Britain is a nation of borrowers. The average Brit owes nearly £17,000 (roughly $21,000) in loans, credit cards, and overdrafts. Much of this debt is revolving, with interest constantly accruing. As no stranger to this, I know how hard it can be to visualize the cost of borrowing, especially when you use several different financial products.

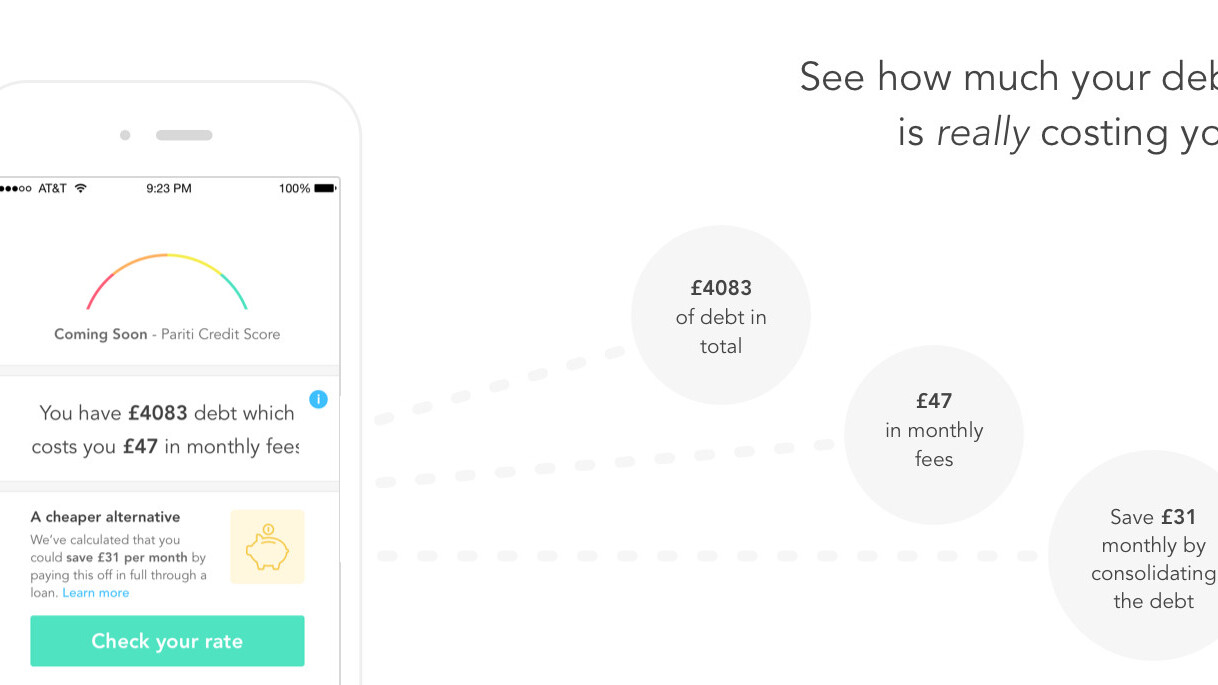

One company that wants to solve this problem is Pariti. It believes that by aggregating the total monthly amount our debt costs us per month, it can shock us into making prudent financial decisions.

The way it works is simple. You give Pariti access to all your financial products – your bank accounts, credit cards, whatever. It will then do the math, figuring out what you’re using, and how much it’s costing you.

The information is then there for you to do with as you wish.

The app will also determine if, rather than using a diverse range of financial products, you’d be best served with a consolidation loan.

So, rather than having several different credit cards, with APRs ranging from 16-percent to 25-percent, you’ll have one single payment, with an APR in the single digits.

If Pariti judges this to be best for you, it will connect you with Zopa, the UK’s oldest and most popular peer-to-peer lending service. According to a Pariti representative, applying for a loan with Zopa often takes as little as three minutes.

Pariti – which raised £475,000 ($710,000) last year – makes its money through commission. It gets a kickback from Zopa whenever someone is approved for a loan, although it declined to say how much.

Right now, the company wants to expand to other lenders. Its goal is to allow users to complete one application, and be pre-approved for a variety of loans

Pariti works with most high-street banks, and most – but not all – credit card providers. I was surprised to see it doesn’t work with New Day, which is a major provider of credit and store cards, including the popular Amazon Platinum Mastercard.

Recognizing it’s able huge amounts of data from its customers, Pariti ultimately plans to offer credit scoring based on the borrowing and spending habits of its users.

This would put it in the same arena as Experian and Equifax – a whole different ballgame.

Get the TNW newsletter

Get the most important tech news in your inbox each week.