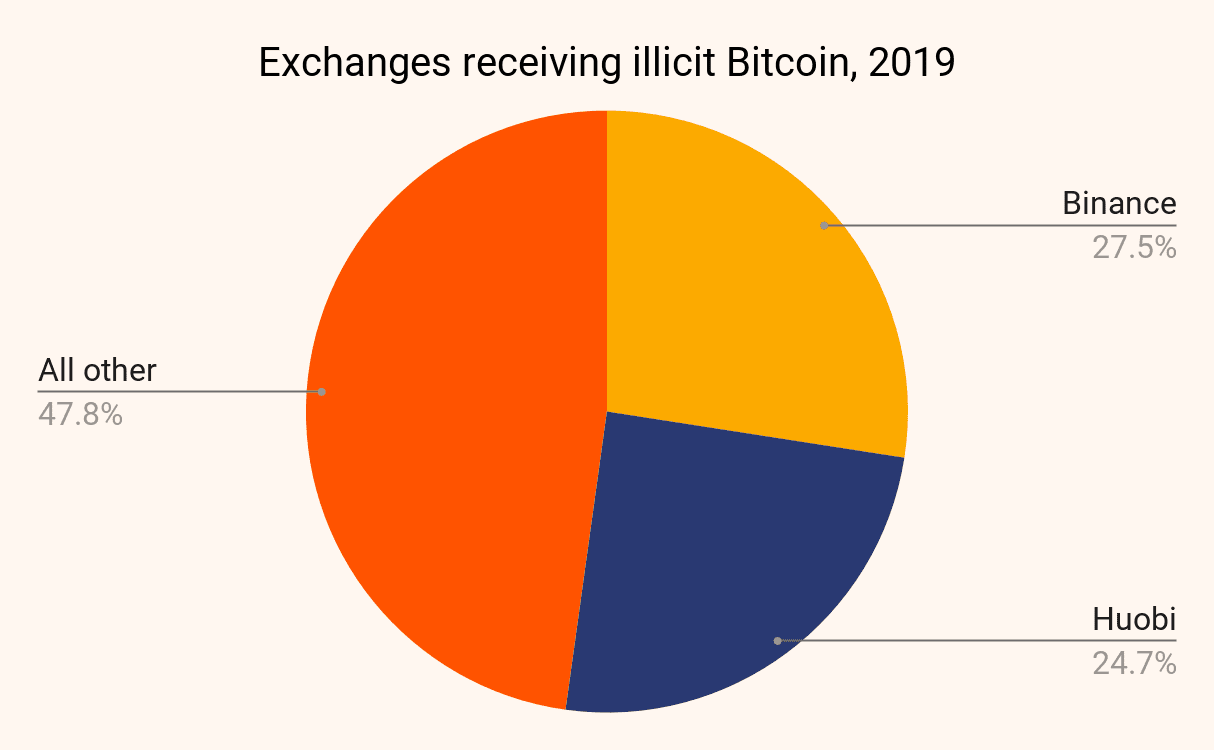

Blockchain researchers traced $2.8 billion in illicit Bitcoin believed to be laundered on cryptocurrency exchanges in 2019 — with over 50 percent ($1.4B) washed through major trading hubs Binance and Huobi.

“Binance and Huobi lead all exchanges in illicit Bitcoin received by a significant margin,” said cryptocurrency analysis unit Chainalysis. “That may come as a surprise given that Binance and Huobi are two of the largest exchanges operating, and are subject to KYC regulations.”

[Read: Greece suspends extradition of alleged launderer for Bitcoin ‘stolen’ from Mt Gox]

