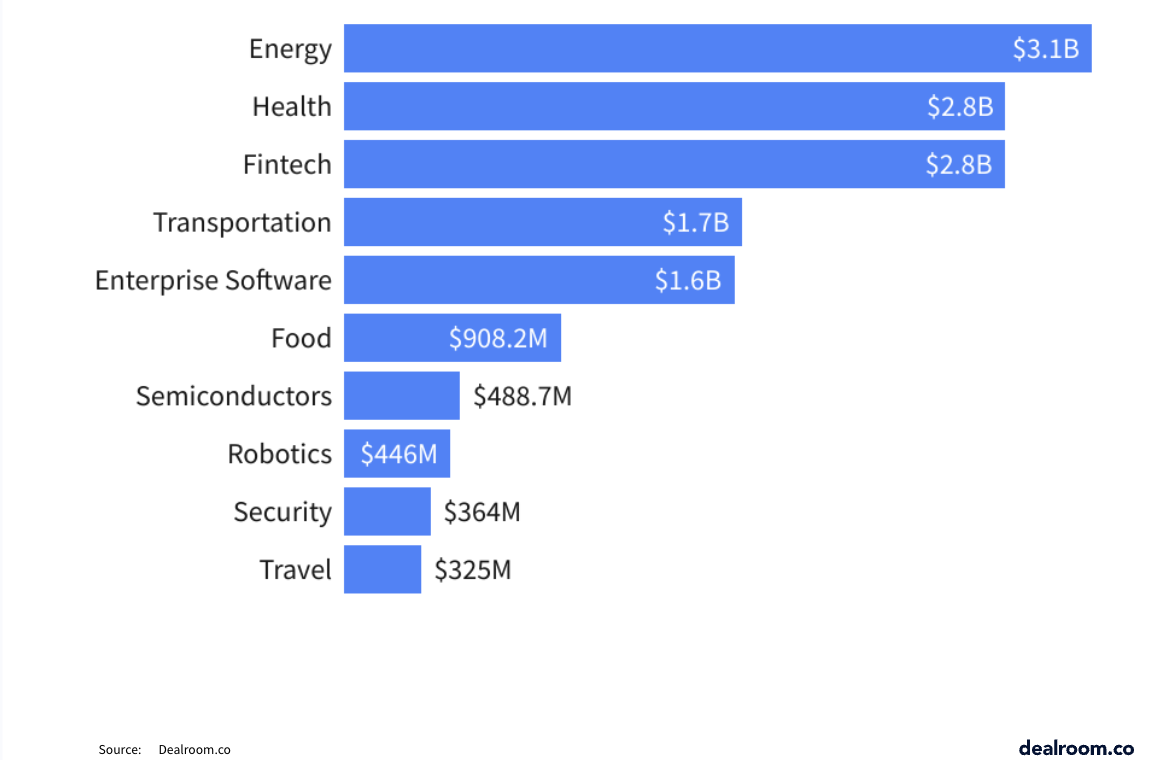

Overall, European VC investment reached $13.7bn in Q1 2024, an increase fuelled to a great extent by the energy transition. Energy was the biggest sector for tech startup and scaleup investment for the fourth quarter in a row, having raised $3.1bn in the first three months of the year.

The top five energy deals of the period were:

- Electra — $330mn, Paris

- H2 Green Steel — $325mn, Stockholm

- Deep Green — $253mn, London

- Sunfire — $233mn, Dresden

- ENVIRIA — $200mn, Frankfurt

Deep tech and climate tech companies raised 27% and 26% of the total funding in the first quarter. Naturally, these two sectors often intersect, and companies belonging to both categories accounted for 13% of total funds raised, with large sums allocated to technological efforts to combat climate change.

Amsterdam startup ecosystem on a funding roll

Dutch startups were, as previously mentioned, off to a flying start. This was driven in large part by substantial raises by grocery delivery service Picnic and recently-turned-unicorn hotel management platform Mews, as well as mobility financing company Moove and intelligent audit platform DataSnipper.

