Arguably everyone experiences financial challenges at one time or another. For some, the challenges are relatively small and insignificant. For others, money issues become big, scary and stressful.

No matter where your income-to-spending ratio currently sits, one thing remains true — you can save more money. Even if you’re someone who saves every month and thinks you’re on top of your finances, the eight applications below will help you keep more dollars in your bank and cash in your wallet.

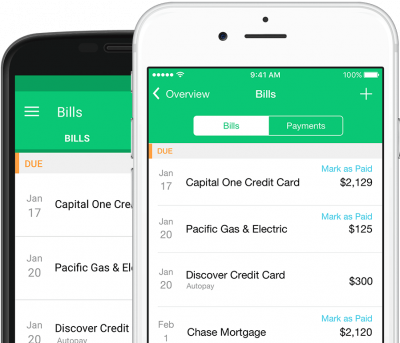

#1 Mint

If you have a hard time keeping track of where you stand financially, you can benefit from Mint. From the makers of TurboTax, mint is a comprehensive application that helps you manage your money and track your finances.

With their platform, you can view your bank accounts, credit cards, bills and investments all in one place. With this information in mind, you can see where you’re spending, where you’re saving and what you can do to improve your standings.

* What it is: Desktop platform, mobile app

* Available for: Any user with an email, Google Play

* Where: The U.S. and Canada, but YNAB offers a similar service for Europeans

* Pricing: Free to sign up

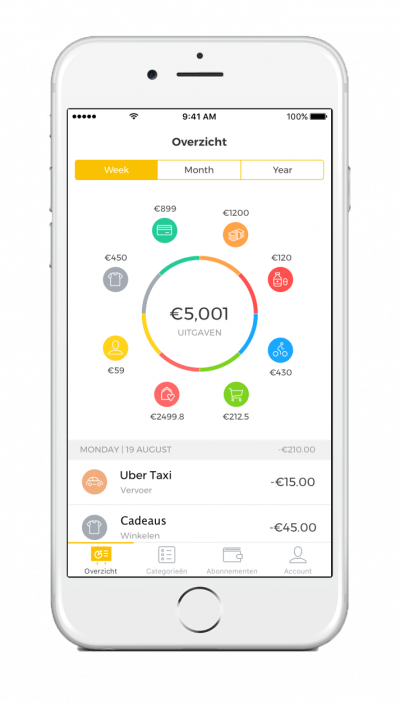

#2 Bittiq

If you sat down right now for a few hours, chances are you could find several ways to save more money. However, the benefit-cost ratio of such an activity might prove unhelpful. It’s hard to justify taking time out of your day to look for little ways to save money, but it’s easy to justify working with an application that does all that work for you.

According to the co-founder of Bittiq, Federico Spiezia, “The right financial decisions take time, and our customers struggle to find the right balance between time to manage personal finances and time for the things that matter to them.”

Continues Spiezia, “No one likes putting expenses in Excel or finding a cheaper energy provider on Sunday when they can be playing with their kids instead. To help people spend more time doing the things they love, Bittiq provides consumers with actionable financial suggestions and money-saving tips.”

* What it is: Mobile app

* Available for: Google Play, App Store.

* Where: The Netherlands (the service requires a Dutch bank account)

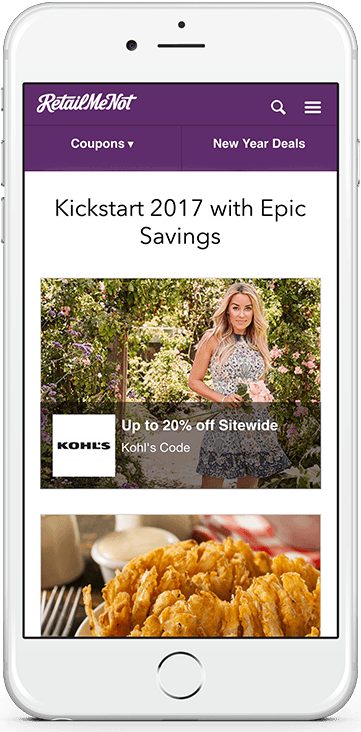

#4 RetailMeNot

When you have to purchase something, you don’t necessarily have to pay full price.

Before you mindlessly spend money, check RetailMeNot for the best and latest promotions and discounts — online and in-store. With discounts on everything from local offerings to nationwide sales, RetailMeNot helps consumers save money with top-notch promotions and deals.