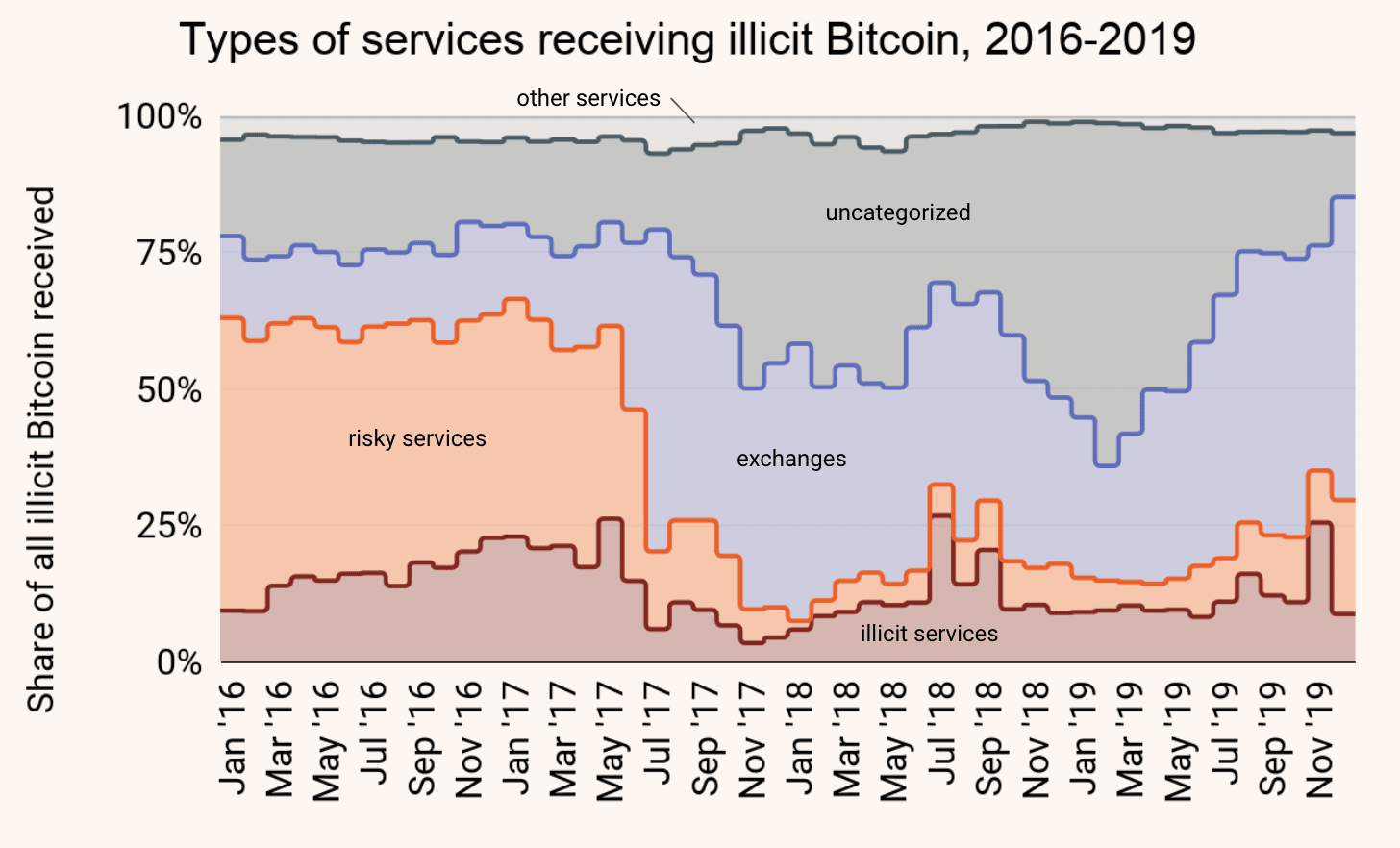

Chainalysis found more than 300,000 individual accounts on those exchanges had touched Bitcoin sent from “criminal sources” last year, and manually identified a list of the top 100 “rogue” over-the-counter (OTC) cryptocurrency brokers they believe to be money launderers.

“[…] A small segment of these accounts is extremely active. The 2,196 accounts in the three highest-receiving buckets received a total of nearly $27.8 billion worth of Bitcoin in 2019,” said the firm.

