When Yahoo reported its 2Q 2013 earnings several hours ago with revenue that came in slightly below expectations, in stark contrast were Chinese e-commerce firm Alibaba’s impressive results.

Alibaba is required to report its earnings to Yahoo because the US company has a 24 percent stake in the Chinese firm. Alibaba’s net income for the quarter jumped 189 percent year-on-year to reach $680 million, while revenue climbed 71 percent to hit $1.38 billion. Yahoo’s net income attributable to Alibaba leaped 203 percent to $669 million.

Alibaba has been strongly tipped to float on the Hong Kong stock exchange before the end of the year in a move that could value the firm at $70 billion — and its earnings this quarter is a testament to the strength of the company’s growth, piling on expectations for its initial public offering.

Newly-installed Alibaba Chief Executive Jonathan Lu has pledged to continue the e-commerce giant’s recent string of big investments as it maintains focus on improving its services for mobile. Lu wants Alibaba’s service – and in particular its two biggest businesses: virtual ‘mall’ for brands Tmall and eBay-like Taobao marketplace – to make better use of customer data to provide a more unique and tailored user experience.

This year so far, Alibaba has grabbed 18 percent of microblogging service Sina Weibo with a $586 million investment and bought 28 percent of mapping firm Autonavi for $294 million. Just yesterday, the company confirmed it had invested in outbound travel site Qyer.com to boost its Taobao Travel e-commerce service.

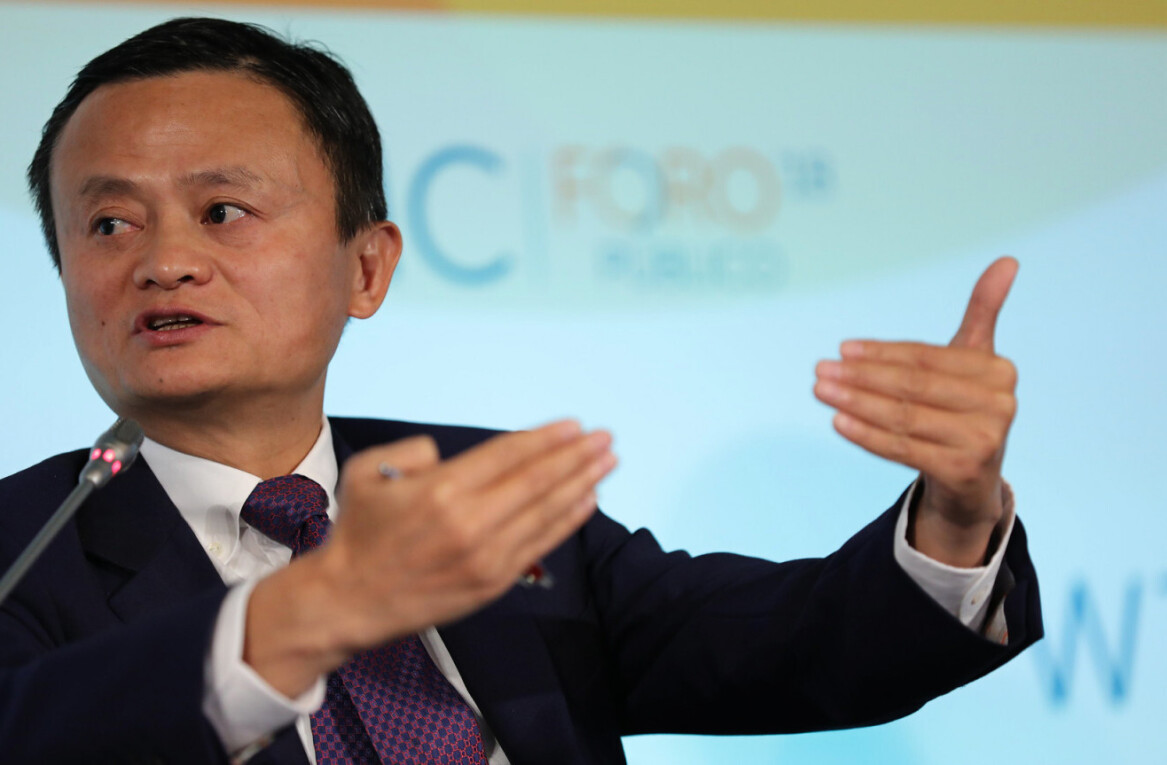

Image Credit: Peter Parks via AFP/Getty Images

Get the TNW newsletter

Get the most important tech news in your inbox each week.