The race for semiconductor leadership is on — and European chip startups are rising to the challenge.

Europe is already home to high-profile chip companies including ASML, NXP, Arm, and Infineon. However, it lags behind in manufacturing capacity. The EU is currently producing about 10% of the world’s semiconductors. The UK accounted for 0.5% of chip sales globally in 2023.

In an ongoing battle against chip giants in Taiwan, China, and the US, both the EU and the UK are doubling down on leveraging their particular strengths in R&D and chip design. The goal is to gain a competitive advantage in next-generation semiconductors. This is also where the continent’s startups can play a pivotal role.

New chip design for AI inference

In July, London-based Fractile emerged from stealth with a £15mn seed funding round for its “radical” chip design that promises to improve AI inference. This is when a trained AI model uses its learned knowledge to analyse live, incoming data togenerate results.

Fractile claims that existing chip hardware poses significant limitations, such as lower model performance, increased costs, and reduced adoption.

To tackle this, the startup has developed a novel computational architecture, with circuits it says can execute 99.99% of the operations needed to run inference.

A key aspect of the technology is in-memory computing. This means that instead of constantly moving data between memory and processing units, the calculations are done right within the memory itself.

Fractile says its chips will make AI inference 100 times faster and 10 times cheaper compared to current solutions, while reducing power consumption. If successful, the company aspires to provide an alternative to US-based Nvidia — the foremost supplier of advanced AI chips.

The funding round included backing from the NATO Innovation Fund.

Gaining an edge for edge AI

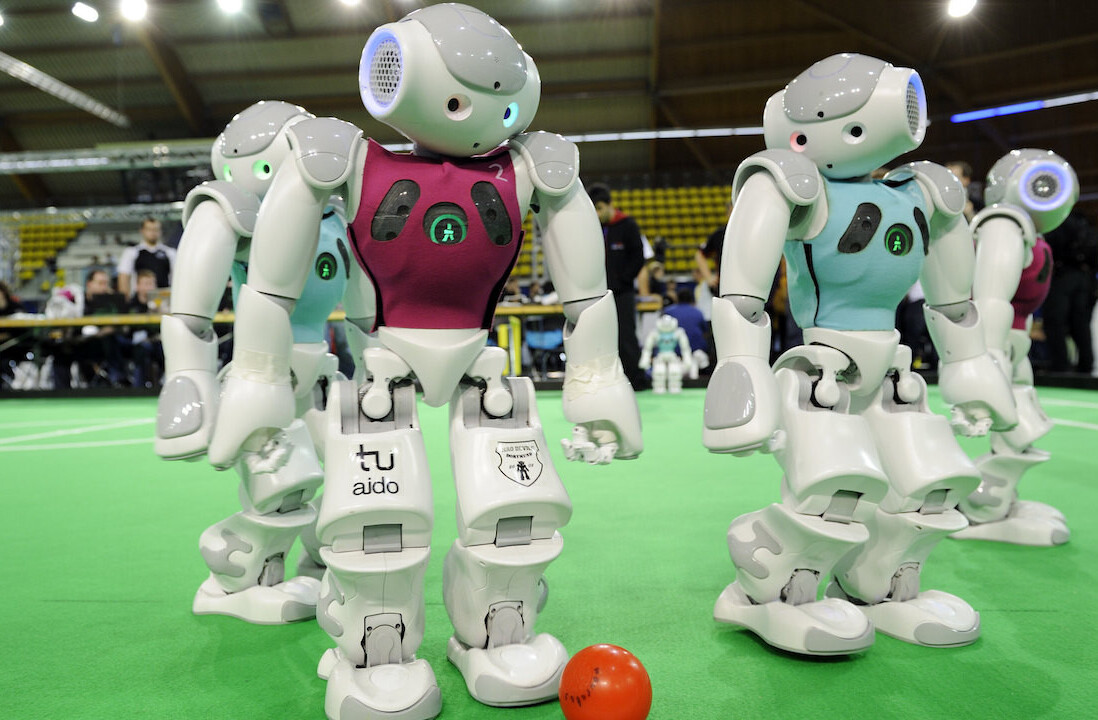

Another potential Nvidia challenger is Axelera AI. Founded in 2021, the Netherlands-based company develops chips for computer vision and edge AI, which means the deployment of AI algorithms directly on local edge devices such as sensors.

Axelera specialises in AI inference solutions based on its proprietary digital in-memory computing and RISC-V technology — an open-source instruction set architecture for designing computer processors.

The startup says that its Metis Platform, which combines both hardware and software, achieves a three to five times increase in efficiency and performance.

In June, Axelera raised a fresh $68mn investment, bringing its total to $120mn. The round included investment from the European Innovation Council Fund.

With the new capital, the company plans to grow its product portfolio and target applications in verticals such as data centres, robotics, healthcare, and generative AI applications. Axelera also aims to expand in North America and the Middle East.

Graphene-based chips

Meanwhile, in Germany, Black Semiconductor is developing a new type of chip-connecting technology using graphene, the “wonder material” discovered in 2010 by Andre Geim and Konstantin Novoselov.

The startup claims that its graphene-based chip technology addresses current shortcomings of traditional silicon chips, such as lower processing power and high energy use.

Black Semiconductor’s technology and hardware enable optical chip-to-chip connections that speed up data communication between chips allowing them to interact almost as a unified system. The company also expects to reduce manufacturing costs with a process that requires 60% fewer steps.

Notably, such chips could prove transformative for technologies such as GenAI, data centres, and autonomous vehicles.

Black Semiconductor plans to set up a pilot line for 300mn chip production in Aachen by 2026. If successful, the integration of graphene into chips on a commercial scale will mark a first for the semiconductor industry.

Justifiably, the company recently raised €254.4mn in one of the largest rounds raised by a European chip startup to date. The German government provided the biggest part of the amount through an EU state aid scheme, aiming to support the bloc’s digital transformation.

Get the TNW newsletter

Get the most important tech news in your inbox each week.