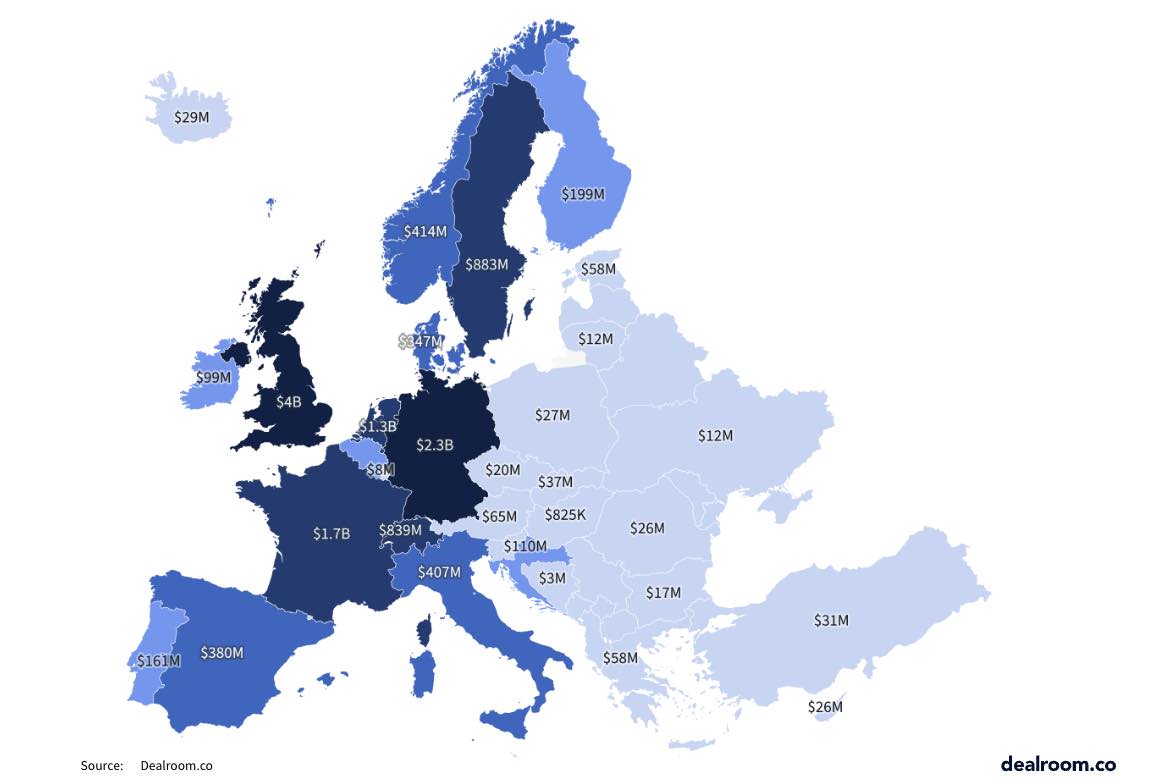

This puts the Netherlands in fourth spot in terms of money raised in Q1 $1.3bn. Unsurprisingly, the UK tops the chart with $3.9bn. London accounted for $2.4bn of this, however, this figure was down 18% from last year. In second place was Germany with $2.3bn, followed by France, where VCs invested $1.7bn.

Across the board, there were over 500 deals of $2mn or more. Meanwhile, generative AI accounted for 38 of investments (up from 24 in Q1 2023 and totalling $399mn), including Berlin-based Qdrant with $28mn, and Paris’ PhotoRoom with $43mn.

“It’s particularly encouraging to see that over 500 companies raised at least $2mn or more, showcasing the strong pipeline of startups who will scale up to build the next generation of category-defining companies,” said Sahar Meghani, partner at Visionaries Club, a VC based in Berlin, adding that the firm was bullish that Europe would continue this momentum into 2024.

One of the themes of this year’s TNW Conference is Venture: Show Me The Money. If you want to go deeper into what it takes to get your startup funded, discover the next company to back, or simply experience the event (and say hi to our editorial team), we’ve got something special for our loyal readers. Use the code TNWXMEDIA at checkout to get 30% off your business pass, investor pass or startup packages (Bootstrap & Scaleup).

Get the TNW newsletter

Get the most important tech news in your inbox each week.