* What it is: Desktop platform, mobile app

* Available for: Any user with email, Google Play or App Store

* Where: The U.S. and Canada, but Honey offers a similar service for many Europeans

* Pricing: Free to sign up

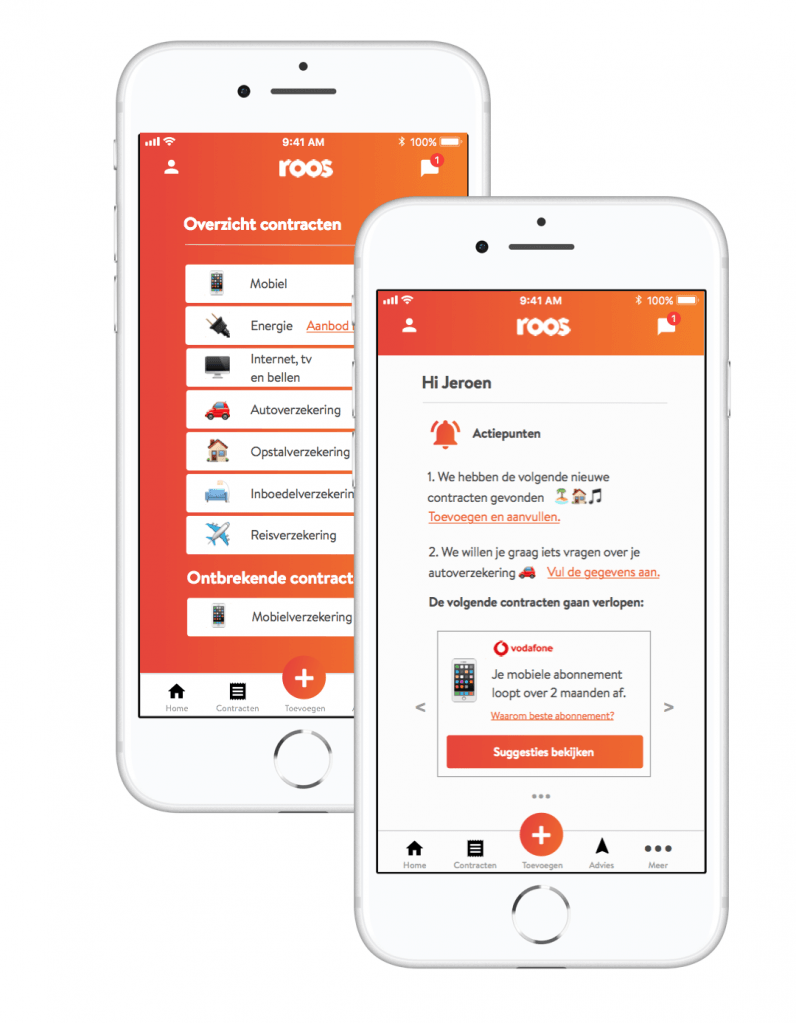

#4 Roos

Have you ever looked at your bank statement to find a charge for a subscription you forgot you had? If so, you’re certainly not alone. Every year, countless people wake up to find that they’ve been charged for services they don’t need or use.

According to Michiel Alkemade, founder of Roos, their company is the answer to this problem because “It’s like having a personal financial assistant who manages all your contacts without the associated costs.” Since the application is mobile-based, it’s more affordable and efficient than hiring an in-person financial advisor.

* What it is: Desktop and Mobile (PWA)

* Available for: Any user with email

* Where: The Netherlands

* Pricing: Free to sign up

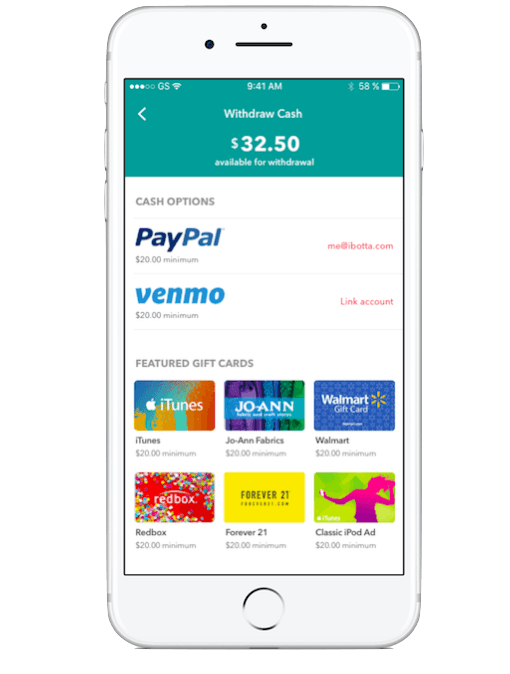

#5 Ibotta

Shopping around for the best grocery prices can be painful. Luckily, with Ibotta, it doesn’t have to be this way. Every time you go to the store, you can check the application for cash back opportunities.

