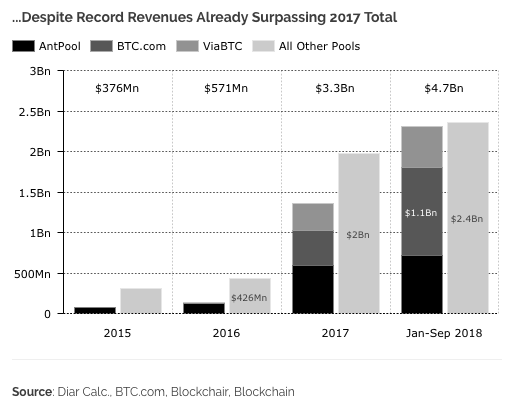

Bitcoin miners have raised over $4.7 billion in revenue so far this year, but rising electricity prices have rendered cryptocurrency mining almost completely unprofitable, even for the world’s biggest pools.

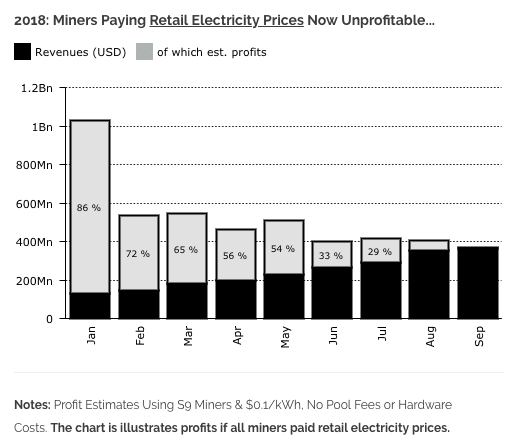

Blockchain research unit Diar has published data mapping the profitability of mining Bitcoin. For the first time, it appears small-time cryptocurrency mining operations, who pay retail rates, are no longer profitable.

Bitcoin miners currently earn 54,000 BTC ($355 million) every month for processing transactions by mining blocks. They are also paid by users in the form of transaction fees.

A sustainably high hash rate and increase adoption has meant Bitcoin mining revenue has surpassed last years numbers by $1.7 billion.

Still, the world’s largest mining pools are barely making a profit from mining Bitcoin – at best.

The situation is so dire that Diar indicates the largest mining pool operator in the world, Bitmain, will be forced to “swing” the Bitcoin hashrate between countries, averaging out electriity costs and maintaining a sense of profitability across all of its facilities.

It is expected these swings will increase as Bitmain opens three new cryptocurrency mining farms in the United States in the first quarter of 2019.

All this suggests that Bitcoin mining is becoming exclusively for the big fish, with Satoshi’s ideal of a profitable, community-run cryptocurrency all but lost.

Craving more blockchain? Join us at Hard Fork Decentralized, our three-day event in London. We’ll discuss the industry’s future together. You can now register on our website!

Get the TNW newsletter

Get the most important tech news in your inbox each week.