Coinbase isn’t the only one trying to make cryptocurrency easier to invest in.

Cryptocurrency exchange and wallet provider, Abra, has launched a new investment token to help upstart investors get into the cryptocurrency game, without actually having to buy any cryptocurrency.

Abra’s exclusive new token, the BIT10, helps Abra users to invest in the top 10 cryptocurrencies of the month.

Importantly, when a user buys a BIT10 token they are not actually buying any cryptocurrency, but rather a kind of synthetic exposure to the cryptocurrency market.

Let me explain.

The BIT10 token will track the top 10 cryptocurrencies every month. As the market value increases, so does the value of the token. Equally, when the market value goes down, so does BIT10’s value. There are no promises of returns.

While Abra’s announcement suggested that the BIT10 is similar to an index, security, or exchange traded fund (ETF) Abra CEO Bill Barhydt, has since stated that it is not.

BIT10 tokens can be bought for as little as $5, with no extra fees. The amount invested dictates the token’s value and owners can sell their tokens when they please. But the BIT10 is exclusive to Abra, you can’t trade this token outside of the Abra app.

Tokens are secured in the Abra wallet with a private key, and verified by the Bitcoin and Litecoin blockchains using a form of basic smart contract called pay to script hash (P2SH).

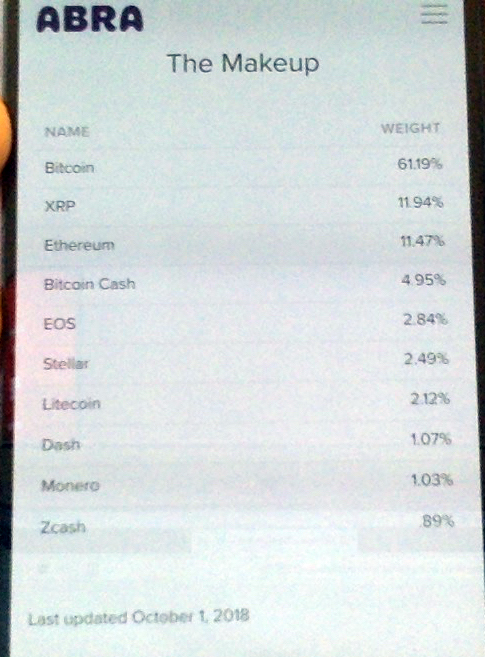

Like the new Coinbase Bundles, the BIT10 token is weighted to spread your investment across the market. BIT10’s weighting appears – for the most part – to follow cryptocurrencies based on market cap.

However, this isn’t entirely true. The BIT10 token was devised in collaboration with Bitwise Asset Management which actively controls the selection of 10 coins that feature in the BIT10 token.

According to Abra, once a month Bitwise Asset Management will adjust these 10 coins and their associated weightings, based on changes in everything from market cap to new regulations that might affect a coins value.

While you are investing in a token, you are also investing your trust in Bitwise Asset Management.

As of October 1, most of the BIT10 token is weighted on Bitcoin, followed by XRP, Ethereum, Bitcoin Cash and so on.

The BIT10 might sound like it is making it simple and easy to invest in cryptocurrency, but it is clearly far more complex than that.

As ever, do your research before investing, if you think you’re buying cryptocurrency, be sure that you actually are.

If you’re interested in everything blockchain, chances are you’ll love Hard Fork Decentralized. Our blockchain and cryptocurrency event is coming up soon – join us to hear from experts about the industry’s future. Ticket sales are now open, check it out!

Get the TNW newsletter

Get the most important tech news in your inbox each week.