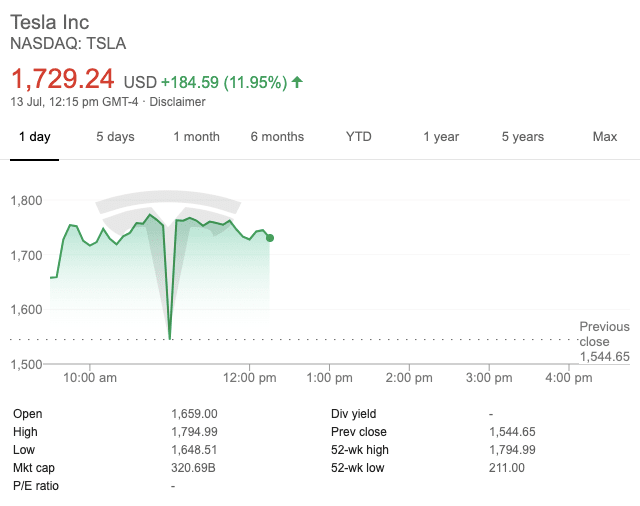

Tesla stock surged again on Monday, this time by more than 12% to reach an intraday high of $1,792.

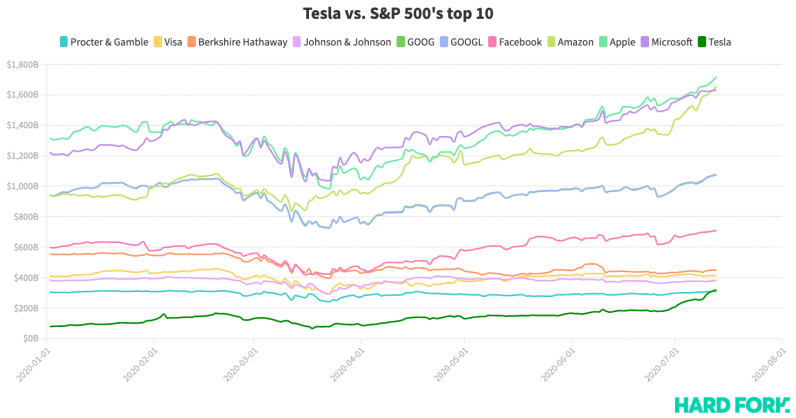

Now, not only is Elon Musk’s electricity wunderstock absolutely the most valuable automaker in the world, but its $320 billion market value places it ahead of consumer goods giant Procter & Gamble, and inside the top 10 public companies in the US.

To say that Tesla has performed well this year is a serious understatement. After all, $TSLA started 2020 at $424.50, and it’s worth $1,733 at pixel time — a 310% increase in a little more than six months.

[Read: Watch Tesla’s meteoric rise — set to techno-remixed Elon Musk tweets]

But while Tesla has featured prominently in the tech-heavy NASDAQ 100 stock index since 2013, $TSLA is noticeably absent from the S&P 500; a wider set of US-listed stocks commonly used as a benchmark for the entire US market.

The real question is: How much does Tesla have to pump before it gets the S&P 500 nod? Well, Reuters asked an S&P spokesperson quite recently about that, but they refused to comment.

Something tells me that’s about to change.

Get the TNW newsletter

Get the most important tech news in your inbox each week.