Games used to dominate the mobile app market, but as use of smartphones continues to grow and mobile devices are becoming bigger and with larger screens, apps are becoming a key driver for other sectors too. One such, rapidly growing, industy is online retail.

We’ve dug into our data to analyze the performance of the top five online retailers in the US, across the Web, mobile Web and Android mobile apps.

Rankings and ratings data used in this articles has been collected directly from app stores. Web and mobile Web and app data has been collected from our panel of millions of users who agree to share their data with us. All data is available in our competitive analysis platform – SimilarWeb PRO.

So, how are Amazon, eBay, Walmart, BestBuy and Target faring against each other at all three fronts?

On the Web

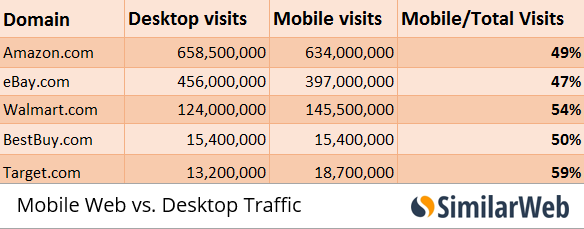

Four out of these five retailers see a roughly 50/50 split between desktop and mobile traffic. Target attracts a much larger proportion of mobile users. All and all we can say that mobile web is a traffic source to be reckoned with.

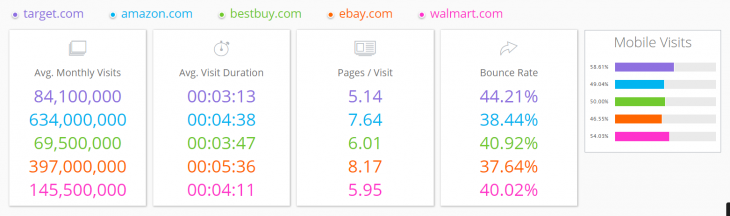

The metrics below break down mobile Web traffic by engagement. While Amazon is an obvious leader in terms of average monthly visits, eBay is the one to take the lead when it comes to the time spent on the site and pages per visit. Based on these stats we can assume that eBay is clearly doing a good job in terms of mobile engagement.

Mobile apps

When analyzing desktop and mobile web traffic, we found that the traffic splits more or less in half between the two channels. It would be interesting to see how mobile apps fit into this equation.

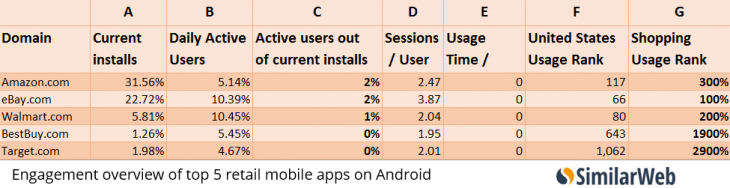

We’ve started by looking into the engagement stats of each of these retailers, examining their current installs, daily active users percentage, and usage metrics.

When comparing these retailers’ mobile apps, we find that while Amazon is taking the lead in terms of current installations, eBay is doing a much better job is keeping their users around (see column b in the table below), although the percentage of active users out of current installs is ultimately the same for both (see column C below). eBay holds the best app engagement rates with the highest number of sessions per user and the highest average usage time. This is consistent also when benchmarking eBay to the shopping industry and to the US (see columns F and G).

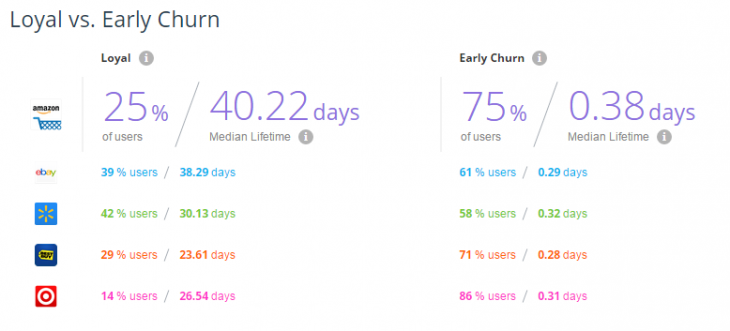

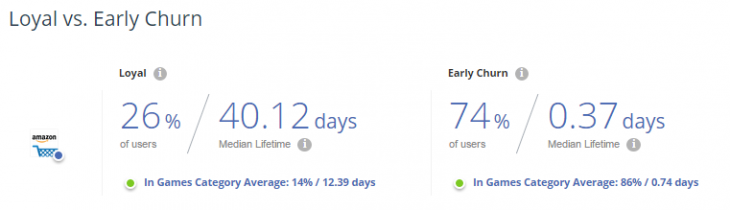

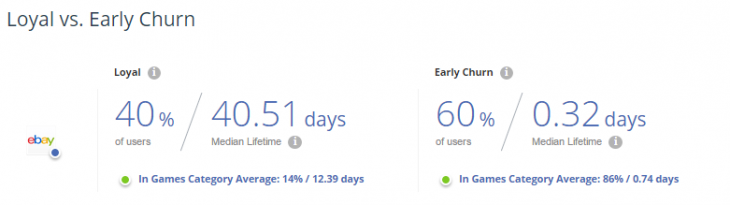

Let’s check how successful the five retailers are at maintaining loyal app users. We calculate an app’s stickiness by looking at its percentage of loyal users and early churn on their median lifetime day. When analyzing the raw data we’ve collected for app usage, we’ve identified two repeating patterns: users who stop using the app at an early stage (churning users), and users that stop using the app at a later stage (loyal users).

