Exchange-traded funds (ETFs) for Bitcoin are in back in the news. This week, another application submitted by Bitcoin billionaires, the Winklevoss twins, was shot down by the US Securities and Exchange Commission (SEC).

This was the second attempt of theirs to be rejected by government regulators, after waiting more than a year for another SEC ruling. To date, no cryptocurrency-based ETFs have been approved, making this a major hurdle on the way to widespread adoption by Wall Street.

But all hope might not be lost; the SEC’s commissioners are not uniform in their disapproval. An official dissent to the ruling has even been registered – effectively arguing that Bitcoin is being unfairly singled out for over-regulation.

Commissioner Hester M. Peirce wrote the following in a lengthy public statement, posted this morning:

I am concerned that the Commission’s approach undermines investor protection by precluding greater institutionalization of the Bitcoin market. More institutional participation would ameliorate many of the Commission’s concerns with the Bitcoin market that underlie its disapproval order. More generally, the Commission’s interpretation and application of the statutory standard sends a strong signal that innovation is unwelcome in our markets, a signal that may have effects far beyond the fate of Bitcoin ETPs.

(Note: ETPs refer to ‘Exchange-traded Products.’ An ETF is one example of an ETP.)

The SEC’s concerns are really just the same tired excuses repeatedly trotted out by official regulatory bodies: Bitcoin and digital currencies like it are too susceptible to fraud and other market manipulations. The Winklevoss twins have been taking it upon themselves for years to prove otherwise. They even created new market-surveillance technology just for the policing of their Gemini exchange in a bid to win over the SEC with their newfangled AI.

The ETF application requests the right to list and trade shares in the Winklevoss Bitcoin Trust on their BZX stock exchange. Simply put, this is a license to sell shares in a fund dedicated solely to Bitcoin, offering stock to the greater investment community through widely accessible exchanges.

Still, the SEC remains unconvinced. The official 92-page refusal reads:

The central factor for the Commission in its current consideration of the BZX proposal is whether it is consistent with Exchange Act Section 6(b)(5), which requires, among other things, that the rules of a national securities exchange be designed to prevent fraudulent and manipulative acts and practices and to protect investors and the public interest.

Although BZX argues that its proposal can satisfy these requirements because Bitcoin markets are inherently difficult to manipulate, and because alternative means of identifying fraud and manipulation would be sufficient, the Commission concludes that, as discussed above, BZX has not established that these proffered means of compliance—alone or in combination—are sufficient to meet the requirements of Exchange Act Section 6(b)(5).

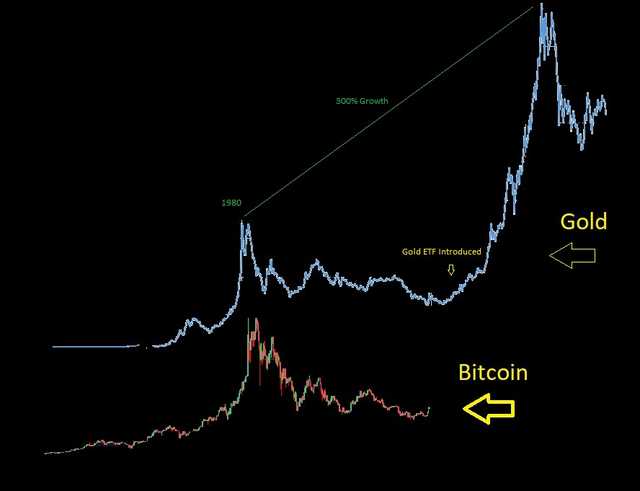

Many pundits have attributed Bitcoin’s recent price rise to keen speculators who envision massively positive movement if precedent is set for the trading of Bitcoin ETFs. The image below made the rounds across cryptocurrency communities in the lead-up to the SEC’s decision, fueling the dreams of those looking to cash in on history repeating itself.

Image courtesy of Reddit

The optimism responsible for this graph is probably what’s driving the Winklevoss twins. It is certainly reassuring, too, that regulatory officials are now coming to Bitcoin’s defense. Perhaps accusations of stifling innovation, especially when it comes from one of their own, might just make the difference for the inevitable next round of ETF applications.

But, for now, despite the sum of their efforts, the Winklevoss twins must return to the drawing board – and not come back until they can prove that Bitcoin is not overtly prone to manipulation.

Get the TNW newsletter

Get the most important tech news in your inbox each week.