As soon as you’ve completed your transaction, you simply scan your receipt into the application and it will send you cash back on the items you’ve purchased within one week.

Currently, Ibotta users have earned over $370 million back in cash rewards.

* What it is: Desktop platform, mobile app

* Available for: Any user with email, Google Play or App Store.

* Where: The U.S. and Canada, but Cashback World offers a similar service for Europeans

* Pricing: Free to sign up

#6 Digit

Do you have a dream vacation in mind right now? If so, stop thinking about it and make it happen with Digit

Once you load the application and share what you’re saving for, Digit can help you budget to make sure you can pay off your credit cards, put money away for a rainy day and afford your next vacation. Without changing your lifestyle, Digit will learn how you spend and show you how you can save.

* What it is: Desktop platform, mobile app

* Available for: Any user with email, Google Play and App Store

* Where: The US

* Pricing: Free to sign up

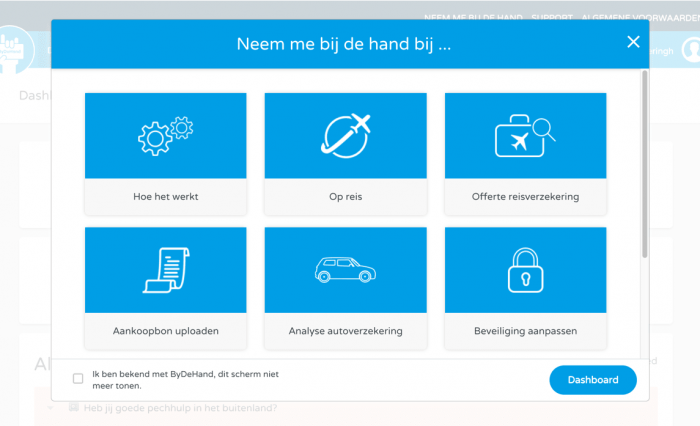

#7 ByDeHand

At this point, you think the world would have a better system in place than paper receipts.

Although this antiquated system seems to make little sense, it’s still one of the main ways transactions are recorded. If you have a hard time keeping track of your paper-based receipts, you will benefit from ByDeHand.

“We live in an increasingly digital world, but many financial documents are still on paper. We offer a smart solution that helps people take their receipts and transactions online so they can save time, hassle and worries,” reports Paul Kuijpers, chief commercial officer at ByDeHand.

His concept was selected for the Accenture Innovation Awards — just like Roos and Bittiq, which are also mentioned in this list — in the category ‘finance.’ (Registrations to join the Accenture Innovation Awards are still open till July 1st.)

* What it is: Desktop platform, mobile app

* Available for: Any user with email, Google Play

* Where: The Netherlands

* Pricing: Free for anyone under 25, users who are 25+ pay € 2,50 per month

#8 Acorns

In less than five minutes, you can sign up for one of the best micro investing platforms in the world. Acorns will take your spare cash and use it to help you build a portfolio of investments. Mainly, it’ll help you own stocks and bonds while ensuring that you own several different asset classes — buffering your losses when the market changes so you can be set up for overall success.

* What it is: Desktop platform

* Available for: Any user with email

* Where: The U.S. and Australia, but Saveboost offers a similar service for Europeans

* Pricing: Free to sign up

These apps have answers — have at ‘em.

Almost everyone has money challenges, but with the right support, many of them can be overcome.

The eight applications above are not comprehensive, but they’re diverse and detailed enough to help you start saving a significant amount of money today with minimal effort

Get the TNW newsletter

Get the most important tech news in your inbox each week.

This post is sponsored by the Accenture Innovation Awards, a year-round program aiming to create an extensive ecosystem to connect all innovators. Keep an eye on their social channels for relevant updates.

This post is sponsored by the Accenture Innovation Awards, a year-round program aiming to create an extensive ecosystem to connect all innovators. Keep an eye on their social channels for relevant updates.