Vikas Lalwani is a member of the marketing team at FusionCharts, a startup providing JavaScript charts to 23,000+ customers. He also volunteers as community manager at Zidisha,

Microfinance, in simplest words, can be defined as providing small loans to people in need. It is already a $70 billion industry, serving more than 150 million people worldwide, by more than 10,000 micro-finance institutions.

The numbers look fantastic, but ground realities do not look that bright under the lens.

What’s the problem?

There are two main factors affecting this problem – ‘loan repayment’ and ‘interest rate.’ Any microlending service out there is playing a balancing act between these two.

To ensure high repayment rate, you need to employ people (field force) who will work in the field doing tasks like background checks, loan disbursement, follow-ups and collection. But these resources cost money, which proportionately increases the interest rate that poor borrowers will have to pay.

The global average interest and fee rate is estimated at 37 percent, with rates reaching as high as 70 percent in some markets. This means that world’s poorest are paying the highest interest rate and it defeats the whole purpose behind microfinance.

To keep the interest rates low, field forces need to move out of picture. But without field force, loan default rate starts going up, creating mistrust in lenders’ mind, and weakening their belief in the concept of microlending.

How is technology solving this?

Earlier microlending services tried to optimize for high-repayment-rates, meaning they recruited field forces for all kinds of jobs and opened offices wherever they started operations. As expected, this led to very high interest rates. For example, an average loan through the non-profit Kiva Microfunds has 35.21 percent interest rate.

To break this stalemate, a new breed of microlending services is coming up which is taking everything online. There are no offices where they operate, no field force and no offices even for themselves. Zidisha and Kiva Zip are pioneers of this.

Zidisha, which is active in eight African countries and Indonesia, is mostly run by virtual volunteers with only two full-time employees. All loans are disbursed electronically and there are no offices at all. It filters fraudulent applications using machine-learning algorithms developed by Sift Science.

To calculate credit risk, it uses the services of Bayes Impact, another YC non-profit, which gets data scientist teams to tackle social problems. Zidisha has been able to bring down the interest rates to as low as 5.8 percent, an astronomical improvement over previously existing rates.

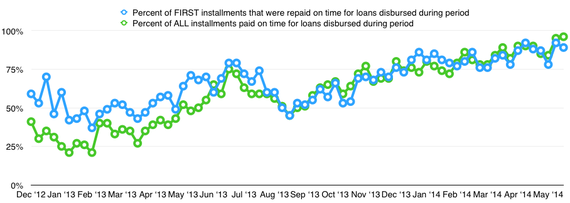

Zidisha’s repayment performance, in turn, has a positive rate, as seen in the graph below.

Same is the case with Kiva Zip, operating solely online. Borrowers set up their profile and lenders decide which one to fund. Payments are made electronically and there is literally no overhead. However, Kiva Zip is still in alpha phase and only allows borrowers from US and Kenya.

Conclusion

Digital is transforming many traditional sectors in brilliant ways. In today’s world, where technology is affecting everything and making it efficient, microfinance has not remained untouched.

That’s not to say it will come easy. Naturally, there will be hiccups, but they will improve eventually, as it happens in case of any emerging industry. The sector still needs more lenders, and in time, the movement may grow to support major global markets. Whether it takes months or years for them to jump in is another issue entirely.

What do you think? Will these microfinance startups ever make it to major markets?

Special thanks to Nishith Sharma for helping me improve this article.

Get the TNW newsletter

Get the most important tech news in your inbox each week.