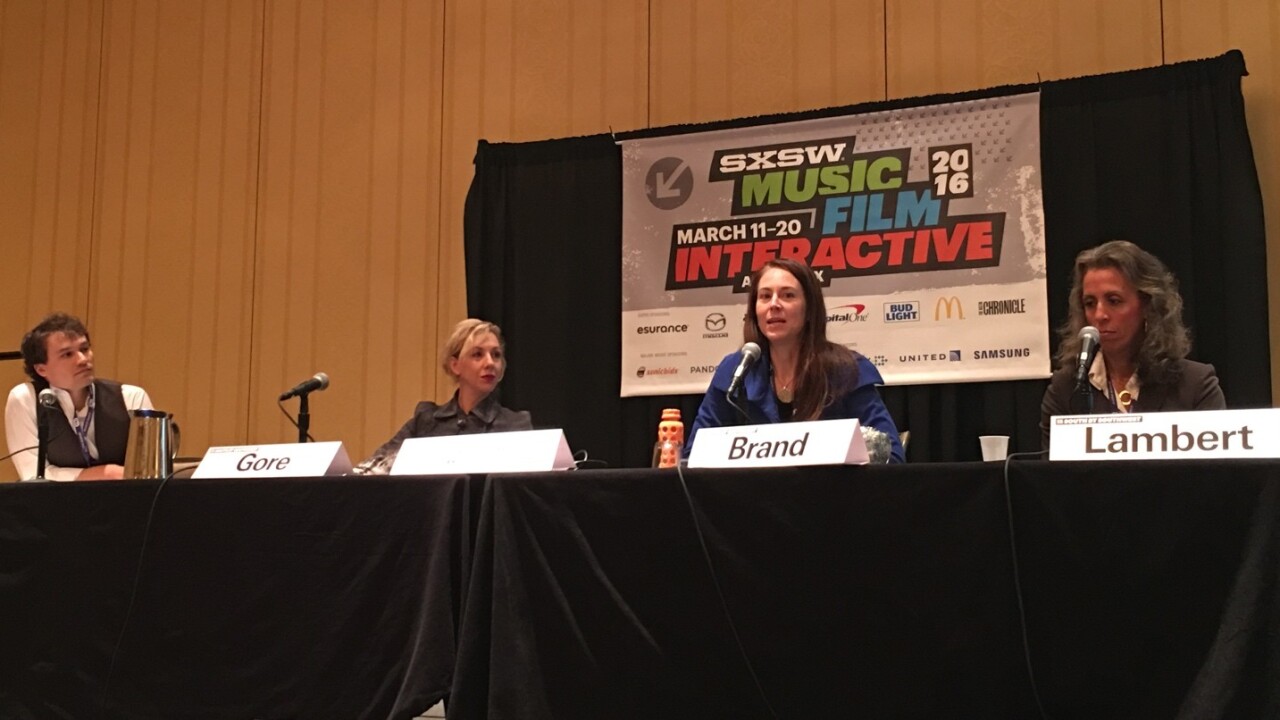

At SXSW today, a panel of diversity-minded people from the venture capitalist world got together to address the problems surrounding the primarily white, male VC world.

Gender diversity was the primary focus of the discussion. First Round Capital recently reported that its portfolio companies with female founders performed 63 percent better than investments with all-male founding teams. Village Capital found that female-run companies outperformed male-led firms by at least 20 percent in revenue earned and jobs created while raising less capital.

Meanwhile, a Babson College study found that the proportion of female partners at VC funds in the US fell from 10 percent to 6 between 1999 and 2014, and more than 97 percent of businesses that received venture funding between 2011-2013 have male CEOs, according to Village Capital.

There was a frustration expressed by audience members in the room that while data pointed to more investment in companies founded by people who aren’t male or white being a good thing, it not being borne out in the actions of the VC world.

Lisa Lambert, who runs Intel Capital’s Diversity Fund, said that VC bias is not necessarily intentional. People tend to associate with others who are like them. When it comes to venture capital, this ’sameness’ can help investors make decisions quickly in a competitive market. What’s more, if previous data shows that white males are good investments, VCs will invest in them in the future.

So, what can be done? Joshua Henderson, VP at Springboard Enterprises, a non-profit organization that supports women entrepreneurs, said that creating success stories for other VCs to learn from should be a priority for the industry.

Putting on pressure

Sara Brand, Founding General Partner at True Wealth Ventures, a VC firm focused on female entrepreneurs, added that the real pressure for change should come from the limited partners who put money into VC funds. She added that institutional investors are getting pressure to invest in diversity-focused funds, even if those funds are presently quite small.

Lambert noted that the corporate VC world should also be a big driver of change. Intel invests in businesses run by people from minority groups not as part of a social mission but as a way of making money. She said that the company knows it’s at risk if it doesn’t diversify its target market, and investing in companies from diverse backgrounds is a way of working towards that.

Another representative of the corporate world on the panel was Elizabeth Gore, Entrepreneur in Residence at Dell. She said that there was an opportunity to incentivize VCs to act in a more diverse way, similar to how the Obama administration incentivized government supplier contracts from companies with diverse founders.

Gore also highlighted some useful resources for female entrepreneurs. These included 1776, which she said is set to start a global platform called Union in May, the Circular Summit, and perhaps most importantly “your right hand.” Raising their hands and asking for money is something women should do more of, she said.

Lambert added that in her experience, women tend to ask for less money than men. She said that women tend to be more “cash efficient-oriented” and don’t want to waste people’s money. She said that women need to get over that, think bigger and raise more so they can scale bigger, faster and create the success stories that are needed.

Overall, the panel painted an optimistic view for the future of female tech entrepreneurship, assuming change occurs. And yet, as members of the audience pointed out during the panel’s Q&A, ethnicity, geographic location and age are other biases that the VC world needs to address.

And on that note, why not read stories of tech entrepreneurs aged 40+ from around the world?

Get the TNW newsletter

Get the most important tech news in your inbox each week.