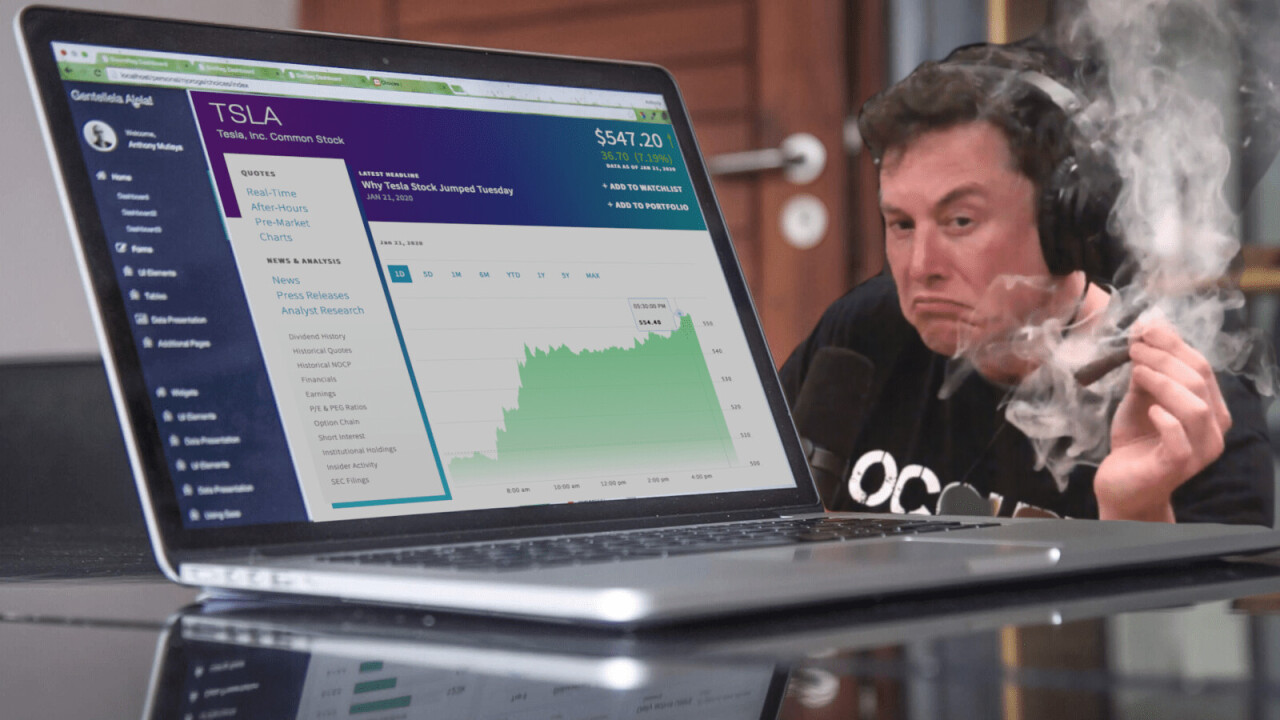

In light of its popularity and strong sales figures, Tesla seems to have turned a corner recently after posting its first annual profit, kind of.

According to CNN, in operating terms, Tesla posted a $386 million profit across the last three months of 2019. This meant it finished the year $35.8 million in the black.

That said, when considering the full company accounts, Tesla actually posted a loss for the whole year. In fact, it lost $862 million, The Verge writes. A notable improvement over the $1 billion loss it posted in 2018, though.

[Read: Tesla becomes America’s first $100B publicly listed car maker]

In other words, after the costs of making and delivering Teslas are subtracted from the profit made by selling the vehicles, the company is making a profit. But when all things are considered, like cash flow, and spending on new factories and expansion, Tesla made a loss.

Tesla flips cars at a profit, but is spending loads more elsewhere

Tesla’s spending on improving its fixed assets like buildings, land, and manufacturing equipment, for Q4 was $412 million. This is 7 percent higher than it was in Q3, and 27 percent higher than it was a year earlier.

This isn’t surprising, though. Tesla is forging ahead with two new “gigafactories.” One in China, which is nearing completion, and one just outside Berlin that’s due to be built this year.

While Tesla is still yet to turn a true profit, the fact that its daily operations are becoming consistently profitable shows the company is heading in the right direction.

In fact, across Q4 2019, Tesla brought in total revenue of around $7.4 billion, a 17-percent increase over the previous quarter, and a 2-percent increase over the previous year. This revenue even outstripped the expectations from Wall St. analysts by about 3 percent.

What’s more, earlier this month, the EV company became America’s first $100 billion publicly listed car maker after its stock price surpassed $550 per share.

Turning things around

It also seems that Tesla has learned from its past mistakes, so don’t expect this to be a flash in the pan.

The early production runs of the Model 3 were marred by delivery delays and quality control issues. This challenged the business in early 2019 operationally and financially, but the company has addressed issues and delivered the Model 3 in record numbers last year.

With Tesla’s new factories and the upcoming launch of its Model Y compact SUV in the next few months, it’s laying the groundwork to maintain this positive start to 2020.

Get the TNW newsletter

Get the most important tech news in your inbox each week.