As we can see from the ‘Loyal vs. Early Churn’ stats below, while Amazon and eBay has about the samemedian lifetime (~40 percent), eBay has a higher percentage of users that are sticking around longer.Walmart has the best median lifetime (43.48 percent), but less active users that are sticking around that long. BestBuy and Target are far behind with about half of the median lifetime that the three top retail giants have and Target has the lowest active users percentage, out of the five (14 percent).

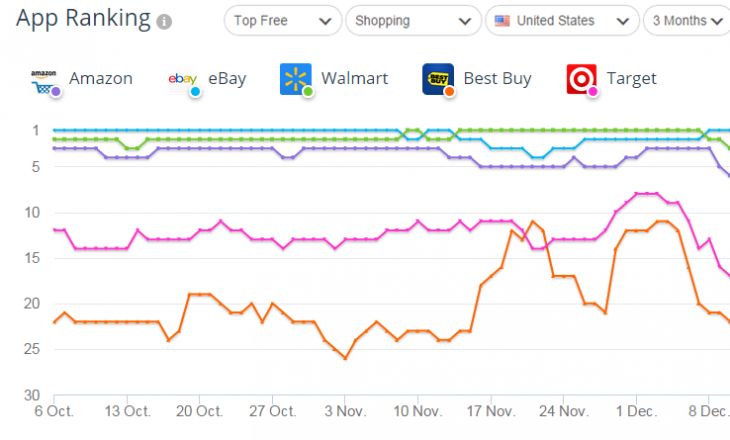

We see that while all five retailers stay within the top 30 free shopping apps in the US, Best Buy and Target’s rankings are markedly lower than Amazon, eBay and Walmart’s and Best Buy’s ranks haven’t been very stable since mid November up until mid December.

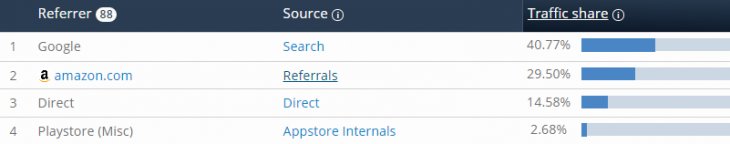

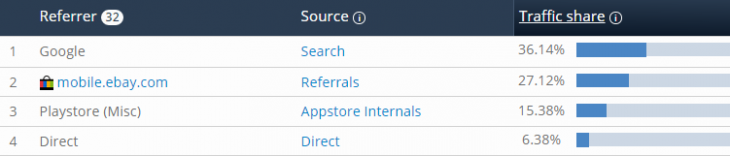

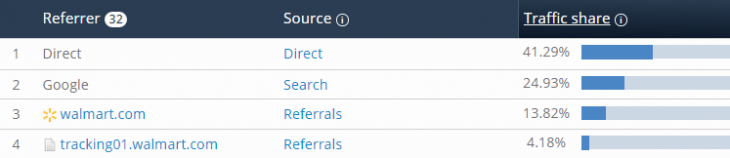

So people are reaching retail mobile apps, but how do they get there? We’ve looked into the incoming traffic of the top three out of these five retailers and found the same results – the app’s main traffic sources from outside of the store comes from the retailers’ sites:

Amazon’s App Traffic Top Sources:

eBay’s App Traffic Top Sources:

Walmart’s App Traffic Top Sources:

It seems that the top sources for all three apps are either search on Google, from the site’s desktop or mobile website, and direct traffic, which shows a recognition of these apps by interested users.

Benchmarking against the games industry

We started by saying that online retail apps are becoming more popular among mobile users while it used to be that games app were the obvious leaders. Let’s benchmark a few of these retail giants against the games industry and see what we get.

Amazon holds a 40 percent median lifetime while the Games industry holds around 12 percent. Amazon also has almost twice as much loyal users percentage.

We see similar stats for eBay when benchmarked against the Games industry:

And Walmart:

All in all, mobile is becoming much more significant for online retailers, whether on mobile Web or in mobile apps. More and more people are relying on apps for their digital shopping activity and the top retails understand this trends and are working hard on directing their users to these channels.

It would be interested to see where we’ll stand by the end of 2015 in terms of app shopping habits across the world.

Don’t miss: Data-driven predictions for 2015

Get the TNW newsletter

Get the most important tech news in your inbox each week.