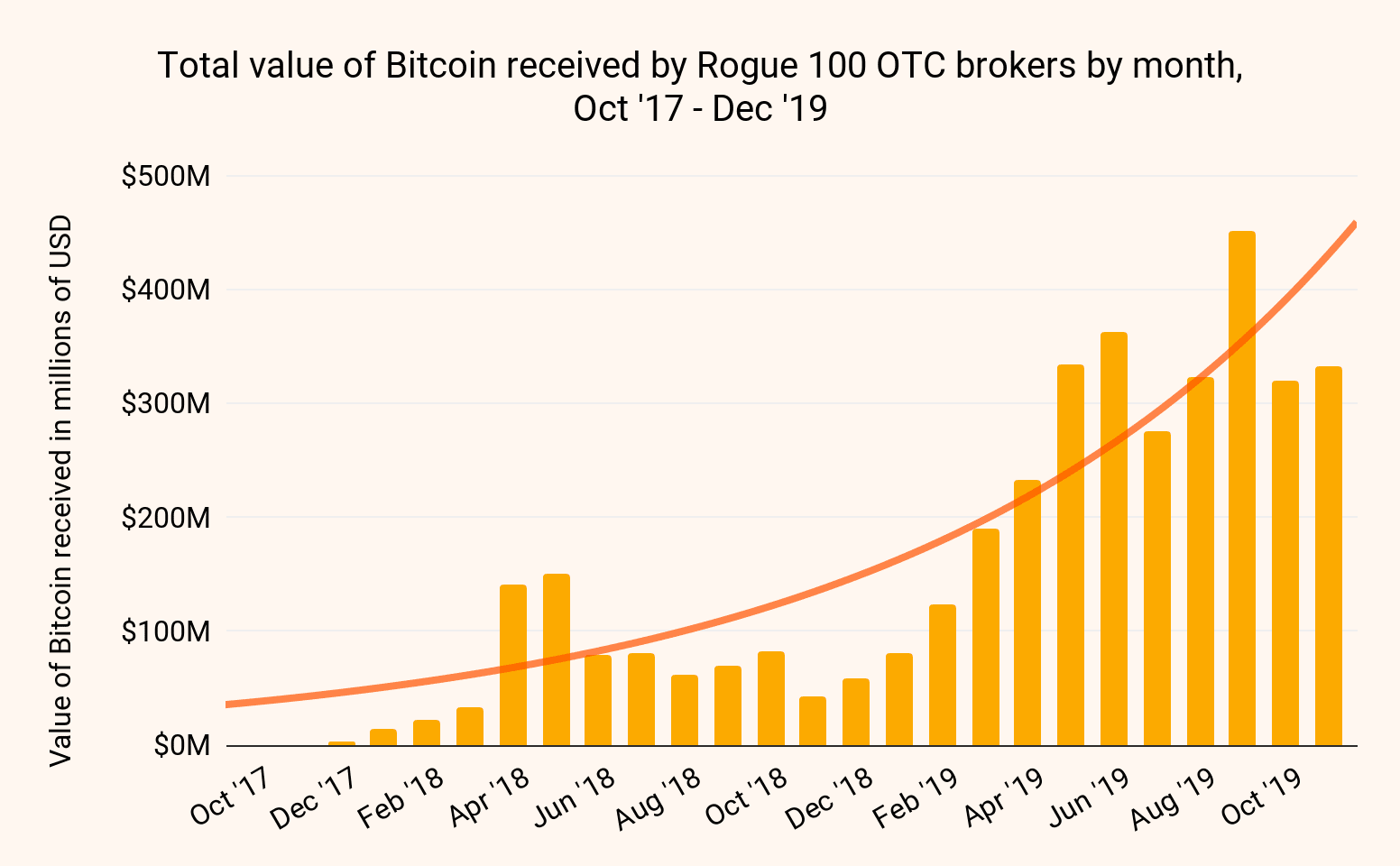

The amount of illicit cryptocurrency touched by the Rogue 100 is no joke: they reportedly received more than $3 billion worth of Bitcoin in 2019, and accounted for as much as 1 percent of all Bitcoin activity in any given month.

Top dodgy cryptocurrency brokers hold influence over markets

OTC brokers serve as middle men for those looking to transact away from public exchanges. They typically facilitate clients by negotiating trades for larger amounts of cryptocurrency for set price.

Chainalysis described OTC brokers as a “crucial source of liquidity in the cryptocurrency market,” citing evidence provided by data firm Kaiko that estimates they’re actually involved in the majority of all cryptocurrency trade volume.

There’s a multitude of reasons for enlisting OTC brokers, many legitimate. Market makers and whales with fat stacks of digital cash often trade in this way to avoid influencing the overall cryptocurrency market with their big movements.

Some OTC brokers specialize in laundering money for criminals drawn to their services as they can have much lower know-your-customer requirements than online exchanges, Chainalysis explained.

Huobi appears to attract the top launderers

Seventy of the top 100 addresses linked to OTC brokers laundered Bitcoin exclusively though Huobi. In total, those 70 brokers reportedly received more than $194 million from criminal entities last year.

Researchers however posited it could be possible that some had additional accounts on Binance or other exchanges.

“Keep in mind, the Rogue 100 only represents OTC brokers we’ve manually identified as money launderers over the course of our investigations on behalf of Chainalysis clients,” said the firm. “We think it’s extremely likely that some percentage of the other highly-active Binance and Huobi accounts taking in illicit funds also belong to corrupt OTC brokers we’ve yet to identify.”

Last month, Hard Fork reported that PlusToken, a Chinese Ponzi scheme worth some $2.6 billion, may have been responsible for keeping the Bitcoin’s price down. Chainalysis noted that many of the Rogue 100 played a substantial role in the scam.

As for what Binance is doing to mitigate exposure to money-laundering OTC brokers, spokesperson assured the firm that it was aware of the “growing trend and movements” of illicit funds, and that its platform is compliant with KYC requirements in each jurisdiction in which it operates.

While Chainalysis did clarify that criminally-connected cryptocurrency represents a small fraction of total amount received by Binance and Huobi, the amount is still significant, with the top 31 suspicious accounts alone exposed to more than $163 million in Bitcoin linked to dodgy sources.

Get the TNW newsletter

Get the most important tech news in your inbox each week.