Back in 2007, the Chief Executive of Visa Europe claimed that we could all be living in a cashless society by 2012. With that milestone fast approaching, it’s safe to assume that notes/bills and coins won’t be going the way of the dodo that quickly, but a new forecast has emerged from another giant from the finance world.

PayPal has produced a new report which will be released shortly – Money: The Digital Tipping Point – in which it predicts not only that consumers won’t need cash to go shopping, but they won’t need a wallet at all. And when can we expect this vision to be realized? 2016, it seems.

We’ve written quite extensively about mobile payment technology in recent times. Back in September we spoke with Ben Milne, founder of peer-to-peer Web and mobile payment platform Dwolla, who discussed the future of m-commerce. And prior to that, The Next Web’s Brad McCarty looked at how NFC will get its piece of the $4 quadrillion payments pie. There’s little question mobile payments will play a big part in the future of commerce. But will it completely outmanoeuvre paper, coins AND plastic by 2016?

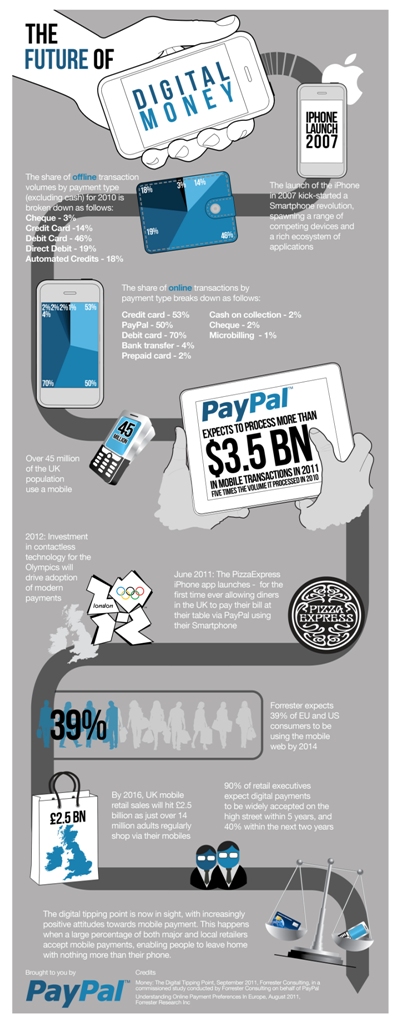

Around 45 million people in the UK use a mobile phone, and 49% of mobile users surveyed use their device to purchase products at least once every three months. But there is still a big demand for in-store purchases too, as we saw with London’s Oxford Street retailers gearing up for Christmas by introducing a number of tech initiatives to help capitalize on the growing m-commerce trend.

PayPal’s findings are based on interviews by Forrester Consulting with 10 senior executives from major UK retailers and other businesses, with a combined turnover of £85bn.

“We’ll see a huge change over the next few years in the way we shop and pay for things”, says Carl Scheible, Managing Director of PayPal UK. “By 2016, you’ll be able to leave your wallet at home and use your mobile as the 21st century digital wallet. Our vision of money is to enable you to pay for something from wherever you are, whatever device you’re on – a PC, mobile phone, tablet, games console and a whole lot more.”

Indeed, Scheible continued by saying that it will take another 4 years before we’ll see the real beginning of money’s digital switchover in the UK, but he stopped short of any discussion relating to a ‘cashless society’. “We’re not saying cash will disappear entirely, but we’ll increasingly use our phones and other devices rather than our wallets to pay in-store as well as online”, he says. “The lines between the online world and high street will soon disappear altogether. Children born today will become the UK’s first ‘cashless generation’. It will be completely natural for them to pay by mobile.”

So the real prediction here is that the uptake of mobile payment technology will increase significantly over the next 4 years – something that most people would probably agree with. But at the rate we’re currently going at, and with the likes of NFC technology gaining momentum in the micro-payment sphere, cash could be under threat sooner than we may otherwise have realized.

By 2016, it’s thought that UK mobile retail sales will hit £2.5bn. PayPal currently has over 14m active UK accounts, over a million of which have been used to send a mobile payment. Around the world, PayPal expects to process more than $3.5bn (£2.25bn) in mobile payments this year, five times more than in 2010.

Meanwhile, PayPal has produced this little infographic, outlining its vision:

Get the TNW newsletter

Get the most important tech news in your inbox each week.