Amid a global race for semiconductor leadership, an Aachen-based startup has raised €254.4mn for its chip technology in a big boost for the German as well as the European semiconductor sector.

Brothers Daniel and Sebastian Schall launched Black Semiconductor in 2020, spinning it out from the University of Aachen.

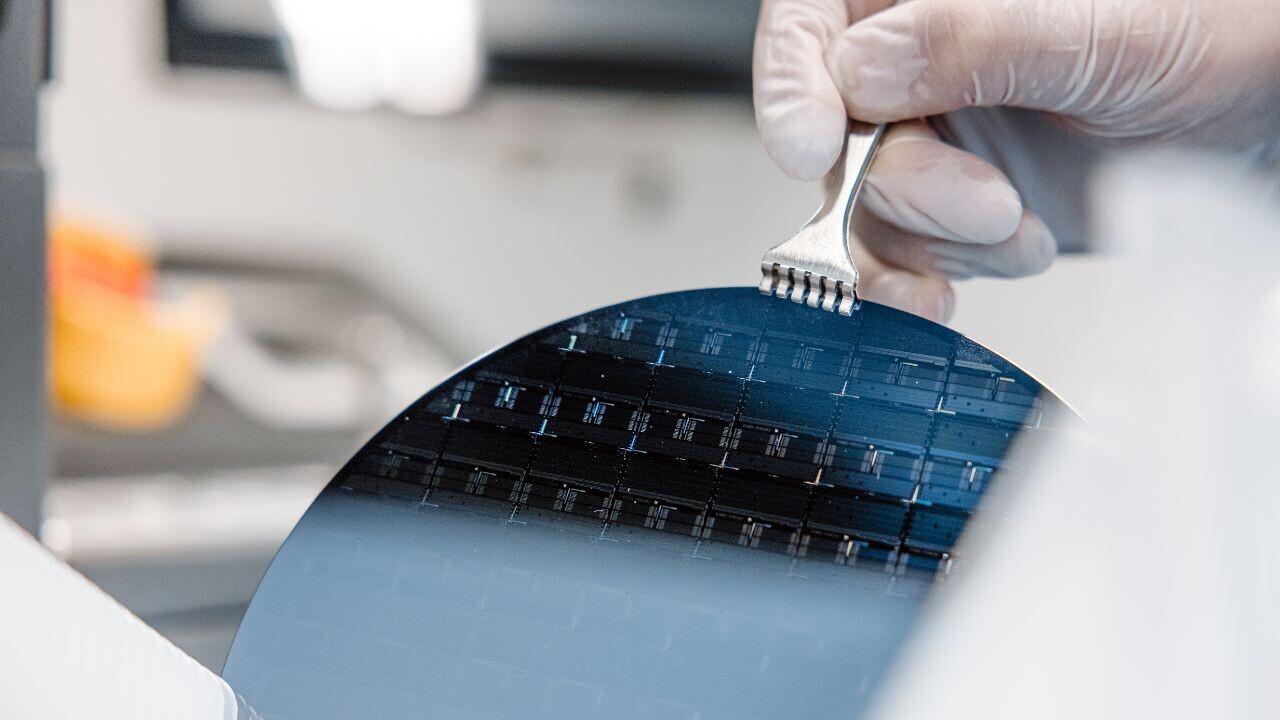

The startup is developing a new type of chip-connecting technology using graphene, a novel material discovered in 2010 by Andre Geim and Konstantin Novoselov.

Graphene has been hailed as a “wonder material” thanks to its remarkable properties. That’s because it’s the thinnest and strongest material known to science and an excellent conductor of electricity. As such, graphene has the potential to transform a wide range of industries from medicine to electronics — and semiconductors.

Black Semiconductor says that its graphene-based chips can overcome limitations in current silicon chip architecture, such as processing power and energy consumption. In turn, it can faciliate chip networks with a higher-than-ever performance.

These networks can speed up data communication between chips, improving their performance and energy efficiency. The startup also expects a significant reduction in manufacturing costs, with a process that requires 60% fewer steps.

The chips can power applications across multiple industries, ranging from data centres to GenAI, and autonomous driving.

With the fresh capital, Black Semiconductor will accelerate R&D and quadruple its workforce from 30 to 120. It also plans to establish a pilot line for 300mm wafer production in Aachen, set for launch by 2026. The company expects mass production to begin by 2031.

EU backing

The potential successful integration of graphene into chips on a commercial manufacturing scale will mark an industry milestone. This explains why the €254.4mn capital injection is one of the largest raised by a European chip startup to date.

The sum is a combination of private and public funding. Private investors including Porsche Ventures, Partner A Ventures, and Scania Growth backed the startup with €27.5mn.

The bigger part of the amount (€228.7mn) comes from Germany’s federal government and the state of North Rhine-Westphalia under the Important Projects of European Common Interest (IPCEI). This is a €8.1bn state aid scheme introduced by the EU Commission last year.

A boost to Europe’s semiconductor sector

“As part of IPCEI, we are committed to contributing to the semiconductor value chain in Europe,” said Daniel Schall.

“We believe that this investment, coupled with Europe’s ambitious push to increase funding for deep tech companies, will inspire even greater participation from startups and industry players.”

Uwe Horstmann, co-founder and General Partner of Project A Ventures, also emphasised the importance of such investments for the continent’s chip sector.

“Europe needs to focus on achieving independence in key enabling technologies to ensure the continent’s autonomy and economic stability amid geopolitical challenges and supply chain issues.”

Chips are high on the EU’s list of strategic technologies, powering everything from consumer electronics and digital infrastructure to healthcare and military applications.

Next to state aid funding schemes and key partnerships, the bloc has introduced the Chips Act. The act aims to mobilise €43bn in public and private investments, and bring the EU’s share in global production capacity from 10% to 20% by 2030.

One of the themes of this year’s TNW Conference is Venture: Show Me The Money. If you want to go deeper into what it takes to get your startup funded, discover the next company to back, or simply experience the event (and say hi to our editorial team), we’ve got something special for our loyal readers. Use the code TNWXMEDIA at checkout to get 30% off your business pass, investor pass or startup packages (Bootstrap & Scaleup).

Get the TNW newsletter

Get the most important tech news in your inbox each week.