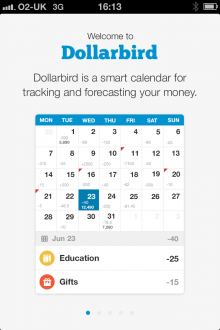

What do you get when you cross a smart calendar app with a budgeting app? You get Dollarbird.

What do you get when you cross a smart calendar app with a budgeting app? You get Dollarbird.

If you’re wondering why you’re not doubled-over with laughter at that punchline, well, it wasn’t a joke.

Launching in the App Store today (though not optimized for iPad), Dollarbird is an expenses app that uses a familiar calendar layout to help you track and forecast all your spending. And we think you’ll like it.

How it works

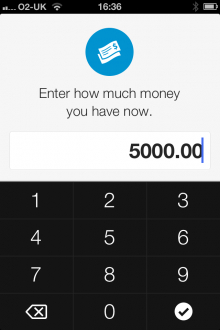

Dollarbird doesn’t require accounts or anything, so you’re good to go as soon as you launch it. The first thing it’ll ask is how much money you currently have – this essentially serves as the starting point for all future income/expenses to be added/subtracted from.

Also, Dollarbird doesn’t bother with currencies – it assumes that whatever number you put in here, you’ll know what currency you’re operating in. Which is a fair assumption, really.

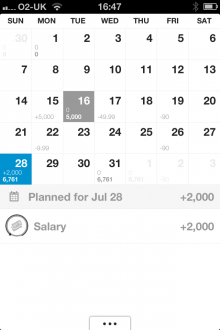

While nearly every expenses app I can think of uses charts, graphs, lists or tables as the primary display, Dollarbird instead opts for the grid-like familiarity of a good old-fashioned calendar – and we have to say, it works really well.

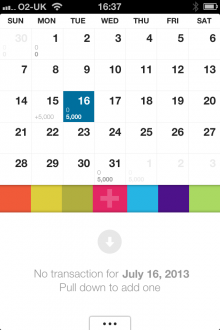

Whatever your starting figure was, this will show-up on whatever date it was you first launched the app. Then, it’s up to you to fill-in the blanks. Highlight a specific day, and swipe down from top-to-bottom to create a new entry.

Initially I thought I’d found a minor deal-breaker for this app – an annoying little bird that pops up to give financial tips and mantras. You’ll be pleased to know, like I was, this can be switched off in the settings.

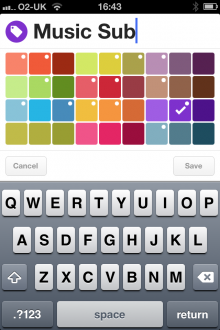

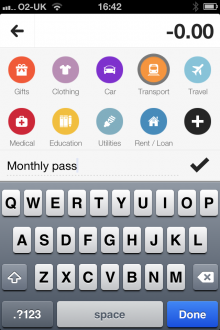

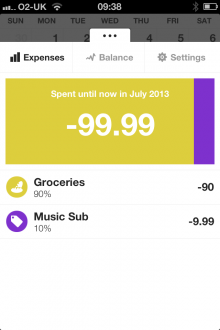

While there are a slew of existing categories to choose from – such as Groceries, Clothing and Transport, Dollarbird helpfully lets you set your own color-coded category too. So, if you’d rather not throw all your music subscriptions under the fairly broad ‘Fun’ label, you don’t have to.

You can also add notes to each expense – so if you’re adding something under ‘Transport’, you can specify whether it’s a monthly travel-card or a daily ticket.

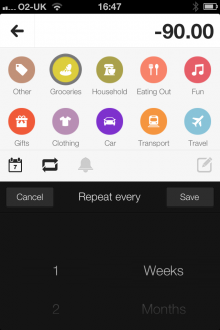

An absolutely imperative feature here too is the ‘recurring’ tab. This is often missing or well-hidden in expenses apps, and it’s useful to be able to tap this when setting up an expense, so that it automatically populates your calendar for future weeks/months.

There’s also a reminder/alarm function, which will ping up a message whenever you’re due to pay something. This can be set for up to four days prior to it coming out of your account.

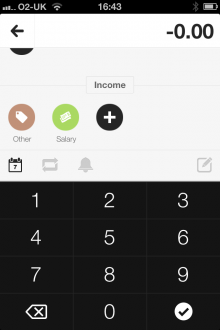

Scroll down from the expenses tabs, and you’ll see the option to add income – this includes one for salary and one for ‘other’. You can also add your own category here, which could be handy if you get income from other sources such as rent.

A small point here – it would be good if you could delete or edit existing categories, both in expenses and income. You may have no need for ‘car’ or ‘medical’ expenditure, while ‘other’ is decidedly vague. But it’s not a big problem.

When you go back to the main calendar view, you’ll see each figure you’ve input on each day, and when you click on a particular box you’ll see more details on what these amounts refer to.

If you tap one day, then long-press another day later in the month, this will automatically select that period of time and show your running balance. And you can swipe right to delete a transaction at any point.

You’ll also see a little tab at the bottom of the screen – this is where you get a broader overview of what you’ve spent so far, and glean a running balance over a period of time set by you.

This offers a very neat way of seeing how your balance evolves over time, and how much it changes each month. And, based on your evolving spending/earning patterns, it will project how much money you’ll have up to five years from now.

While there’s no shortage of personal finance tools in the App Store, take BUDGT and Planwise for starters, Dollarbird brings a fresh perspective to the notion of what a well-designed expenses app really means. It’s a delight to use, though it would perhaps benefit from having a better budgeting element – for example warning you when you’re approaching a pre-set monthly spend.

Dollar-who?

Dollarbird is the handiwork of Halcyon Mobile, a Transylvania, Romania-based app development company.

Though it has partnered with agencies, brands and startups since 2005 to produce apps, Dollarbird represents Halcyon’s first self-branded product. And, we’re told, if the reception for this launch is a positive one, they’ll look to bring it to Android in the future too.

“While there are a lot of personal finance apps out there, most of them are just too complicated – and the ones that are simple, though, are too superficial to be really useful,” says Levente Szabo, cofounder of Halcyon Mobile.

“After having built hundreds of apps for our clients in the past few years, we decided to take this challenge personally,” he continues. “We set out to build our first internal product, that would become Dollarbird, our first shot at trying to fix personal finance apps. We dreamed about an app that would be easy to use, but powerful and flexible enough to really allow people with different needs to master their money.”

Dollarbird is available to download from the App Store for $0.99 now, a price that will rise to $3.99 in the coming days – so get in fast.

Disclosure: This article contains an affiliate link. While we only ever write about products we think deserve to be on the pages of our site, The Next Web may earn a small commission if you click through and buy the product in question. For more information, please see our Terms of Service

Get the TNW newsletter

Get the most important tech news in your inbox each week.