Tencent stock jumped 5% on Wednesday after the Chinese gaming giant posted an 89% jump in quarterly profits, Reuters reports.

Tencent pocketed 38.5 billion yuan ($5.8 billion) between July and September this year to eclipse analyst estimates by nearly 25%.

The company’s total quarterly revenue increased 29% year-on-year to 125.45 billion yuan ($18.4 billion), powered by strong growth in Tencent’s smart phone games.

In fact, Tencent’s online games revenues reached 41.42 billion yuan last quarter ($6.3 billion), a 45% rise year-on-year.

“The increase was primarily due to revenue growth of our smart phone games, including domestic titles such as Peacekeeper Elite and Honour of Kings, as well as overseas titles,” said Tencent in a statement.

[Read: Traders dump Zoom for Expedia as Pfizer vaccine teases life after COVID]

Tencent did see some reprieve from the affects of the coronavirus pandemic in the past three months. Advertising revenue — which had dwindled across global industry — gained 16% year-on-year.

Tencent attributed that success to rapid growth in demand for education, internet services, and ecommerce adverts. The company also said demand from real estate and automobile sectors had recovered from earlier this year.

Tencent investors spooked by Xi’s anti-monopoly plans

Tencent’s post-earnings stock rally comes just as investors dumped more than $200 billion worth of equity on Tuesday, and one week after the curious suspension of Alibaba subsidiary Ant Financial’s much-anticipated US IPO (which would’ve been the biggest in history.)

As noted by Bloomberg, share prices for Chinese tech giants like Tencent and Alibaba have dropped sharply since their government revealed new regulations to curb monopolies in the internet sector.

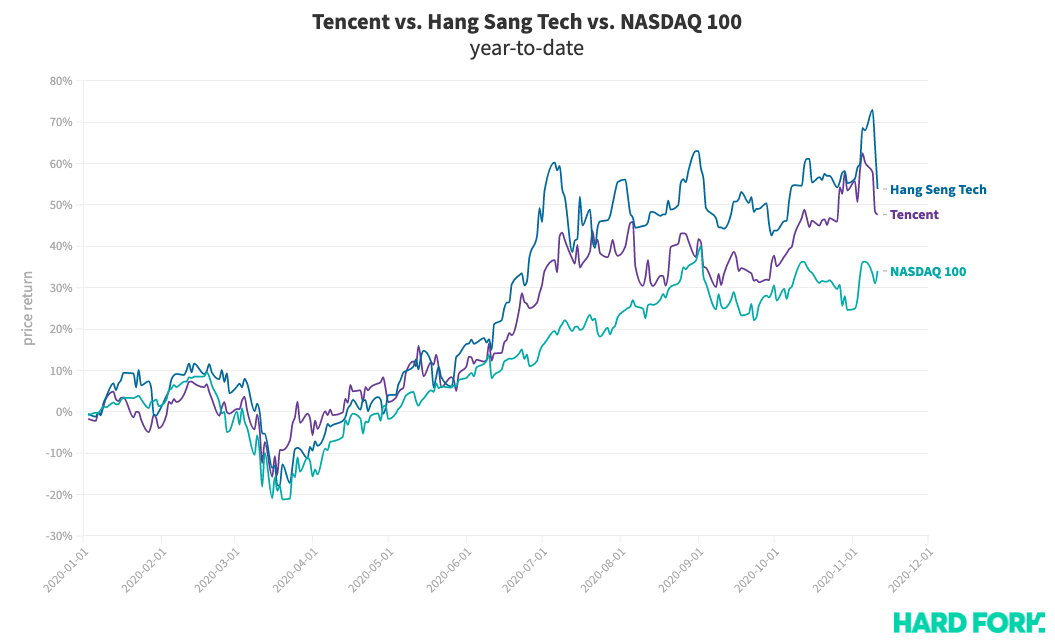

Tencent stock is still up 50% for the year-to-date, trailing the Hang Seng Tech index of top 30 Hong Kong-listed technology stocks by around 4%.

Get the TNW newsletter

Get the most important tech news in your inbox each week.