The early days of ecommerce were filled with old concerns in new contexts, one of which was credit card fraud. Was anyone really sure that a bookstore named after a rain forest was going to securely protect their payment information? eBay was even more of a frontier town for online payments. Third parties allowed credit cards and escrow but most of the transactions took place using 1800s technology: the Post Office money order.

The early days of ecommerce were filled with old concerns in new contexts, one of which was credit card fraud. Was anyone really sure that a bookstore named after a rain forest was going to securely protect their payment information? eBay was even more of a frontier town for online payments. Third parties allowed credit cards and escrow but most of the transactions took place using 1800s technology: the Post Office money order.

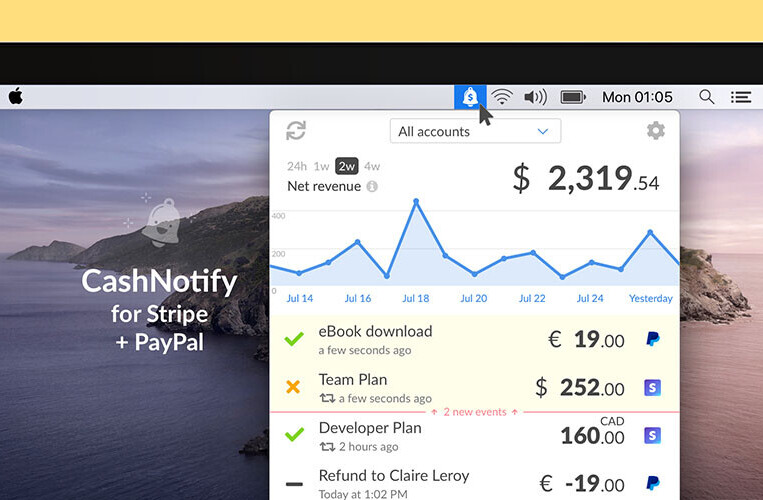

One company had a good thing going however and eBay took notice. The PayPal acquisition gave credit cards on eBay an air of legitimacy and sellers today usually insist on the popular online payment system. With debit card availability, PayPal has become the default method for sending money online, but it isn’t perfect. PayPal, for all its strengths just isn’t very good at casual transactions.

Joining the exclusive club of items that we can’t leave home without, the cellphone is now right up there with wallet and keys. Recent industry talk has the cellphone carriers branching out into banking, with smartphones serving as an alternative to the traditional credit card. We hear about plans to phase out cash at vending machines and stores, which is well and good in a retail environment, but how do you easily repay your friend five bucks without cash?

Venmo, a startup founded by a group of students at the University of Pennsylvania, has a solution. The service lets you associate a bank account with Venmo and send text messages from your phone to send the money to whomever you choose. All you need to send money is the phone number of the person or business you want to pay. If you pick up the bill at a restaurant for your cashless friends, they can just send you a text with the money and have it charge their credit card or draw from their bank account.

What could be the most interesting feature, though obviously limited, is “trusting” your contacts. A trusted contact can withdraw money from your account on their own, without your authorization. If you and a friend often pick up coffee for the other taking $3 each time might be a headache saver if one of you forgets to bring cash to the office. [Ed. this terrifies me]

Another startup working on money management solutions is WePay. Unlike Venmo, WePay is more focused on groups, rather than person to person or person to business transitions. For example, the commissioner of a fantasy sports league could set up an account on WePay and send out an invoice to each member of the league, and everyone puts their payments into one big pot without the worry of hanging onto an envelope of cash or forgetting who paid their dues and who did not. Group money management has a broad audience from school clubs to friends sharing the cost of a party or a few friends all chipping in to buy an item they’ll all share.

This means WePay can also handle donations. Rather than worrying about where the money is stored or hoping people have cash on them at the moment, prospective donors only need to be given a web address to participate from their computer with a credit card.

Jack Dorsey of Twitter fame has gotten into the mix with his latest venture: Square. Square aims to give everyone the ability to simply and cheaply process credit cards by sending out free credit card readers, compatible with the iPhone, iPad and iPod Touch to customers allowing them process transactions anywhere. For everyone from the local hot dog cart to a company selling t-shirts outside s sporting event to a coffee shop that doesn’t need a cash register, Square allows businesses to be mobile and fast on their feet. Not having a storefront doesn’t matter if you can set up shop anywhere your customers are.

One more player is lurking in the shadows are the moment: Facebook. The Facebook Credits system, while currently used for in-game purchases inside of Facebook could become a legitimate virtual currency. With people’s entire social graphs connected to Facebook it wouldn’t be too hard for friends to just swap money in and out of the credit system. If a chunk of the 500 million registered users start using Facebook Credits it might not be long before outside stores start accepting them as well.

Get the TNW newsletter

Get the most important tech news in your inbox each week.