The UK, Switzerland, and Sweden are poised to cash in from the AI gold rush, but most of Europe will be a poor nephew to Uncle Sam.

So say the expert analysts at Capital Economics, a financial research firm based in London. In a new study, the company assessed which countries are best placed to benefit from the AI boom — and which ones will be left behind.

Using 40-sub-indicators, the researchers analysed their capacities for AI innovation, diffusion of the AI effectively, and adaptability to the impacts. The three categories were then combined to calculate a global ranking.

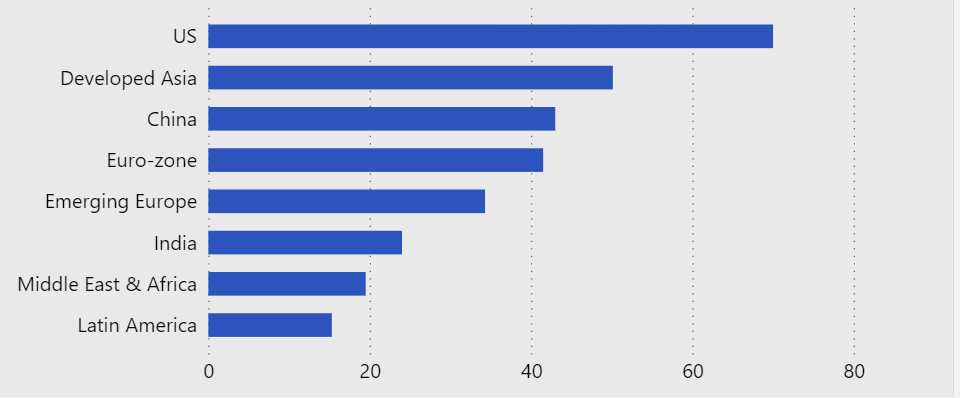

Unsurprisingly, the US topped the charts, but there were some shockers in the chasing pack.

Among them was the relatively low position of China. Despite the phenomenal AI developed at companies like TikTok and within research institutions, immense regulatory barriers and government intervention in the private sector sunk China to a middling performance.

In Europe, meanwhile, the outlook is mixed. Leading the continent is the UK, which ranked third globally, behind only the US and Singapore.

“The UK could benefit from lighter-touch regulation.

The study team gave several reasons for Britain’s loft position. Despite perennially low investment rates, the country has become a magnet for AI talent and boasts a propitious business foundation.

One of the country’s greatest strengths is its higher education system, particularly in the golden triangle formed by the university cities of Cambridge, London, and Oxford, which attract top talent from around the world.

Another innovation engine is Google DeepMind’s pioneering AI lab, which is based in London. The analysts also expect the UK’s flexible labour market to support the wider economic adaption to AI, while its service-oriented economy can accelerate the diffusion.

Britain may be further impacted by its position outside of the EU — both positively and negatively. While Capital Economics doesn’t expect Brexit to be a major factor in the AI economy, the research team can envision some effects.

“On the plus side, the UK could benefit from lighter-touch regulation if the EU regulates AI more strictly in future,” Andrew Kenningham, the firm’s Chief Europe Economist, told TNW. “But set against that, there could be reduced collaboration on AI projects or the UK could be hindered from participation in large-scale European AI initiatives.”

Next in line for the throne

The UK is one of three European countries rounding out the global top five. Taking fourth spot is Switzerland, while Sweden bagged fifth. Both countries were particularly strong in adaption, ranking first and second in the world, respectively.

“This essentially means that they have a good track record on redeploying resources,” Kenningham said.

In terms of innovation, Switzerland and Sweden ranked slightly higher than Germany and a bit lower than the UK. But they both lagged far behind China and the US — a common issue in Europe.

“Europe is a long way behind the US and China on our sub-index of ‘innovation’ essentially because it invests less in AI research and has less academic research in that area,” Kenningham explained.

Outside of the continent’s three leaders, the European landscape is considerably bleaker.

One of the gloomiest areas is a scarcity of financial backing. Investors are ploughing enormous capital into US tech firms with GenAI capabilities, whereas European equities are receiving a lesser AI-related boost.

As a result, the continent’s stock markets will likely struggle to keep pace with their counterparts across the Atlantic. These divides will be amplified if the US market entices more European firms, as it recently did to Arm, the UK-based chip designer.

A further obstacle is the continent’s sparse cloud infrastructure, which provides essential foundations for AI. There also remain several enduring barriers. Compared to the US, Europe has a small VC ecosystem, scarce enormous companies, rigid labour markets, tight regulations, and strict local planning restrictions. Collectively, these components restricted growth during the 1990s ICT boom. In the AI era, they may create even greater hindrances.

To emphasise this point, the study team note the impacts of EU tech regulations. A prominent example recently emerged with the release of Bard, Google’s answer to OpenAI’s GPT. Due to concerns over GDPR compliance, Bard arrived in over 100 countries before the EU.

Future launches will be further inhibited by the impending AI Act, which restricts technologies such as biometric surveillance and emotion recognition. Protecting the public doesn’t always please businesses — or the economy.

The future is not set

There’s still time to move up — or down — the rankings. As with previous transformative technologies, AI’s productivity boost will likely be more of a slow-burn than an overnight surge. Capital Economics expects the big impacts to come in the late 2020s and 2030s.

To improve their preparations, the firm advises European governments to more actively support immigration of IT and AI talent. The researcher also championed the UK’s provision of fiscal aid for academic and commercial research.

In the long-term, further support for the enabling environment, such as universities and education in STEM subjects, will also have a positive impact.

“Apart from innovation/R&D governments can also do more to support the diffusion of AI through, for example, ensuring that regulations do not discourage adoption, labour markets are flexible, and [the] public sector leads by example in adopting new technology,” Kenningham said.

Without these changes, much of Europe is set to slip further behind the US in the global economic order.

Get the TNW newsletter

Get the most important tech news in your inbox each week.